The No Warrant, No Covenant Alternative to SaaS Capital

They'll require an office visit and want you to have at least $3m in revenue. Founderpath offers:

Join 3,021 Bootstrapped SaaS Founders

SaaS Capital Reviews

Josh

United States

I took $1m at my last SaaS company before our exit. We kept more equity and made more money when we exited.

We had several growth tactics we wanted to try going into Q3 of 2022. As we started executing and growing, we got an M&A offer we couldn't refuse. The extra cash in our bank gave us more confidence going into the negotiation. We got a higher valuation and closed last month. Founderpath's capital was hugely strategic during our M&A process. They let us pay off early without paying any fines once we finalized our acquisition," Josh, SaaS Founder

Flint Holbrook

United States

Longer terms than others, & a personal touch

Founderpath couldn't be an easier. I have experience with some of their competitors and they are leaps and bounds better. Here's what stood out:1. They took time to understand my business and our unique dynamics2. They offer a pro-rated early payoff schedule3. They are extremely responsive to communication (even on weekends)4. Most important: the cost of capital was about 20% lower than what competitors quoted.So far, its been a joy to work with founderpath. If you're a rapidly growing startup I highly encourage you to explore founderpath and see how this non-dilutive capital and help you grow.

Why choose Founderpath over SaaS Capital?

Use SaaS Financing Software that scales with you. See why SaaS founders are taking money from Founderpath and using our valuation and reporting tools to make it the #1 SaaS Capital alternative.

| ||

|---|---|---|

Required Revenue | $3,000,000 | $500,000 |

Take Warrants (Equity)? | Yes, penny warrants | No |

Visit your office in person | Yes, Required diligence | No |

Covenants | Yes | No |

Personal Guarantee? | "usually" no | Never |

Commitment Fee | 1-1.5% | None |

Audit | Required every year | Not required |

Minimum financing requirement? | Must draw at least $1m | None |

Tech Enabled | ||

Money wired under 24 hours | ||

SaaS Companies Funded | 60 | 212 |

Total Financings Completed | 209,500,000 | 137,000,000 |

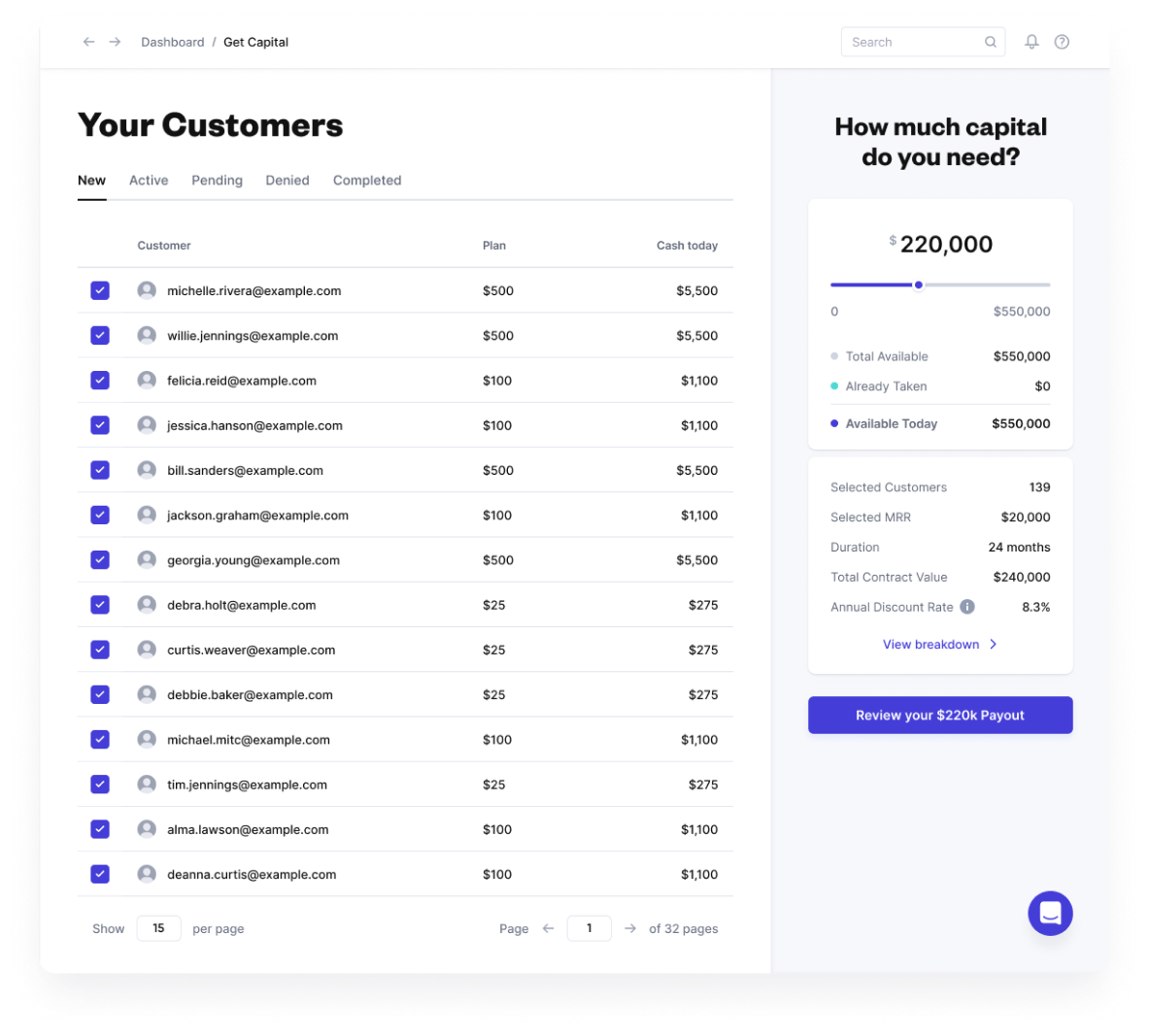

Products | MRR Line of Credit | Term Loans, Factoring |

Total Leverage | 5x MRR | 7x MRR |

Legal Fee | $30k Closing Costs and Legal Fees | No Fees |

OID Fee | 1-2% "Origination Fee" | No Fees |

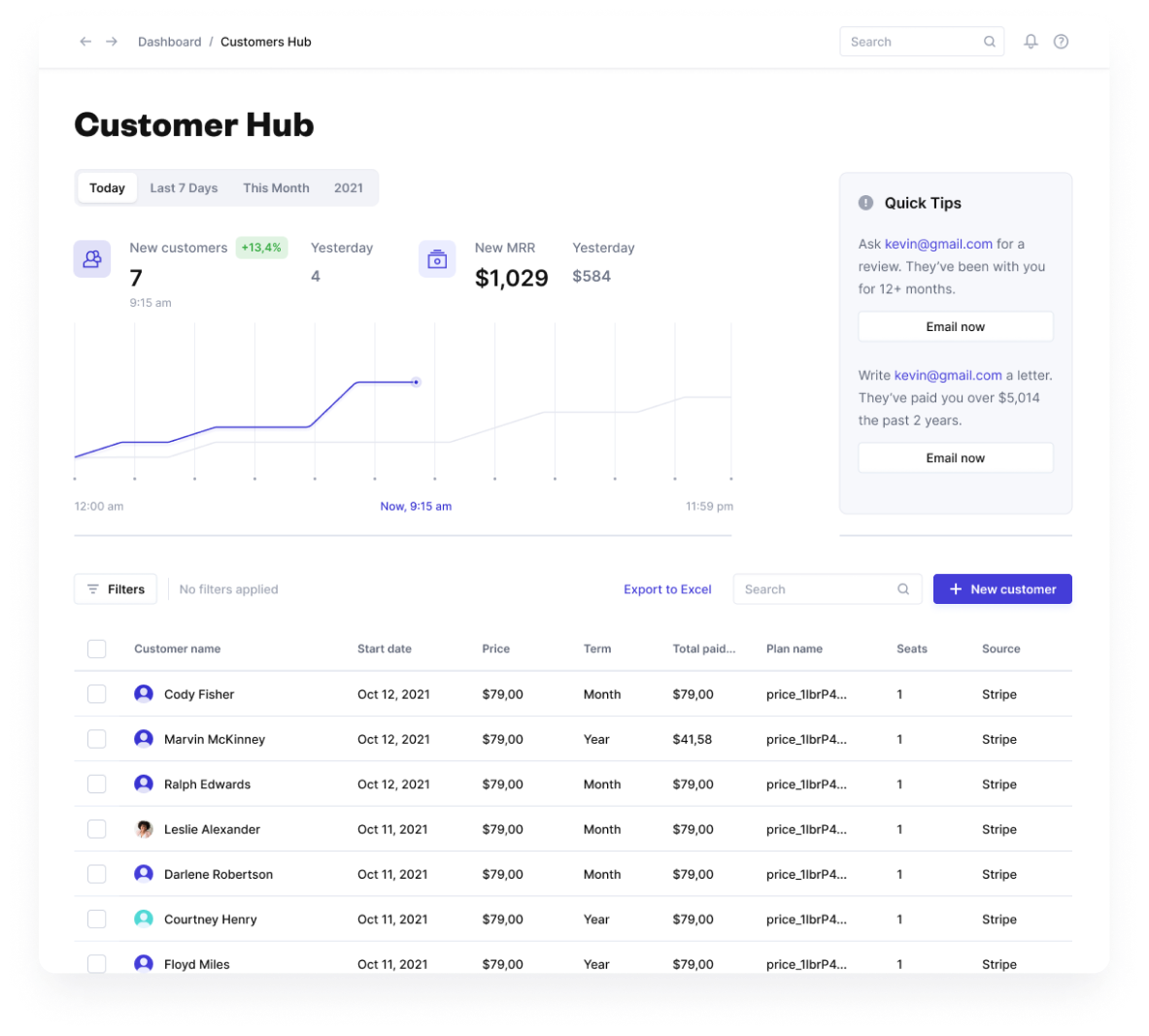

Monthly Reporting Required? | Takes 10 hours (Require monthly GAAP pdf/excel statements) | Automated through platform |

Payoff early without fees or penalties | ||

Spend money how you want? | ||

SaaS Company HQ | US, Canada, UK | Worldwide |

Easy to forecast, fixed monthly payments? | Yes | |

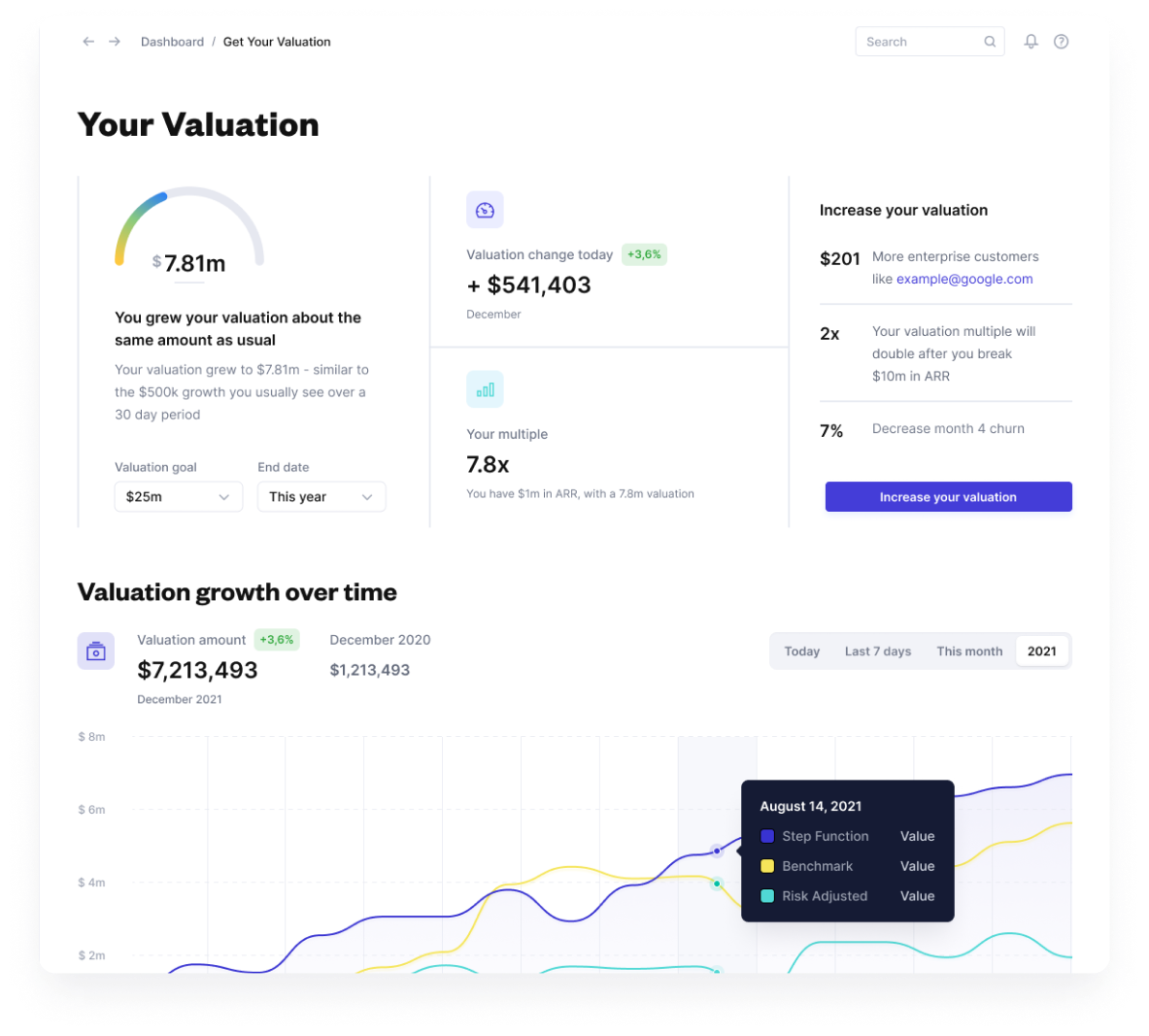

SaaS Valuation Calculator |

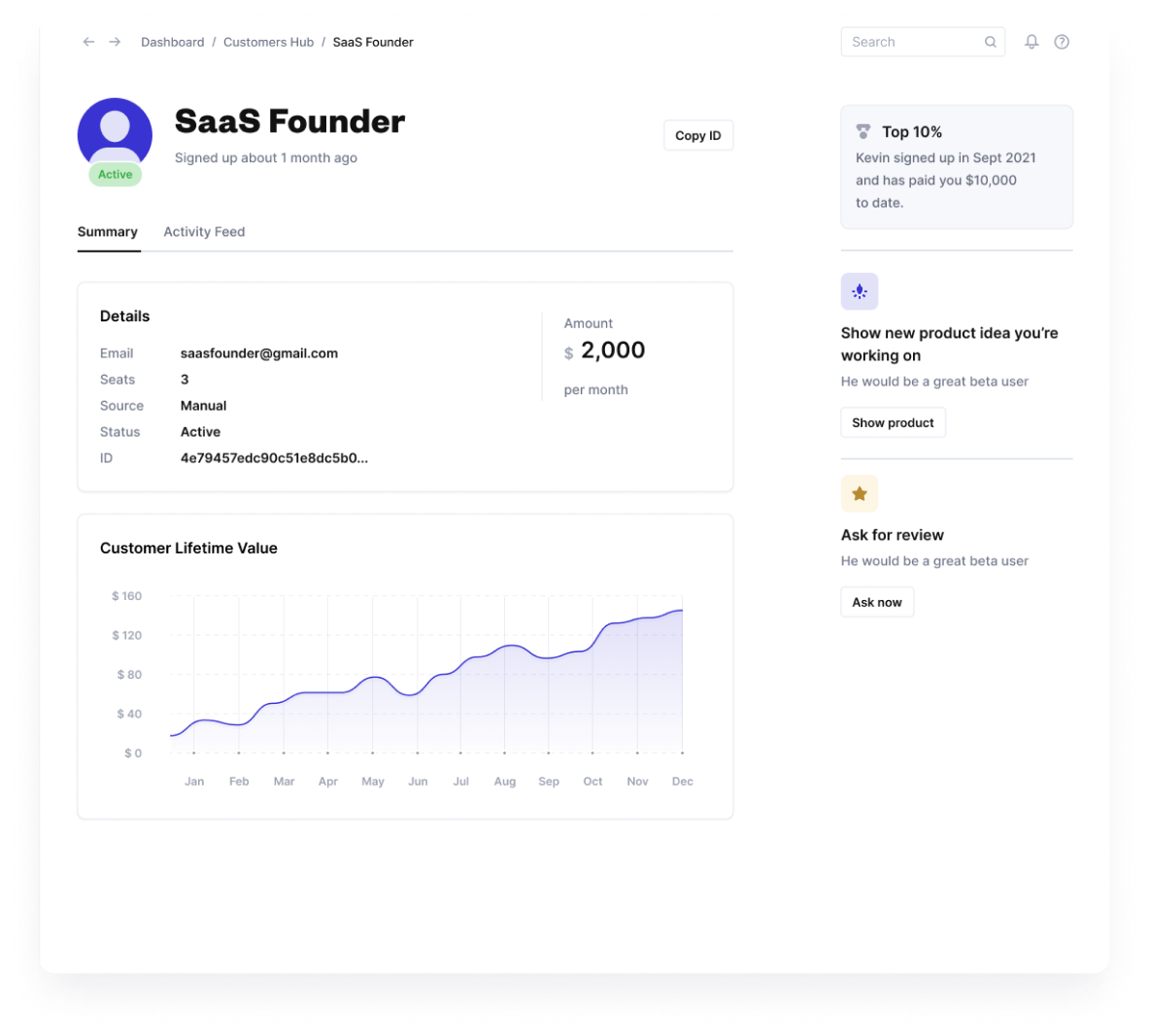

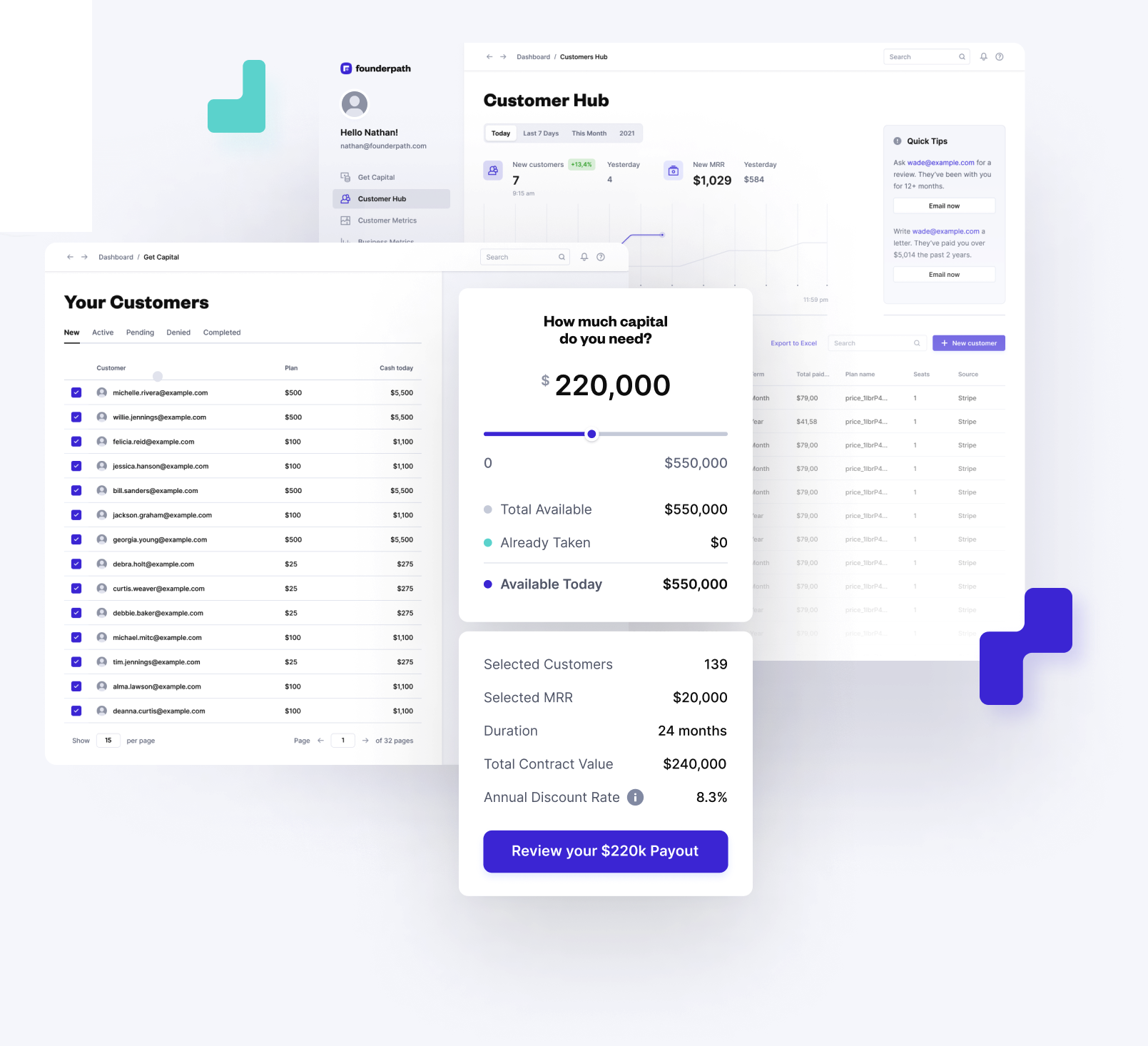

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing SaaS Capital Alternative

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform

Josh LaSov

Founder and CEO of ZoneReporting & Tactical Connect

After looking at 23 lenders, got 7 figure wire from Founderpath in under a week

After interviewing 23 lenders - it was wonderful to meet Founder Path. Their terms, process and understanding of speed was simply incomparable. Within 1 week we had completed diligence (and we aren't a small SaaS company). A few days later a seven figure wire hit our bank account and we were able to turn on the growth engine! In a nut shell, this is how lending should be done - great terms, super fast diligence and super fast to close.