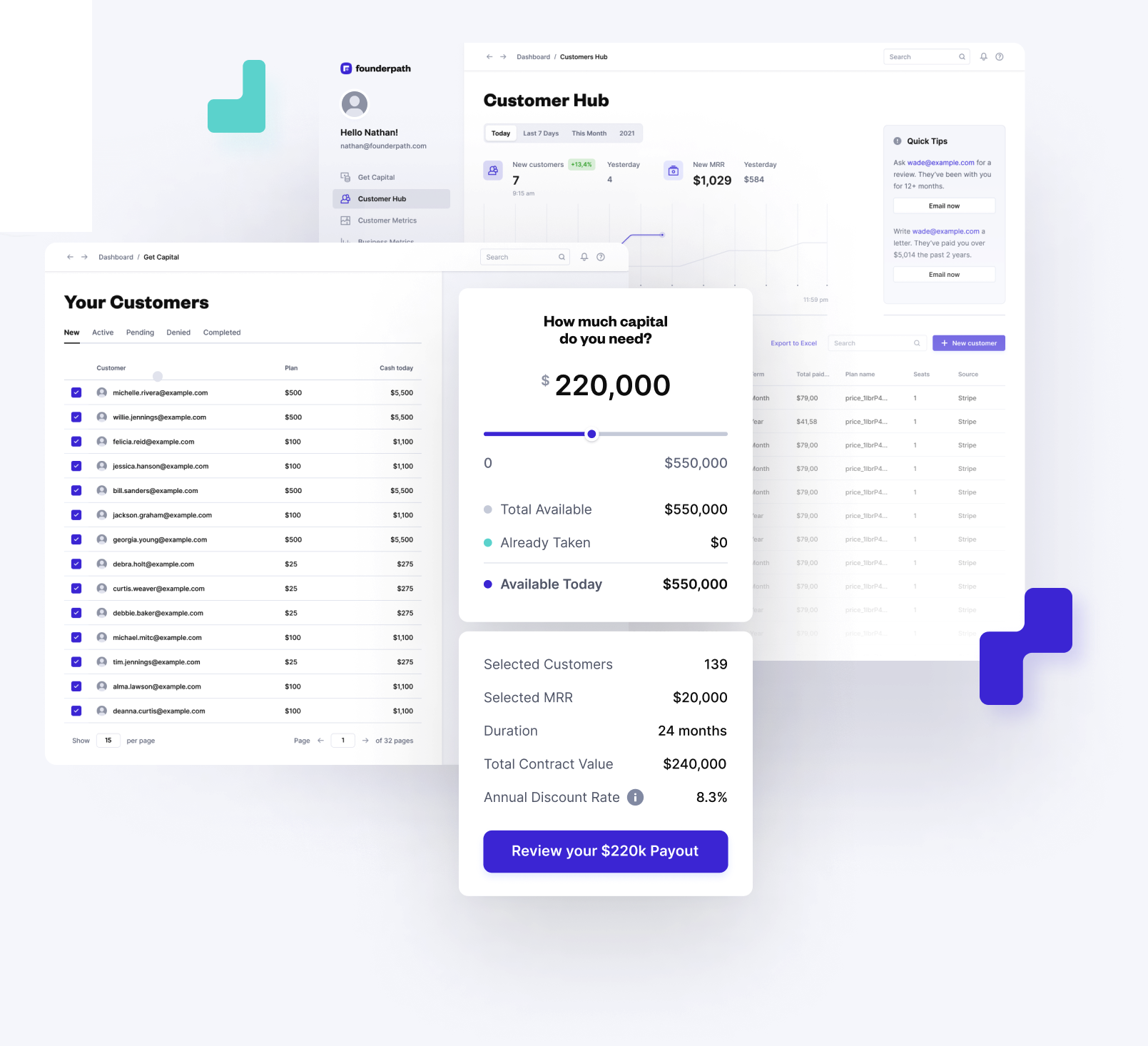

The more flexible, longer payback alternative to Stripe Capital

Founderpath’s SaaS tools, simplicity, and longer paybacks make it the #1 Stripe Capital alternative for SaaS founders who want to save time and money.

Join 3,021 Bootstrapped SaaS Founders

Stripe Capital Reviews

Why choose Founderpath over Stripe Capital?Use SaaS Financing Software that scales with you. See why SaaS founders are taking money from Founderpath and using our valuation and reporting tools to make it the #1 Stripe Capital alternative. |  Stripe Capital Stripe Capital | |

|---|---|---|

Payback over 24 months | ||

SaaS Founder Slack Group (Invite-Only, 1,987 founders) | ||

Annual SaaS Bootstrapper Conference | ||

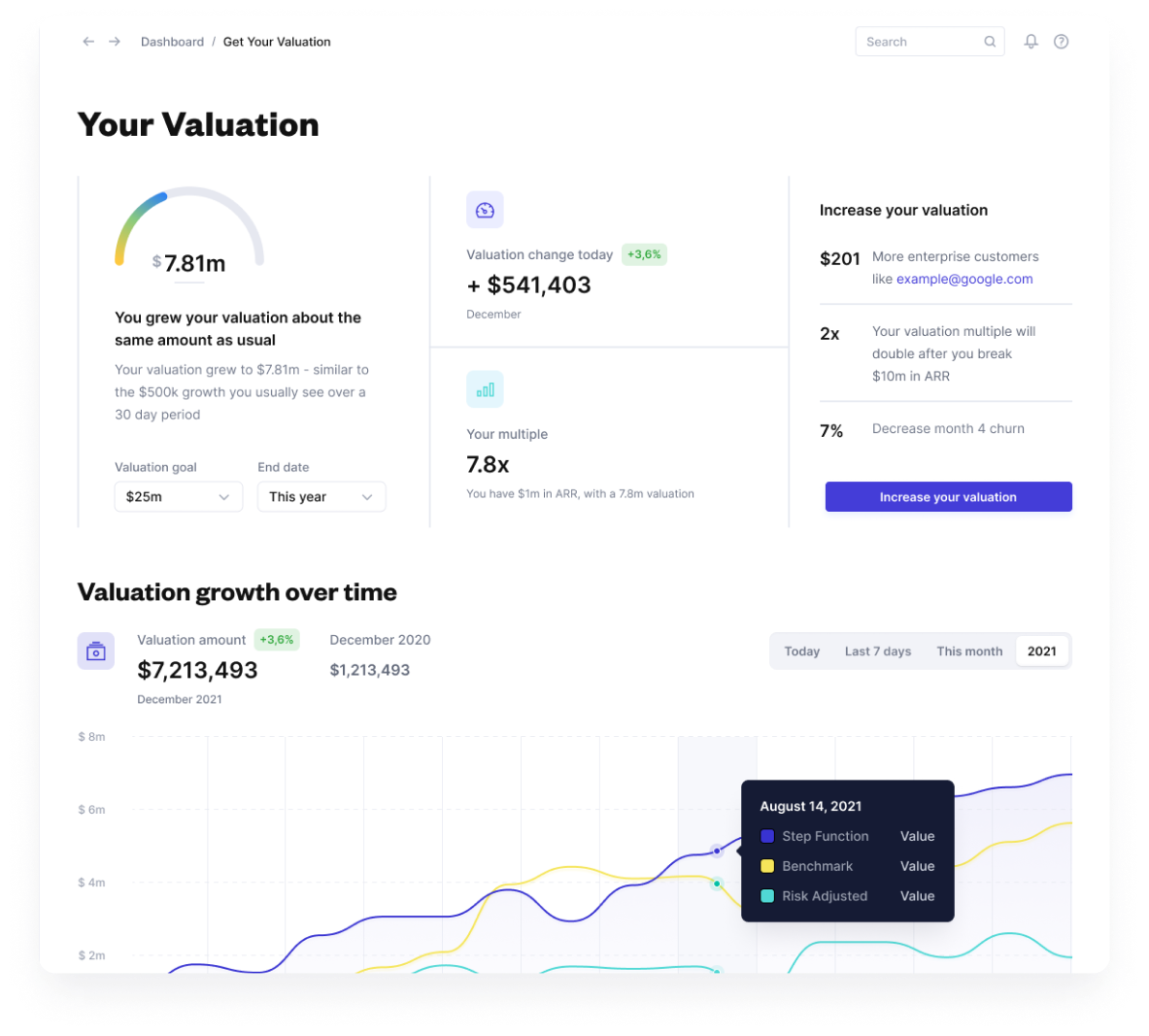

SaaS Valuation Calculator | ||

10% discount rate | ||

Money wired under 24 hours | ||

Payoff early without fees or penalties | ||

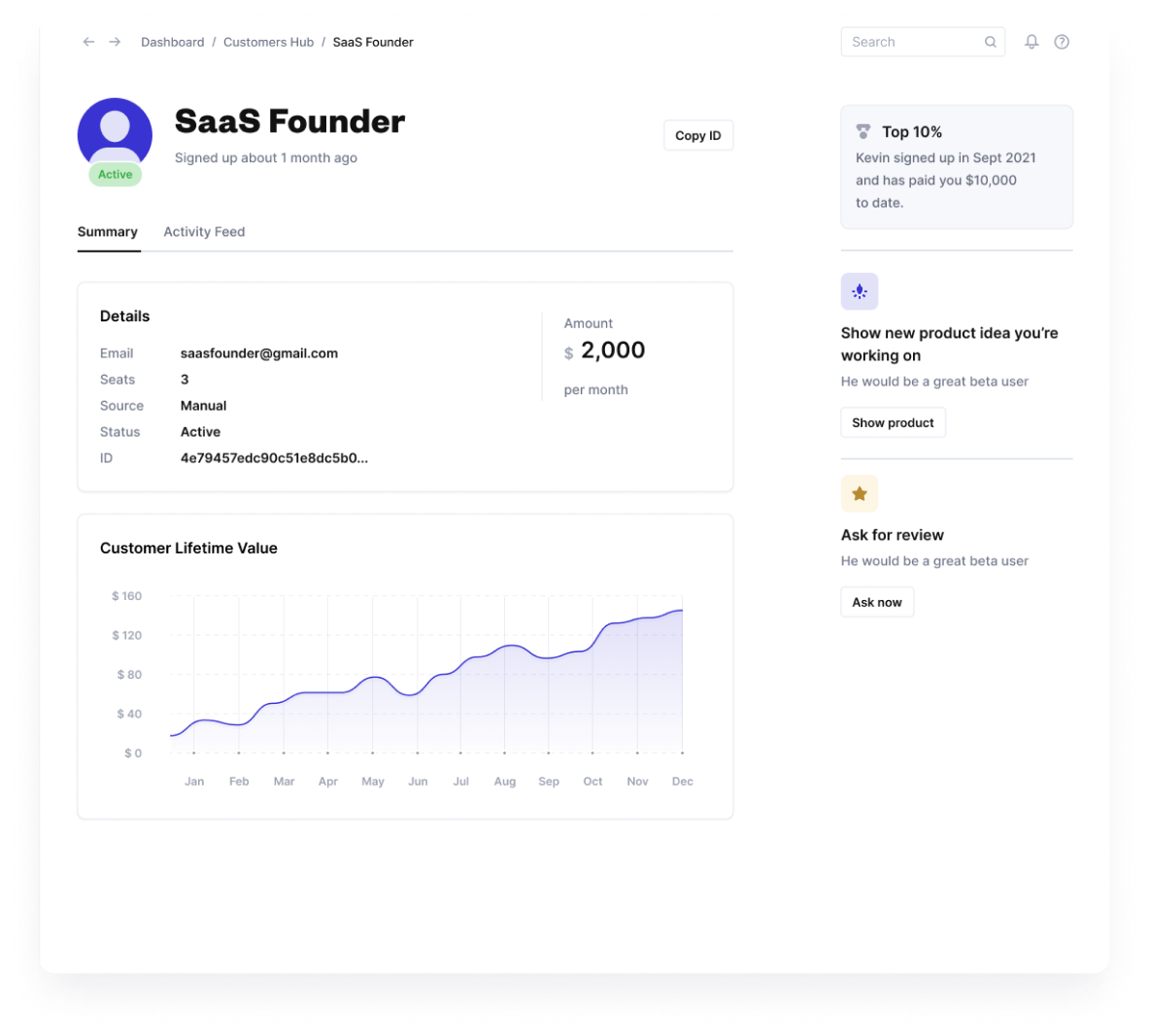

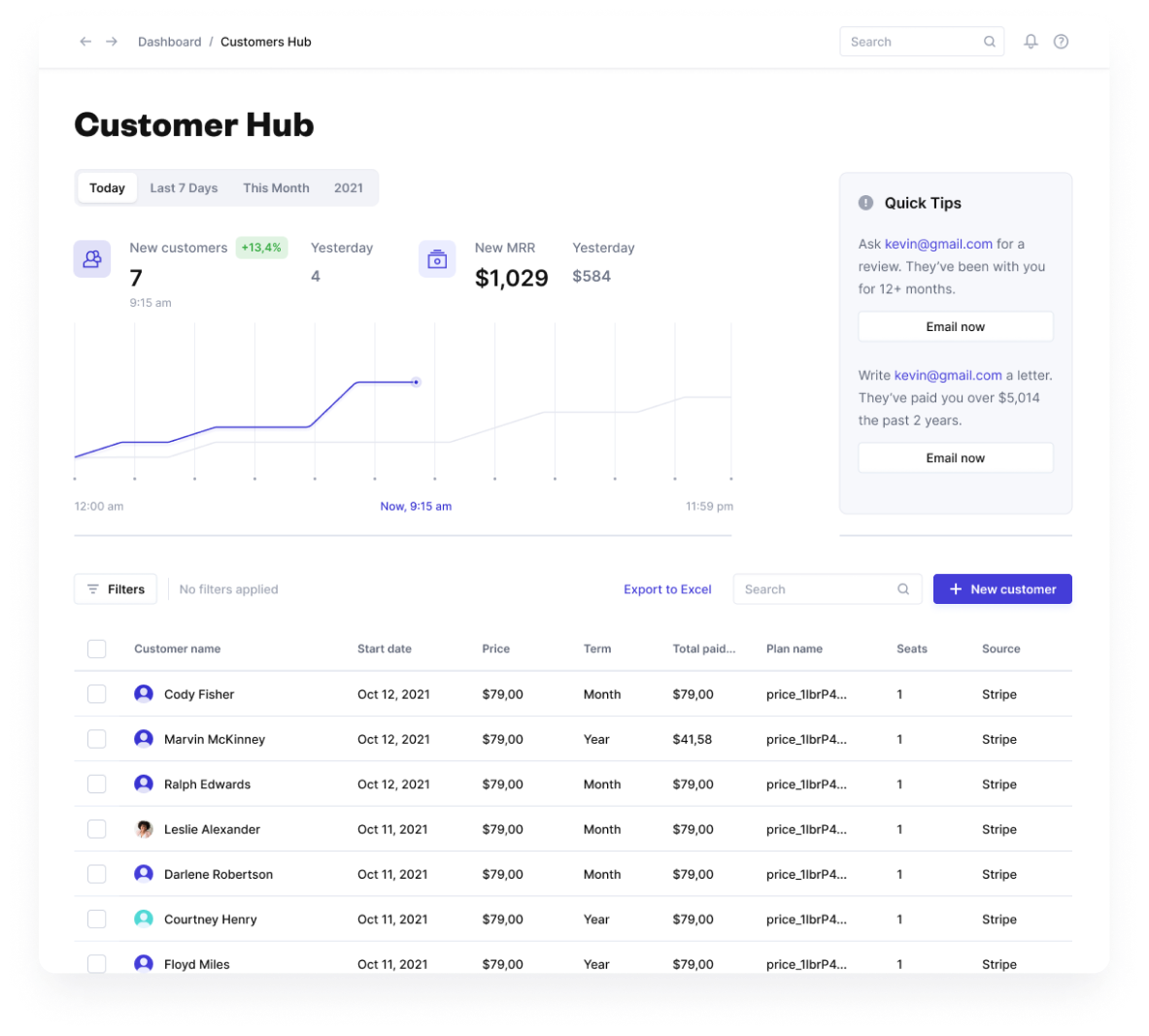

Reporting CAC | ||

Reporting cash flow/profit and loss | ||

Reporting Lifetime value | ||

Reporting Churn | ||

Reporting Customer distribution curves |

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing Stripe Capital Alternative

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform

Joel Ohman

United States

Great Experience with Founderpath; Highly Recommend

We have used Founderpath as an ongoing source of non-dilutive growth capital for our fast-growing B2B SaaS company, Exercise.com, and have been very impressed with the ease of use, quick response times, and flexibility. Nathan and Kevin are great to work with and I look forward to partnering with them in the future. If you are a growing SaaS company that needs capital to fund future growth I would strongly recommend working with Founderpath.