The no fee, longer payback alternative to Capchase

SaaS Founders don't deserve to pay an upfront fee which makes prepayment expensive. Try Founderpath instead.

Join 3,021 Bootstrapped SaaS Founders

Capchase Reviews

David Tabachnikov

Founder of ScholarshipOwl

Refinanced my Capchase Deal with $1.5m From Founderpath

After trying all the RBF platforms out there, we found FounderPath to be the best one to work with, having the best terms, and also giving us added value that nobody else could. FounderPath also worked with us to help us resolve our unique situation, and make our payment more predictable and flexible. With FounderPath, it's not just the money - it's being part of a financial support network. Also, switching from our previous provider (CapChase) was extremely easy and smooth.

Jacob Wright

Founder of Dabble

Longer terms than others, & a personal touch

I've had dealings with Pipe and Capchase, and Founderpath has been the best experience. You aren't just dealing with a sales rep who then hands you off to someone else who hands you off to someone else. Founderpath has a more personal touch.They also have longer and more flexible terms, allowing you to pay off early if needed without penalty like the others.Overall, a great experience.Note that Discount Rate isn't the same as APR you get with a bank loan, so don't compare them apples-to-apples. All these companies use Discount Rate which ends up converting to ~2x APR, so bear that in mind when making decisions.

Why choose Founderpath over Capchase?

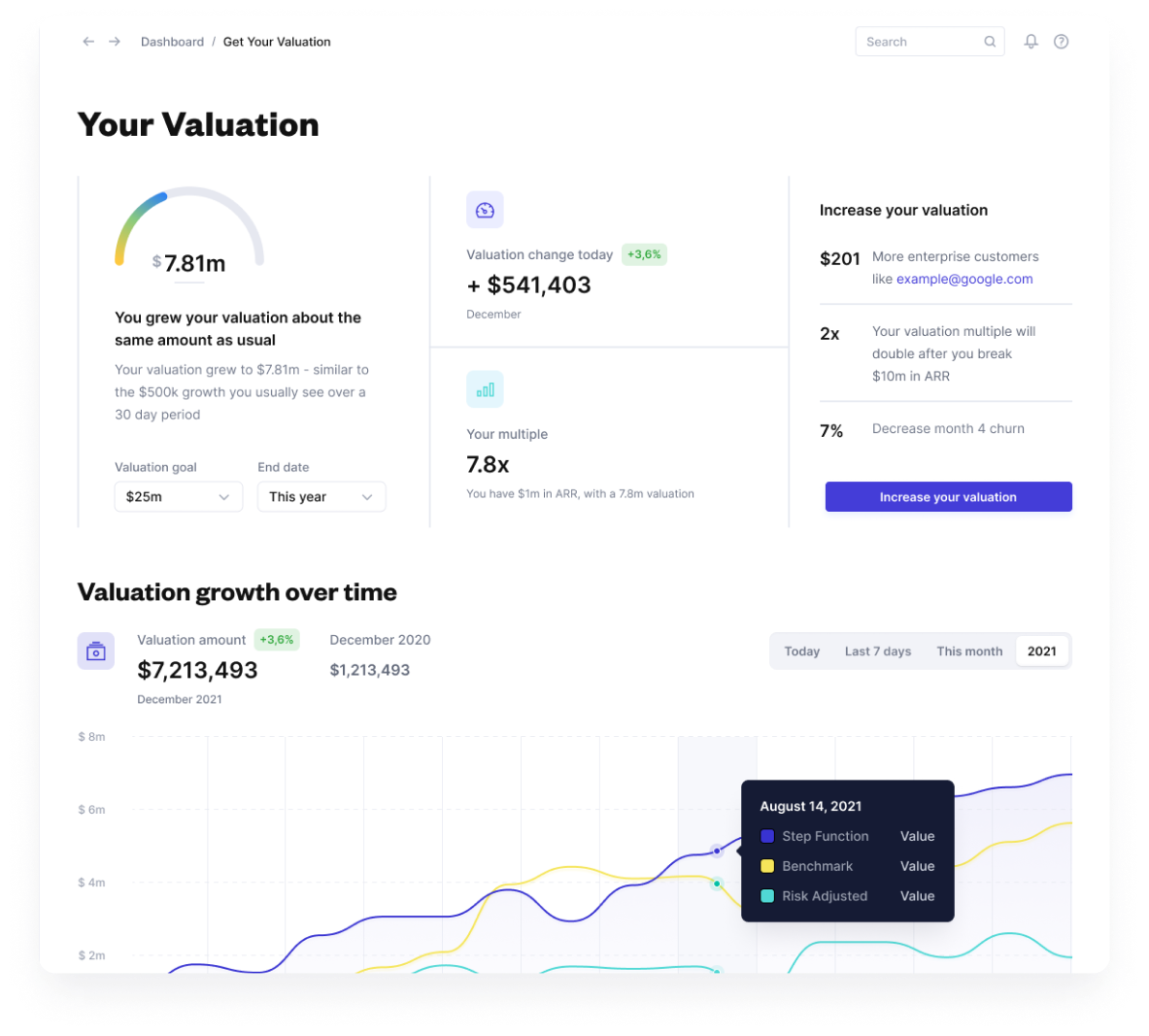

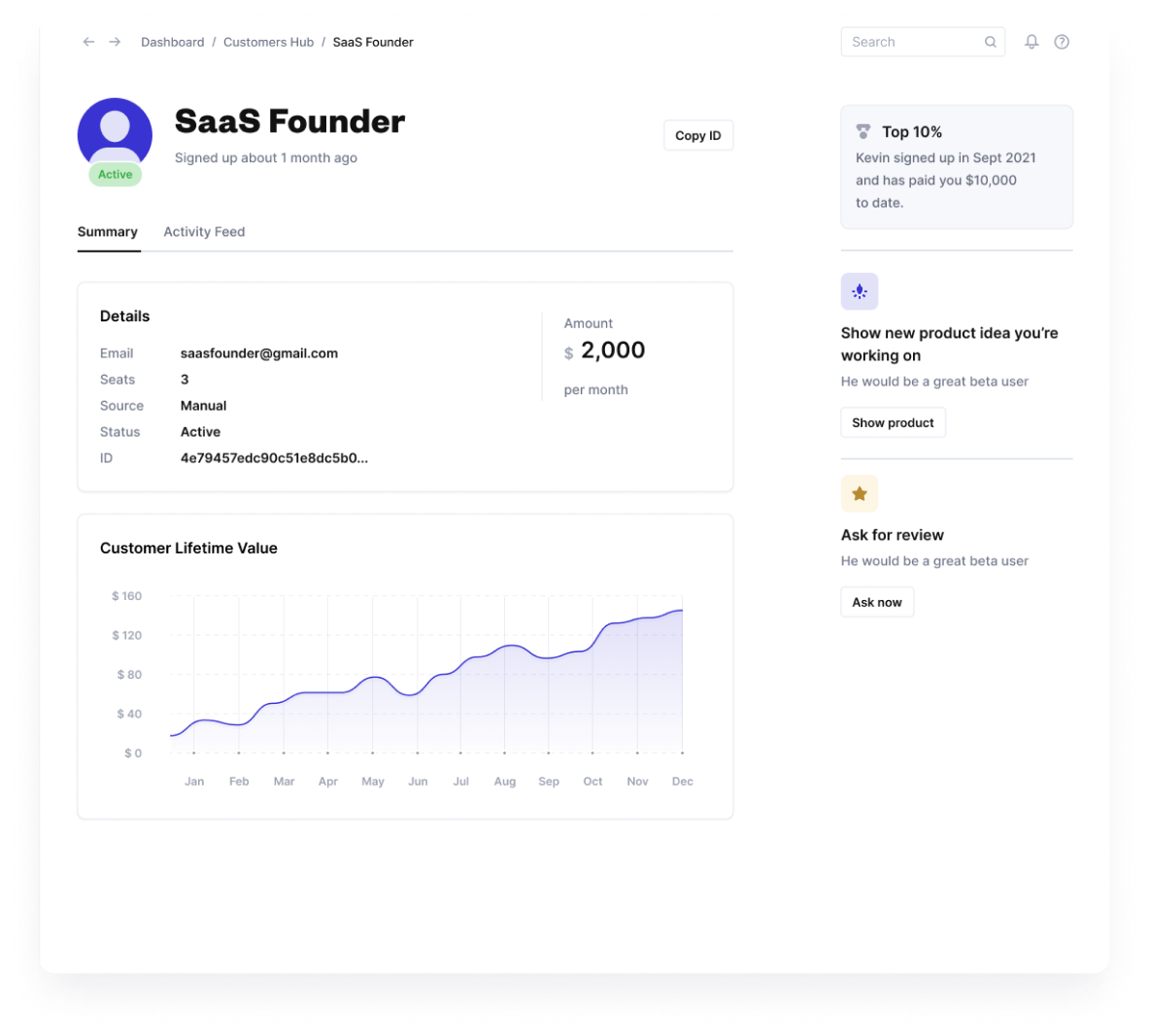

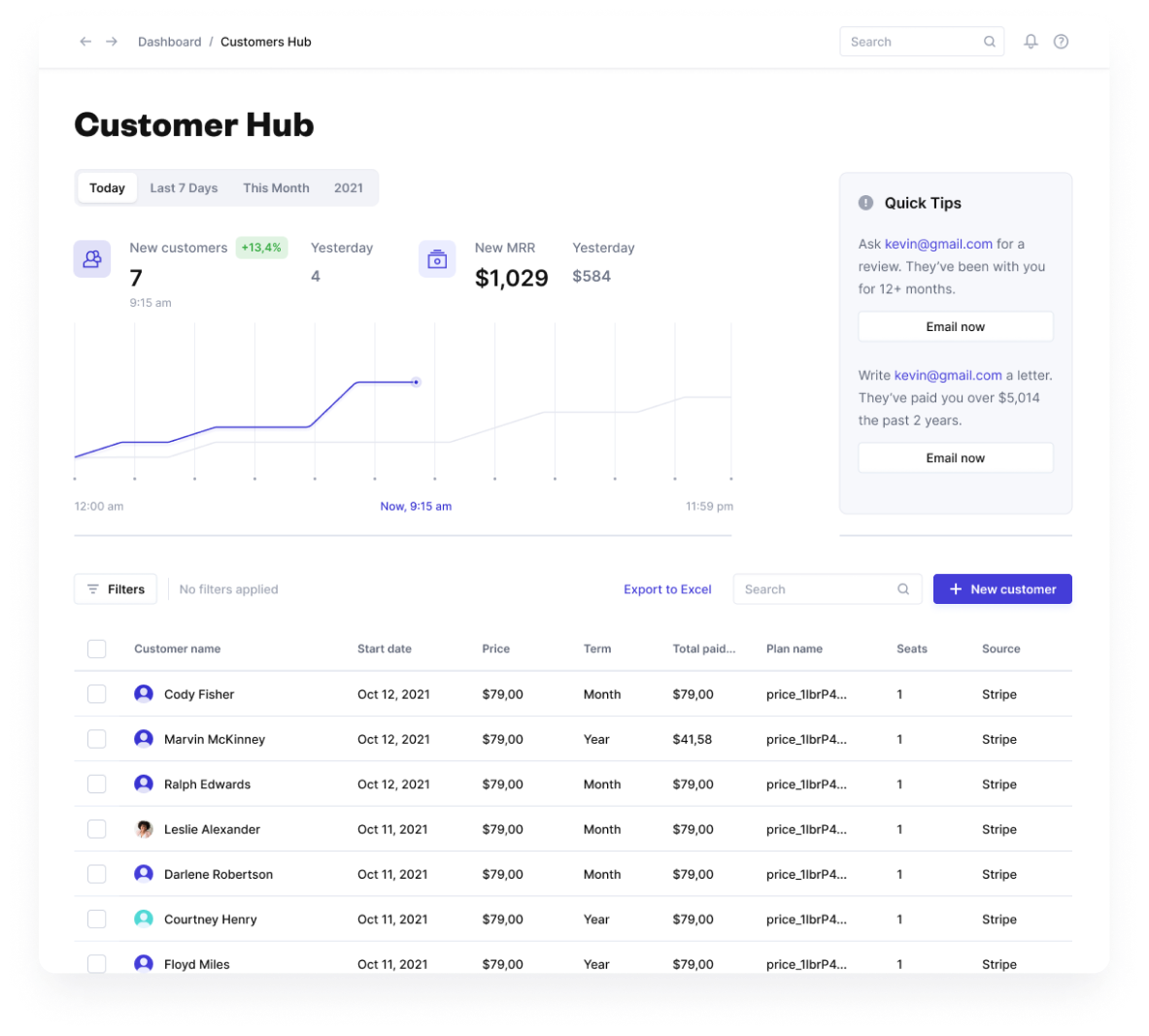

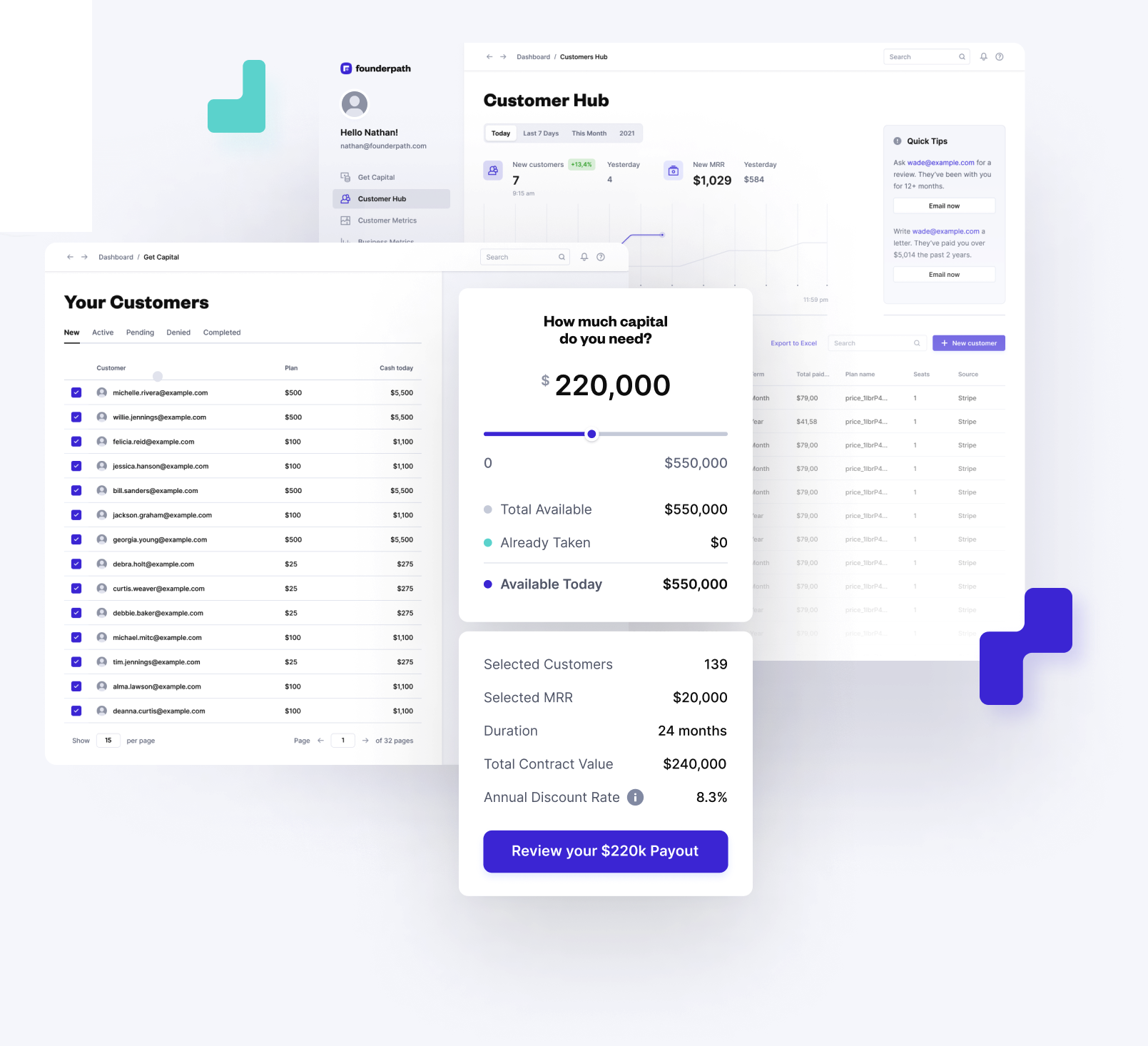

Use SaaS Financing Software that scales with you. See why SaaS founders are taking money from Founderpath and using our valuation and reporting tools to make it the #1 Capchase alternative.

Capchase Capchase | ||

|---|---|---|

Upfront fee? | Yes | No upfront fees |

Platform Fee | 3% | None |

Discount Fee | 11% | 8% |

Effective interest rate | 11% discount fee on a 12 month term is about 25% Interest Rate | 8% discount fee on a 12 month term is about 19% Interest Rate |

Duration | 12 months | Up to 48 months |

Cash Runway requirement | 6 months | No Covenants |

Money wired under 24 hours | Yes | |

CEO Retreats | ||

SaaS Valuation Tool with Benchmarks | ||

Built by SaaS Founders? |

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing Capchase Alternative

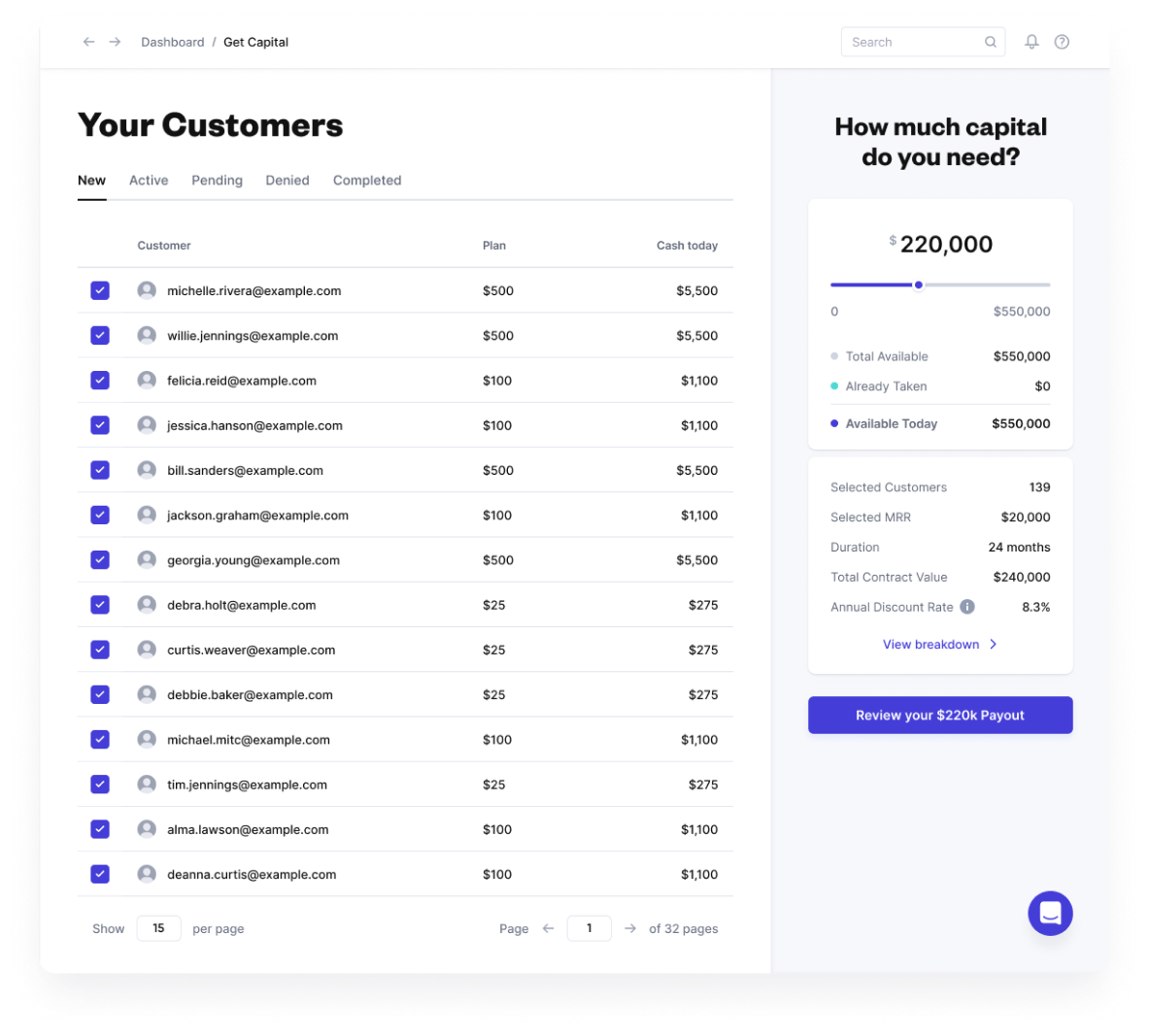

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform