Best Clearco Alternatives for SaaS & Ecommerce (2026)

An independent analysis of Clearco's contract terms, pricing, and how the top alternatives compare on fees, repayment structure, and funding speed.

Compared in this guide

Quick Cost Estimate

Save $24,221 with Founderpath

What is Clearco?

Clearco (formerly Clearbanc) is a revenue based financing company founded in Toronto, Canada. Clearco provides merchant cash advances primarily to ecommerce and direct to consumer businesses. Instead of traditional loans, Clearco purchases a share of your future receivables and collects repayment by sweeping a percentage of your daily revenue until the full amount is repaid.

Clearco originally launched as a revenue share model where founders would receive capital on a prepaid card (not a wire to their bank account) and repay through daily automated deductions. The company has gone through significant restructuring, including handing its international operations to Outfund in 2022 and reducing its workforce. Clearco now focuses primarily on the North American market.

Many founders search for Clearco alternatives because of the daily revenue sweep model, which penalizes companies during strong revenue months, and the restrictive covenants that prevent founders from using other financing sources. The prepaid card model also limits how founders can deploy the capital they receive.

Why Founders Look for Clearco Alternatives

- 1.Effective APRs up to 45%. Clearco charges a flat fee of 20 to 23% on top of your advance with no early repayment discount. Because you repay through daily revenue sweeps, the faster your business grows, the faster you repay and the higher your effective APR. For a company growing quickly, that flat fee translates to annualized rates above 45%.

- 2.Daily revenue sweeps punish growth. Clearco takes up to 50% of daily receivables, so the better your business performs, the more cash leaves your account each day.

- 3.Exclusivity clauses lock you in. Clearco's contract prohibits competing financing arrangements, factoring, or revenue share deals with other providers.

- 4.Funds arrive on a prepaid card, not your bank. You can only spend the advance at Clearco's approved vendors. No wire transfers, no ATM withdrawals.

- 5.No early repayment savings. The Percentage Discount in Clearco's contract is set to 0%, meaning you owe the full Specified Amount regardless of when you repay.

- 6.Short repayment windows squeeze cash flow. Most Clearco advances need to be repaid within 12 months through daily revenue sweeps. Founderpath offers repayment terms up to 36 months on RPAs and 48 months on Term Loans, giving founders significantly more breathing room to grow.

- 7.Unpredictable payments make forecasting impossible. Finance teams cannot model cash flow when repayments fluctuate with daily revenue.

Top 7 Clearco Alternatives for SaaS & Ecommerce

Here are the best Clearco alternatives available to SaaS, ecommerce, and subscription businesses in 2026.

Company | # | Best For | Pricing | Funding Speed |

|---|---|---|---|---|

1 | Founderpath | Software and ecommerce businesses | Predictable fixed payments | Under 24 hours |

2 | Pipe | SaaS with annual contracts | Trading marketplace model | 2 to 5 days |

3 | Capchase | SaaS subscription financing | Subscription advance model | 48 hours |

4 | Wayflyer | Ecommerce, DTC brands | Revenue based financing | 24 to 48 hours |

5 | Shopify Capital | Shopify store owners | Revenue share on sales | Instant (invite only) |

6 | OnDeck | Small businesses needing lines of credit | Interest-based term loans | 1 to 3 days |

7 | Settle | CPG and ecommerce inventory financing | Working capital advances | 3 to 5 days |

Founderpath is the only Clearco alternative on this list that offers both a revenue purchase agreement and a term loan with fixed monthly payments and no daily revenue sweep.

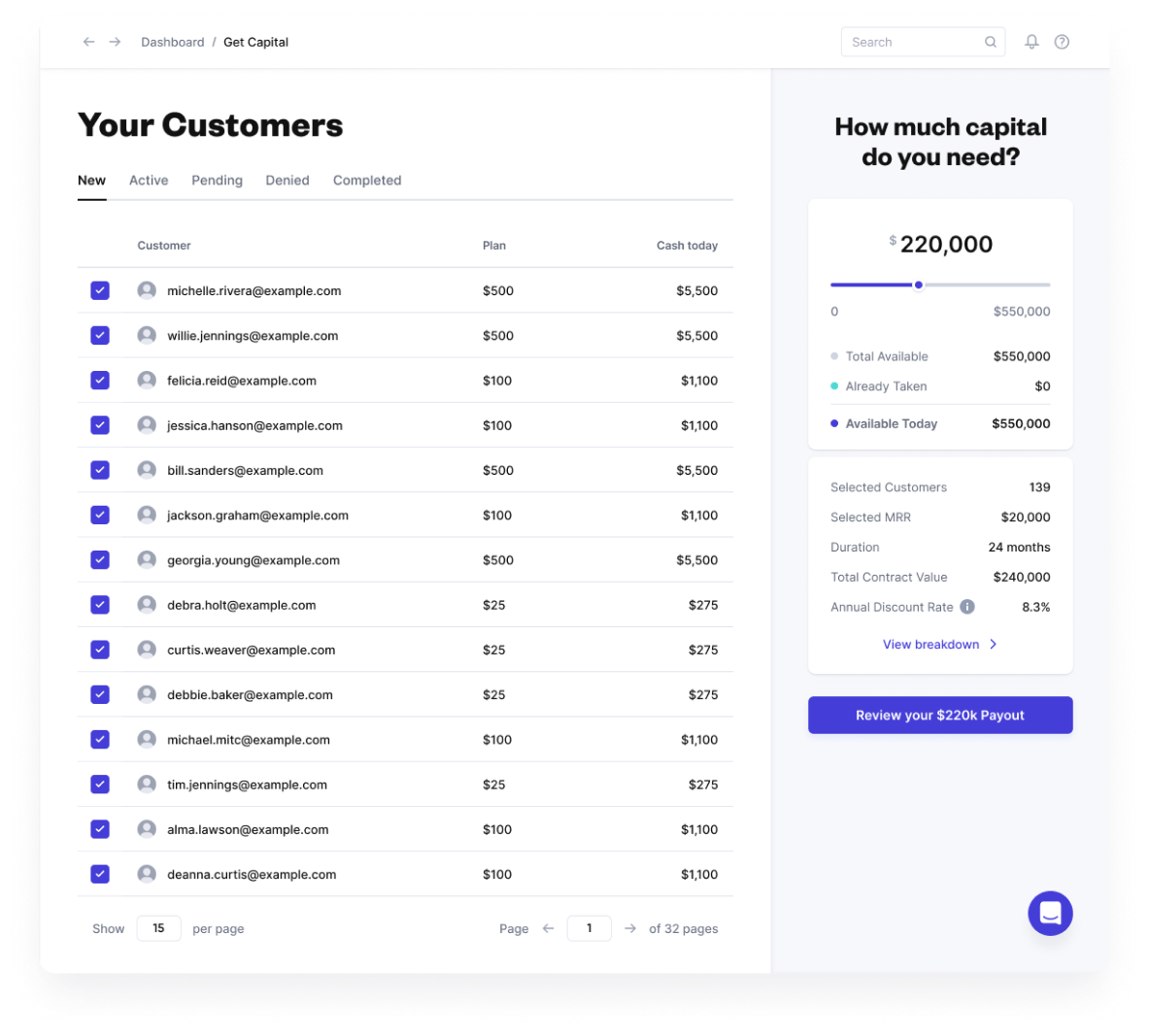

1. Founderpath

Founderpath is the best Clearco alternative for software and ecommerce businesses with recurring revenue. Unlike Clearco's daily revenue sweep, Founderpath offers predictable fixed payments through two products: a Revenue Purchase Agreement for companies with $100K or more in annual revenue, and a Term Loan for established businesses with $3M or more in ARR. Funds are wired directly to your bank account in under 24 hours, with no exclusivity clause and no prepaid card restrictions. Founderpath has funded over $220M to more than 500 founders.

2. Pipe

Pipe operates as a trading marketplace where SaaS companies can sell their annual or multi-year subscription contracts for upfront capital. Instead of taking a loan, founders list their recurring revenue streams and institutional investors bid on them. Pipe works best for companies with predictable annual contracts and long customer lifetimes. The model is less suited for monthly subscription businesses or companies with high churn, since the discount rate on traded contracts increases with risk.

3. Capchase

Capchase provides subscription advances for SaaS companies, allowing founders to pull forward future recurring revenue. Capchase underwrites based on your MRR and customer retention metrics. The platform integrates with billing systems like Stripe and Chargebee to verify revenue. Capchase is a solid option for SaaS companies that want fast access to capital, though their pricing model can become expensive for smaller deals and they primarily serve the SaaS vertical.

4. Wayflyer

Wayflyer is a revenue based financing provider focused on ecommerce and direct to consumer brands. Wayflyer connects to your Shopify, Amazon, or ad platform accounts to assess performance and offers capital based on your sales trajectory. Repayments are tied to a percentage of revenue, similar to Clearco's model but typically with lower sweep rates. Wayflyer is best for ecommerce businesses that need inventory or marketing capital and are comfortable with variable repayments.

5. Shopify Capital

Shopify Capital is available exclusively to Shopify merchants who receive an invitation through their Shopify dashboard. Funding amounts are based on your store's sales history and are repaid through a fixed percentage of daily sales. The application process is seamless since Shopify already has your data, but you must be a Shopify merchant to qualify. Shopify Capital is best for smaller ecommerce businesses that want a frictionless funding experience within the Shopify ecosystem.

6. OnDeck

OnDeck offers term loans and lines of credit to small and medium businesses across a wide range of industries. Unlike the other alternatives on this list, OnDeck is not specifically built for SaaS or ecommerce. Their underwriting considers overall business health rather than recurring revenue metrics. OnDeck is best for businesses that need traditional term loans with fixed repayment schedules and may not qualify for revenue based financing products.

7. Settle

Settle provides working capital and inventory financing for CPG and ecommerce brands. Settle combines accounts payable automation with financing, allowing brands to extend payment terms with suppliers while Settle fronts the capital. This model is specifically designed for product businesses that need to purchase inventory before generating revenue. Settle is best for CPG and ecommerce brands with strong supplier relationships that need to manage cash flow around purchase orders.

Pros and Cons of Clearco

Pros of Clearco

- +No equity dilution. Clearco does not take ownership in your company.

- +No full personal guarantee required from founders.

- +Originally designed for ecommerce, so the product understands DTC business models.

- +Straightforward application process that connects to your revenue platforms.

Cons of Clearco

- −Daily revenue sweep of up to 50% makes cash flow unpredictable and penalizes growth months.

- −Effective APR can exceed 45% for fast growing companies due to accelerated repayment.

- −Exclusivity clause prevents using other financing providers while the advance is outstanding.

- −Funds arrive on a prepaid card restricted to approved vendors, not wired to your bank.

- −No early repayment discount. The Percentage Discount in the contract is set to 0%.

- −Clearco can assign your contract to a third party without your consent or notice.

Clearco Pricing Explained

Clearco does not charge interest in the traditional sense. Instead, they charge a flat fee built into the total repayment amount, which they call the "Specified Amount." Based on publicly filed SEC documents, a typical Clearco advance of $320,000 requires a total repayment of approximately $393,000, representing a flat fee of roughly 22.8% or $73,000.

The challenge with Clearco's pricing is that the effective annual percentage rate depends entirely on how quickly you repay. Since repayment is tied to 50% of daily revenue, companies with strong sales repay faster and face a higher annualized cost. A company that repays in 6 months would face an effective APR above 45%. A company with slower sales might repay over 12 to 18 months and see a lower effective APR, but the total dollar cost remains the same because the contract's "Percentage Discount" for early repayment is set to 0%.

In addition to the flat fee, Clearco charges a $10,000 deposit fee and requires borrowers to cover Clearco's legal fees. These costs are not always disclosed upfront in marketing materials but are present in the contract terms.

By comparison, Founderpath's Revenue Purchase Agreement starts at an effective APR as low as 14%, and the Term Loan starts at 14% APR with the ability to save on interest by repaying early. Both products use fixed monthly payments, so founders know exactly what they owe each month regardless of how fast their revenue grows.

Clearco Funding Cost Calculator

Use this calculator to estimate the true cost of a Clearco advance based on your revenue and growth rate. Compare it side by side with Founderpath's fixed payment model to see how much you could save.

Calculate the Real Cost of Clearco

See how Clearco's revenue sweep model compares to fixed monthly payments.

How often Clearco sweeps your revenue

Clearco Cost

Founderpath Cost

You could save $24,221 by choosing Founderpath over Clearco for this advance.

Clearco cost assumes a 22.8% flat fee with 50% daily revenue sweep. Founderpath cost assumes 14% APR with fixed monthly payments over 24 months. Actual terms may vary.

Disclaimer: This calculator is for illustrative and educational purposes only. It does not represent an actual Clearco offer, quote, or financing term. All figures are hypothetical estimates based on publicly available information and user-provided inputs. Actual Clearco terms may differ significantly. Founderpath is not affiliated with Clearco and makes no representations about Clearco's current pricing or terms. Consult directly with any financing provider before making decisions.

Clearco for SaaS vs Ecommerce: Which Works Better?

Clearco was originally built as Clearbanc, a funding platform for ecommerce and direct to consumer businesses. The daily revenue sweep model makes more sense for ecommerce companies with high-volume daily transactions, since the percentage of revenue deducted each day is spread across many small orders. However, even ecommerce founders have increasingly moved to alternatives because the 50% sweep rate takes too much cash during strong sales periods like Black Friday or seasonal peaks.

For SaaS companies, Clearco's model is a poor fit. SaaS businesses typically collect revenue through monthly or annual subscriptions, which means daily revenue is lumpy or concentrated around billing cycles. A 50% daily sweep can take a disproportionate amount of cash on days when annual renewals process, leaving the company short on operating capital for the rest of the month. SaaS companies also tend to have longer sales cycles and higher customer lifetime values, which means the capital should be deployed over longer time horizons than Clearco's repayment model supports.

This is why many SaaS founders choose Founderpath as a Clearco alternative. Founderpath's fixed monthly payments align with SaaS billing cycles, and repayment terms of up to 36 months on RPAs and 48 months on Term Loans give founders the runway to invest in growth without sacrificing daily cash flow. Ecommerce founders also benefit from the predictability, particularly those who have experienced the pain of Clearco's sweep model during high-revenue months.

Clearco vs Founderpath: Full Contract Comparison

Based on Clearco's publicly filed SEC agreements, independent reviews, and founder testimonials. See exactly how Clearco revenue share terms stack up against Founderpath RPA and Term Loan products.

Feature | Clearco | Founderpath RPA | Founderpath Term Loan |

|---|---|---|---|

Legal structure | Purchase of future receivables (not a loan) | Purchase of future receivables (not a loan) | Senior secured term loan |

Repayment type | 50% daily revenue sweep that changes with your revenue | Fixed daily or weekly deductions on a set schedule | Fixed monthly payments with interest only periods available |

Penalizes you during a good revenue month? | Yes. 50% of higher revenue is swept, punishing growth | No. Same fixed deduction regardless of revenue | No. Same fixed payment regardless of revenue |

Easy for finance teams to forecast? | No. Payments fluctuate with daily revenue, impossible to model | Yes. Fixed schedule set at closing, fully predictable | Yes. Fixed monthly payments, easy to build into cash flow models |

Interest only period | None. 50% sweep starts immediately | Not applicable | Up to 3 years interest only before principal repayment begins |

Repayment term | No fixed term (repay until full Specified Amount is delivered) | 12 to 48 months depending on tier | Up to 4 years (48 months) |

Maximum leverage | Varies. No published ARR based formula | Up to 70% of ARR for flagship companies | Up to 70% of ARR for flagship companies |

Typical effective APR | ~22.8% flat fee (effective APR 45%+ if repaid in 6 months) | As low as 14% effective APR depending on tier and term | As low as 14% APR depending on tier |

Minimum annual revenue | Not publicly disclosed | $100,000 | $3,000,000 ARR |

Early repayment | No discount. Percentage Discount set to 0% in contract | Full fee applies (no savings on early exit) | Save on interest by repaying early |

Fees | $10k deposit fee + pay their legal fees | Standard and customary | Standard and customary |

How you receive funds | Prepaid card only (approved vendors, no ATM, no wire to your bank) | Wire to your bank account | Wire to your bank account |

Collateral | Irrevocable ACH authority plus Approved Card control over all accounts | UCC 1 first position lien on future receivables and bank account | UCC 1 first position lien on all business assets |

Full personal guarantee | No (but irrevocable ACH authority plus Approved Card control) | No | No |

Can you use other financing? | No. Exclusive, no competing financing allowed per Section 6 | Yes. No exclusivity clause | Yes. No exclusivity clause |

Change of control or M&A | Blocked without Clearco written consent | 30 days written notice required | No restriction |

Can you change bank accounts? | No. Requires Clearco consent | Yes | Yes |

Contract assignability | Clearco can sell your contract to anyone without notice or consent | Cannot be assigned without consent | Cannot be assigned without consent |

Funding speed | Days to weeks | Under 24 hours | Under 24 hours |

- Clearco Revenue Share Agreement, SEC EDGAR Filing (Exhibit 10-15). sec.gov — publicly filed agreement detailing revenue share structure, repayment terms, restrictive covenants, liability limitations, and assignability provisions.

- "Clearco Review," United Capital Source. unitedcapitalsource.com — "automatically deducts a percentage from your daily sales at a rate between 1% and 20%."

- "Clearco Review," Finder. finder.com — "if your sales aren't high enough to repay the advance within four months, the remittance rate increases by 5%."

- "Clearco Review," New Frontier Funding. newfrontierfunding.com — "flat fee typically 8 to 14% of the advance amount, repayments range from 1% to 20% of monthly revenue."

- "Clearco Alternatives Exposed," Luca. ask-luca.com — "APRs that skyrocket to around 40%" and "aggressive daily repayment schedules crushing cash flow during slow periods."

- Clearco Reviews, Trustpilot. trustpilot.com — "does not give you a loan or a direct deposit... instead you get a credit card number you can use to make payments" and "pretty expensive at 35 to 40% APR."

- "Choosing the Best Ecommerce Loan: Is Clearco Marketing Capital Right for You?," Finaloop. finaloop.com — "12% fee upfront... 6% discount credit for eligible marketing spend" at approved vendors only.

- "Clearco hands overseas business to Outfund," BetaKit, 2022. betakit.com — existing capital agreements were transferred to Outfund with minimal notice.

- "Everything You Need to Know About Clearbanc's Financing Model," Jayvas. jayvas.com — annualized rate calculations: 9.6% (shrinking revenue), 20% (steady), 24% (growing 25% MoM).

- "Clearco created a new way to fund ecommerce businesses," The Hustle. thehustle.co — "takes a percentage of sales until it recoups the investment + 6%."

What's Really in Clearco's Contract?

Based on Clearco's publicly filed SEC Revenue Share Agreement, independent reviews, and founder testimonials. Here are the key terms every founder should understand before signing.

50% Daily Revenue Sweep

Clearco takes 50% of your "Specified Future Receivables" every day via automatic ACH debit. This includes all payments from cash, check, ACH, debit, wire, credit card, and any other form of payment. During a strong revenue month, you pay significantly more. You are penalized for growth.

No Competing Financing Allowed

Section 6 prohibits entering into any cash advance, factoring, royalty, revenue share, or similar arrangement with any other party. You also cannot take any new loan secured by future receivables without Clearco's prior written consent. This locks you into a single financing relationship.

~22.8% Flat Fee, No Fixed Term

On a $320,000 advance, the contract requires repaying $393,062, a $73,000 fee with no fixed repayment timeline. The "Percentage Discount" for early repayment is set to 0%, meaning you owe the full amount regardless of when you repay. For fast-growing companies, the effective APR can exceed 45%.

Approved Card & Vendor Restrictions

You can only access the advance through Clearco's prepaid "Approved Card." No wire transfer to your bank account. The card can only be used at Clearco's list of "Preferred Vendors," which they can change at their sole discretion with as little as next-day notice. ATM cash withdrawals are prohibited.

US$500 Liability Cap

Clearco's maximum liability to you is capped at US$500 regardless of the size of your advance or the nature of the claim. Consequential, incidental, punitive, and exemplary damages are waived. Indemnification is one-way: you must indemnify Clearco, but they have no reciprocal obligation.

Affiliate Joint & Several Liability

Clearco's Amendment extends joint and several liability across all of your affiliate companies. If you have entities in multiple jurisdictions (US, Canada, UK, etc.), each entity becomes liable for the obligations of every other entity under the agreement.

Founderpath vs Clearco: Which is Better for Your Business?

Founderpath and Clearco both offer non-dilutive financing, but the similarities end there. Clearco uses a revenue share model with daily sweeps, while Founderpath provides revenue based financing for SaaS companies with predictable fixed payments. This makes Founderpath the better Clearco alternative for founders who want to keep control of their cash flow.

With Founderpath, you choose between two products: a Revenue Purchase Agreement for companies with $100K or more in annual revenue, or a term loan for established SaaS businesses with $3M or more in ARR. Both products wire funds directly to your bank account in under 24 hours and include no exclusivity clause, so you are free to use other financing as well.

Clearco's contract includes restrictive covenants that many founders find surprising: no competing financing, no change of control without consent, and the ability to assign your contract to a third party without notice. Founderpath's terms are transparent and founder friendly by comparison. See the full Clearco vs Founderpath comparison table above for a detailed breakdown.

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing Clearco Alternative

Frequently Asked Questions About Clearco

Written by Nathan Latka, CEO of Founderpath. Founderpath has funded over $220M to more than 500 SaaS and ecommerce founders. All Clearco contract analysis is based on publicly filed SEC agreements and independent third party reviews.