Brick and Mortar Financing for Restaurants, Bars & Retail

Non-dilutive financing from $50k to $5M. Better rates than Toast Capital and Square Loans for restaurants, bars, retail stores, and grocery.

Cabana Club

$2.5M Revenue Pool Bar & Venue

Key Highlights

- ✓

$2.5M Revenue

- ✓

$68K Best Day

- ✓

9 Cabanas

Founderpath Deal

- •

$250,000 merchant cash advance

- •

8% monthly revenue take rate

- •

$275K total payback (10% fee)

Watch the documentary“Toast was taking 14% of our daily sales. Founderpath cut that to 8% — that’s almost $10,000 a month back in our pocket to run the business.”

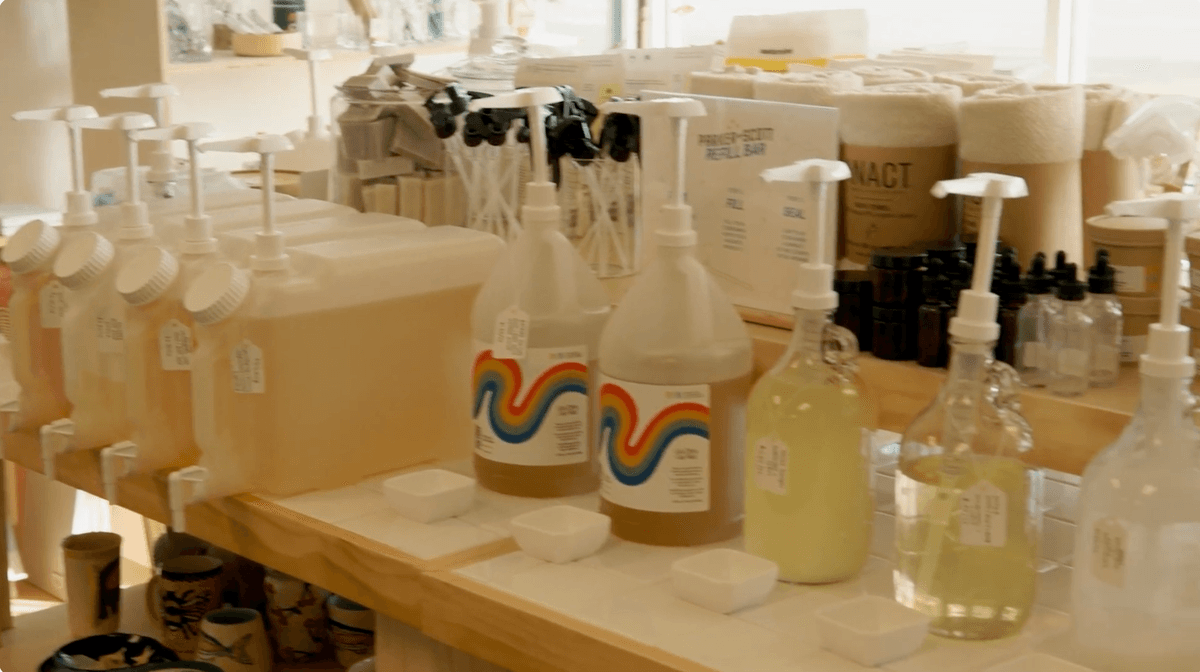

Parker and Scott

$480K Revenue Sustainable General Store

Key Highlights

- ✓

$480K Annual Rev

- ✓

50% Margins

- ✓

3–5 Location Goal

Founderpath Deal

- •

$150,000 term loan

- •

12% annual interest

- •

5-year repayment

Watch the documentary“We started with $40K in personal savings. Founderpath gave us $150K at 12% to open our next locations — no equity, no daily deductions, just a 5-year term we can plan around.”

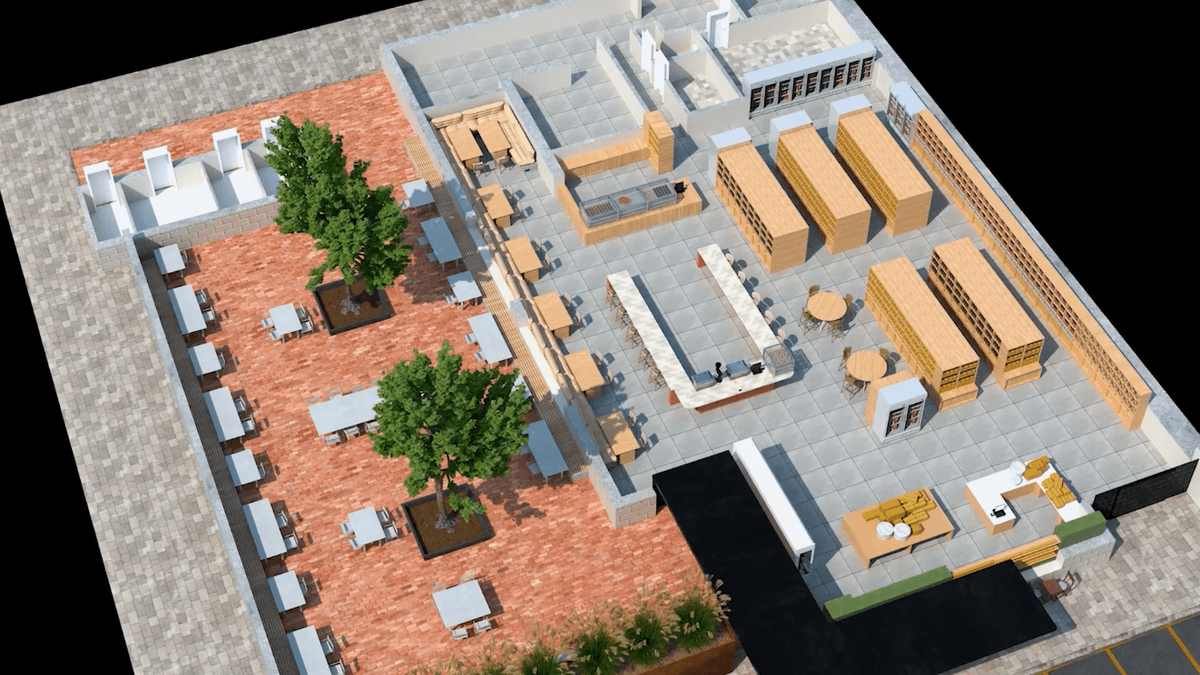

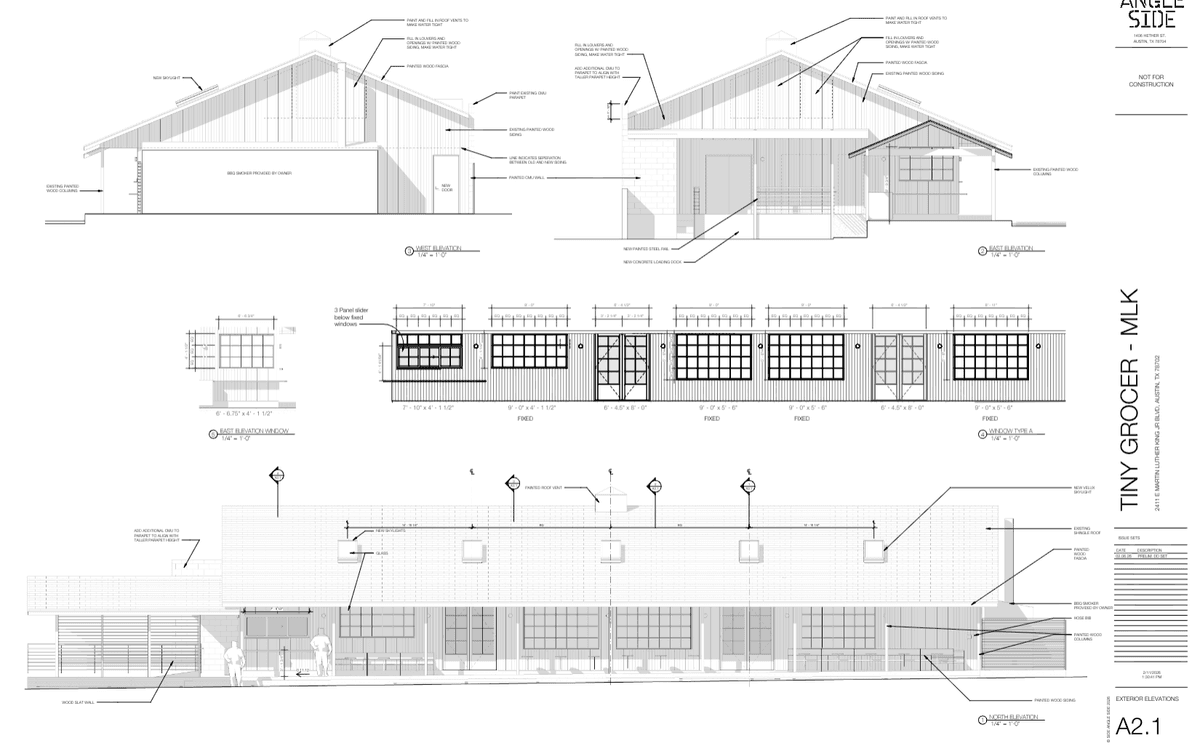

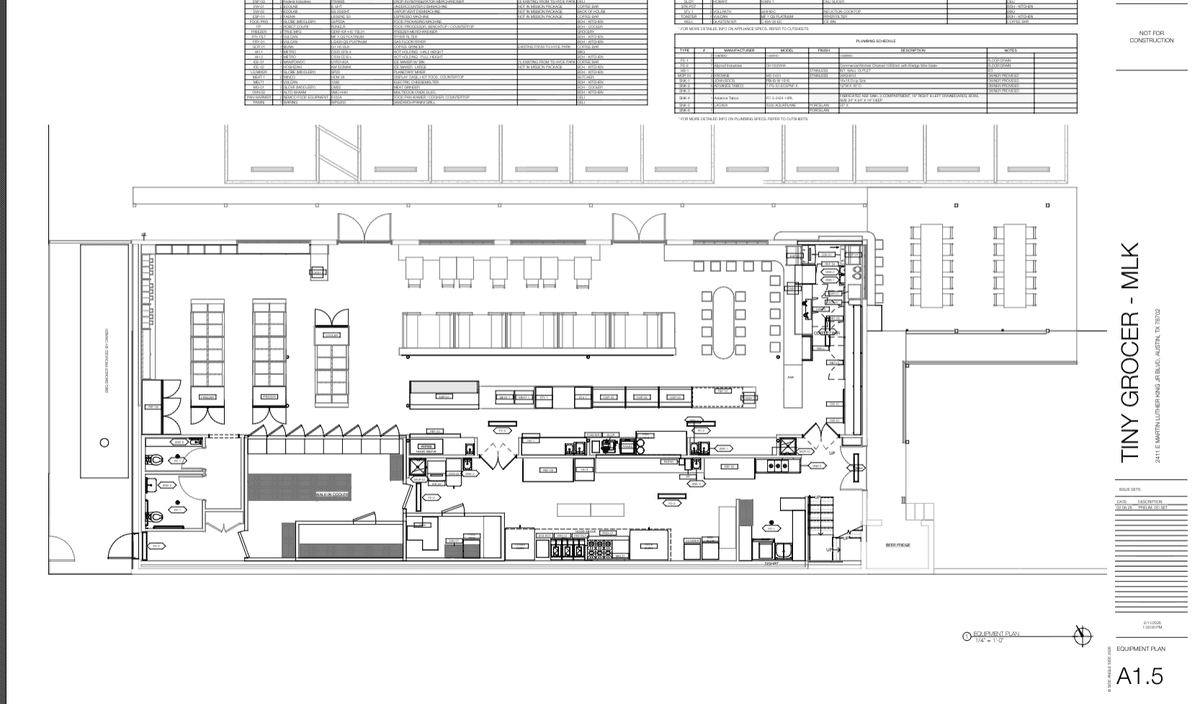

Tiny Grocer

$5M Revenue Curated Grocery & Restaurant

Key Highlights

- ✓

$5M Revenue

- ✓

4,500 SKUs

- ✓

42% Margins

Founderpath Deal

- •

$500,000 expansion capital

- •

New location buildout + inventory

- •

Revenue-based repayment

“Founderpath gave us $500K to build out our second location and stock 4,500 SKUs from local makers. We went from one store doing $3.5M to two stores doing $5M.”

How Brick and Mortar Businesses Use Our Capital

New Location Buildout

Capital for second/third locations including lease deposits, renovations, and equipment ($75K-$200K typical per location).

Inventory Investment

Stocking shelves, buying wholesale product, seasonal inventory pre-builds for retail stores and grocery.

Equipment & Renovations

Commercial kitchen equipment, POS systems, furniture, patio buildouts, pool installations.

Refinance Toast Capital

Replace expensive POS-embedded financing. Toast Capital charges 14% daily take rates (~40% effective APR). Founderpath offers 8-12% monthly structures.

Marketing & Customer Acquisition

Digital ads, local marketing, events, grand opening promotions. Parker and Scott built their Instagram presence 6 months before launch.

Working Capital Smoothing

Bridge gaps between vendor payments and customer revenue. Restaurants operate on thin margins with 30-60 day vendor payment cycles.

Seasonal Capacity Scaling

Hire seasonal staff, build event inventory, expand outdoor dining. Cabana Club staffs 20-40 people depending on season.

Menu & Concept Development

New menu launches, concept pivots, adding revenue streams. Tiny Grocer added a French restaurant to their grocery, now doing $3.5M/year.

Debt Consolidation

Combine multiple high-interest loans, credit cards, and merchant cash advances into a single lower-rate facility.

Estimate Your Brick and Mortar Financing *

See what non-dilutive capital could look like for your restaurant, bar, or retail store. No sign-up required.

Your Numbers

Monthly Revenue

$80k

$10k

$3M

Capital Needed

$150k

$25k

$5M

Payback Period

24 mo

6 mo

48 mo

Estimated Terms

Total Repayment

$168,000

1.12x payback multiple

Monthly Payment

$7,000

8.8% of revenue

Total Cost of Capital

$18,000

12% total cost

Equity Equivalent

$750,000

At 5x revenue multiple

*This calculator provides estimates only. Actual terms depend on your business profile, financials, and underwriting review. Founderpath does not guarantee any specific rate or amount.

Founderpath vs Toast Capital for Brick and Mortar Businesses

A side-by-side comparison based on publicly available data, independent reviews, and real founder case studies.

Feature | Founderpath | Toast Capital |

|---|---|---|

Product Structure | Promissory note, revenue-based financing, MCA | Merchant cash advance embedded in POS |

Effective APR | 10–20% | 30–50%+ effective (14% daily take rate on Cabana Club) |

Term Length | 12–36 months | Until paid in full (typically 6–12 months) |

Repayment | Monthly flexible payments | Daily auto-deduct from card sales |

Revenue Share Rate | 5–10% of monthly revenue | 10–16% of daily card sales |

Interest-Only Period | Up to 6 months available | None |

Typical Deal Size | $50k–$5M | Up to $300K |

Platform Required | None — works with any POS or sales channel | Must use Toast POS system |

Custom Terms | Fully negotiable with investment team | Algorithm-generated, take-it-or-leave-it |

- "Toast Capital FAQ," Toast. pos.toasttab.com — "daily percentage of card sales until repaid"

- "Toast Capital Reviews," NerdWallet. nerdwallet.com — "effective APR ranges from 30% to over 50%"

- Cabana Club case study: "14% daily revenue take rate on ~$200K Toast Capital loan, refinanced to 8% take rate with Founderpath"

Why the Differences Matter for Restaurant & Bar Owners

Toast Capital is the embedded financing arm of Toast POS, one of the largest restaurant technology platforms in the US. Their convenience is real — if you already run Toast, capital can arrive in days with zero additional paperwork. But the product structure creates serious problems for growing brick-and-mortar businesses.

14% Daily Take Rate vs 5–10% Monthly

Cabana Club was paying a 14% daily take rate on their ~$200K Toast Capital loan. At $160K/month in revenue, that meant roughly $22,400/month going straight to Toast before they could cover payroll, inventory, or rent. After refinancing with Founderpath at an 8% monthly revenue share, that dropped to $12,800/month — freeing up nearly $10,000 every month to reinvest in operations. For brick-and-mortar businesses running on thin margins, that difference compounds fast.

30–50% Effective APR vs 10–20% Annual Interest

Toast Capital quotes a simple factor rate, not an APR. When you back into the effective annual percentage rate on daily take-rate merchant cash advances, the true cost often lands between 30% and 50%+ — sometimes higher if you repay early because the total payback amount is fixed regardless of speed. Founderpath structures deals as promissory notes or revenue-based financing with transparent annual interest rates of 10–20%. You know what you owe, and faster repayment actually saves you money instead of costing the same.

Daily Auto-Debit vs Monthly Payments

Restaurants and retail businesses have lumpy revenue. A Tuesday lunch shift looks nothing like a Saturday dinner rush. Daily auto-debits pull cash out on slow days when you need it most, making it harder to manage payroll and vendor payments that land on fixed schedules. Founderpath uses monthly flexible payments, so you can plan around your actual cash flow cycle — paying when revenue has accumulated, not when the POS terminal processes each swipe.

POS Lock-In vs Channel-Agnostic

Toast Capital only works if you run Toast POS. That means your financing is tied to your point-of-sale vendor — and switching POS systems could mean losing access to capital or triggering repayment. Founderpath is completely channel-agnostic. Whether you use Toast, Square, Clover, Lightspeed, or a mix of systems across locations, your financing terms stay the same. Your capital provider should never dictate your technology stack.

When Toast Capital Makes Sense

To be fair — if you need less than $50K fast and you already use Toast POS, the speed is a real advantage. Toast Capital can fund in as little as 1–2 business days with no additional application because they already have your sales data. For a quick equipment repair or a short-term inventory bridge, that convenience has genuine value. The tradeoff is cost: you will pay significantly more in total capital cost for that speed and simplicity. For anything above $50K or any use case where you need the capital for more than a few months, the math favors a structured financing partner like Founderpath.

Founderpath vs Square Loans for Retail & Restaurant Businesses

A side-by-side comparison based on publicly available data and independent reviews.

Feature | Founderpath | Square Loans |

|---|---|---|

Product Structure | Promissory note, revenue-based financing | Merchant cash advance |

Effective APR | 10–20% | 30–50% |

Term Length | 12–36 months | Until repaid (typically 6–18 months) |

Repayment | Monthly flexible payments | % of daily card sales |

Max Funding | $50k–$5M | Up to $250K |

Platform Required | None — works with any POS or sales channel | Square POS |

Custom Terms | Fully negotiable with investment team | Algorithm-generated, take-it-or-leave-it |

- "Square Loans," Square. squareup.com — "automatic daily deductions as a percentage of card sales"

- "Square Loans Review," NerdWallet. nerdwallet.com — "effective APR ranges widely depending on repayment speed"

Why Square Loans Are Expensive for Growing Businesses

Square Loans is the embedded financing arm of the Square POS ecosystem. The convenience is real — if you already process payments through Square, capital can arrive in days with minimal paperwork. But the product is a merchant cash advance, not a loan, and the structure creates problems for businesses trying to grow. Square automatically deducts a percentage of every card transaction until the advance is repaid. There is no fixed monthly payment, no rate negotiation, and no ability to plan around a predictable debt service number. The effective APR typically lands between 30–50% depending on how quickly your sales volume repays the advance.

Parker and Scott: Why Independent Retail Needs Flexible Capital

Parker and Scott runs $40K/month in revenue with roughly 50% margins — a healthy independent retail operation. When they needed $150K to open new locations, a daily auto-deduct from card sales would have gutted their working capital during the build-out period when revenue from existing stores needed to cover both operating costs and construction expenses. Fixed monthly payments with Founderpath let them budget precisely: they knew exactly what left the account each month and could plan inventory purchases, lease deposits, and staffing around that number. For multi-location retail expansion, predictable monthly obligations beat daily uncertainty every time — especially when the new locations take 3–6 months to ramp to full revenue.

When Square Loans Make Sense

If you need a small amount — under $50K — and speed matters more than cost, Square Loans have a genuine advantage. Funding can arrive in as little as 1–2 business days with zero additional paperwork because the platform already has your complete sales history. For a quick inventory purchase before a seasonal spike or an emergency equipment replacement, that frictionless access to capital has real value. The key is understanding the tradeoff: you are paying a significant premium for speed and convenience. For any amount above $50K, any term longer than a few months, or any situation where you want to negotiate your rate, a dedicated financing partner like Founderpath will save you meaningful dollars on total capital cost.

What Is Brick and Mortar Financing?

Brick-and-mortar financing is non-dilutive capital designed for physical retail businesses — restaurants, bars, grocery stores, retail shops, salons, and fitness studios — that need funding for expansion, inventory, equipment, and working capital without giving up equity.

Unlike traditional bank loans that rely on credit scores, collateral, and years of financial history, brick-and-mortar financing is underwritten on your actual revenue and margins. If your business generates consistent sales and healthy gross margins, you can qualify — even without the two-year track record most banks require.

Why Brick and Mortar Businesses Need Smart Capital

Why Location Expansion Is the Biggest Growth Lever

For brick-and-mortar businesses, opening a new location is the single highest-ROI growth decision you can make. Tiny Grocer proved this: their Hyde Park location generates $3.5M in annual revenue, and their South Congress location adds another $1.5M — combining for $5M across just two storefronts. Each location compounds brand awareness, supplier leverage, and operational efficiency.

Parker and Scott, a family-owned retail brand doing $40K per month, is planning to expand from one location to three to five. At that scale, each new location doesn't just add revenue — it multiplies the value of the brand. The challenge is finding capital that doesn't require giving up ownership to fund that expansion.

Operating Margins in Restaurants and Retail (30-50%)

Brick-and-mortar businesses often have stronger margins than people expect. Tiny Grocer runs a 41-42% blended gross margin across their curated grocery and prepared food categories. Parker and Scott hits 50% margins on non-food items like gifts and home goods, and 30-35% on snacks and consumables. Cabana Club, a hospitality venue, generates high margins on beverages — the core profit driver in bars and poolside service.

These margin profiles make brick-and-mortar businesses strong candidates for revenue-based financing, where repayment is tied to a percentage of monthly revenue rather than a fixed monthly payment.

Why Merchant Cash Advances Kill Working Capital

Many brick-and-mortar owners turn to merchant cash advances (MCAs) from Toast Capital, Square Loans, or other embedded POS lenders because they're fast and easy. But the daily deduction model is destructive. When Toast takes 10-16% of every transaction before you see it, your working capital evaporates — especially for businesses with lumpy revenue patterns.

A restaurant doing $80K in a strong summer month and $40K in January still has the same rent, same staff minimums, and same supplier invoices. Daily MCA deductions don't flex down fast enough, creating cash crunches exactly when you can least afford them. The effective APR on most MCAs runs 30-50%, making them among the most expensive capital available to small businesses.

Seasonal Revenue Patterns in Hospitality

Seasonality is a defining feature of hospitality and brick-and-mortar businesses. Cabana Club staffs between 20 and 40 employees depending on the season — pool revenue is heavily weighted toward summer months. This creates a capital planning challenge: you need to invest in staffing, inventory, and marketing before the revenue arrives.

Smart capital for seasonal businesses means flexible repayment that adjusts with revenue. A line of credit lets you draw funds when you need them and repay when cash flow is strongest, rather than committing to fixed payments that ignore your business cycle.

Why Traditional Bank Loans Don't Work for Most Brick and Mortar

Banks require at least two years of operating history, personal guarantees, significant collateral, and a lengthy underwriting process. For most brick-and-mortar businesses — especially those in the first few years, expanding to new locations, or operating in seasonal markets — these requirements are disqualifying.

Even businesses that do qualify face 60-90 day approval timelines, rigid fixed payments, and covenant structures that penalize the kind of revenue variability that's normal in physical retail. Revenue-based financing and term loans designed for brick-and-mortar businesses offer faster funding, flexible terms, and underwriting that actually understands how restaurants, bars, and retail shops operate.

Behind the Counter with Cabana Club

“Toast was taking 14% of our daily sales. Founderpath cut that to 8% — that’s almost $10,000 a month back in our pocket to run the business.”

— Cabana Club, Founder

Parker and Scott: From One Store to Three with Non-Dilutive Capital

“We started with $40K in personal savings. Founderpath gave us $150K at 12% to open our next locations — no equity, no daily deductions, just a 5-year term we can plan around.”

— Parker and Scott, Founders

The Complete Guide to Brick and Mortar Financing in 2026

Revenue-Based Financing for Restaurants and Bars

Revenue-based financing lets you repay as a percentage of your monthly revenue rather than a fixed dollar amount. When sales are strong, you pay more. When sales dip — during slow seasons or between locations — your payments automatically decrease. This makes it ideal for restaurants, bars, and any brick-and-mortar business with seasonal or variable revenue patterns. Most lenders take 5-15% of monthly revenue until the total repayment amount is met.

Term Loans for Retail Expansion

Term loans provide a lump sum with fixed payments over 12-36 months. They're ideal for opening new locations, major renovations, or large equipment purchases where you know exactly how much capital you need and want predictable payments. A term loan gives you the upfront capital to invest in growth while spreading the cost over a manageable timeline.

Merchant Cash Advances: What to Watch Out For

MCAs from Toast Capital, Square Loans, and similar POS-embedded lenders charge a factor rate (typically 1.1x-1.5x) rather than an interest rate. A $100K advance at 1.3x means you repay $130K. But because repayment is accelerated through daily deductions, the effective APR often lands between 30-50%. To calculate the true cost, divide the total repayment minus the advance amount by the advance amount, then annualize based on the expected repayment period. Always compare the effective APR, not just the factor rate.

Working Capital Lines of Credit for Retail

A revolving line of credit lets you draw funds as needed and only pay interest on what you use. This is the most flexible option for managing inventory purchases, payroll gaps, marketing pushes, or unexpected expenses. Unlike a term loan, you can draw and repay multiple times without reapplying, making it ideal for ongoing working capital needs.

How to Calculate Your Debt Service Coverage Ratio

DSCR = Net Operating Income / Annual Debt Service. Lenders use this ratio to determine whether your business generates enough cash to cover loan payments. A DSCR of 1.0x means you break even on debt payments. Most lenders want 1.25x or higher, meaning your business earns 25% more than what's needed to service the debt. To improve your DSCR, increase revenue, reduce operating expenses, or choose longer repayment terms that lower annual debt service.

Toast Capital vs Bank Loan vs Revenue-Based Financing

Toast Capital is fast (funded in days) but expensive (30-50% effective APR) with daily deductions that hurt cash flow. Bank loans are cheap (6-12% APR) but slow (60-90 days), require collateral and personal guarantees, and need 2+ years of history. Revenue-based financing sits in the middle: 10-20% effective cost, funded in 24-48 hours, no personal guarantee, and payments flex with revenue. For most brick-and-mortar businesses, revenue-based financing offers the best balance of speed, cost, and flexibility.

How Much Capital Can My Restaurant or Store Qualify For?

Qualification is based primarily on monthly revenue, gross margins, and time in business. Businesses doing $40K-$50K per month ($500K+ annualized) with 30%+ gross margins can typically qualify for $50K-$500K. Larger businesses doing $200K+ monthly with strong margins may qualify for $500K-$5M. The key factors are revenue consistency, margin stability, and the ability to service debt without straining operations.

Seasonal Staffing and Capital Planning

Seasonal businesses need to align capital deployment with their revenue cycle. Cabana Club, for example, scales from 20 to 40 staff between off-peak and peak seasons. The capital to hire, train, and stock inventory for peak season needs to be deployed weeks or months before peak revenue arrives. The best approach is securing a line of credit or revenue-based facility before your busy season, so capital is available when you need to invest ahead of demand.

Multi-Location Expansion: How to Finance Growth

Opening a second or third location is the highest-leverage move for most brick-and-mortar businesses, but it's capital-intensive. Tiny Grocer's expansion from one to two locations — Hyde Park at $3.5M and South Congress at $1.5M — demonstrates how each location compounds the brand's value. The key is financing the buildout, initial inventory, and pre-opening costs without depleting working capital at your existing location. A combination of a term loan for the buildout and a line of credit for ongoing working capital is often the optimal structure.

Non-Dilutive Funding vs Equity for Brick and Mortar

Debt preserves ownership. When you take equity investment — whether from a partner, investor, or franchise group — you permanently give up a share of your business and future profits. Parker and Scott chose non-dilutive financing to fund their expansion, keeping their family business fully owned by the family. For brick-and-mortar businesses with strong margins and predictable revenue, debt financing almost always makes more economic sense than selling equity.

How POS Providers Price Embedded Financing

Toast, Square, Shopify, and other POS providers offer embedded financing (Toast Capital, Square Loans) primarily as a retention tool — not a lending business. They price aggressively (high factor rates, daily deductions) because the real value to them is keeping you on their platform. The economics work for the POS company even if the loan is expensive for you, because your transaction processing fees far exceed their lending profits over time. Understanding this dynamic helps you evaluate whether their financing is truly competitive or just convenient.

How Brick and Mortar Lenders Price Risk (10-15% Typical Range)

Lenders evaluate brick-and-mortar businesses on revenue scale (higher is better), gross margin profile (30%+ minimum, 40-50% preferred), lease terms and stability, location performance data, and time in business. Businesses with $500K+ in annual revenue, 40%+ margins, and stable leases typically receive rates in the 10-15% range. Newer businesses, those with thinner margins, or single-location operators may see rates toward the higher end. Multi-location businesses with proven unit economics often receive the most favorable terms.

Frequently Asked Questions About Brick and Mortar Financing

Keep Your Business. Fund Your Growth.

We've wired $280M+ in the last 12 months. Now we fund brick and mortar.

Wired last 12 months

Founders funded

Average approval