The Fast, No-Fee Alternative to Lighter Capital

Lighter capital charges big fees and takes months to do diligence. Founderpath offers:

Join 3,021 Bootstrapped SaaS Founders

Lighter Capital Reviews

Pablo Laurino

Founder of Publica

Switched to Founderpath from Lighter Capital

Lighter Capital makes it hard and time consuming for founders to check and pay monthly settlements, they lack an easy-to-use UI , the process of getting an offer involves multiple docs, background checks and meetings while with Founderpath the process is seamless, easy and even fun with easy monthly repayment and no hidden fees or complex agreements.

Why choose Founderpath over Lighter Capital?

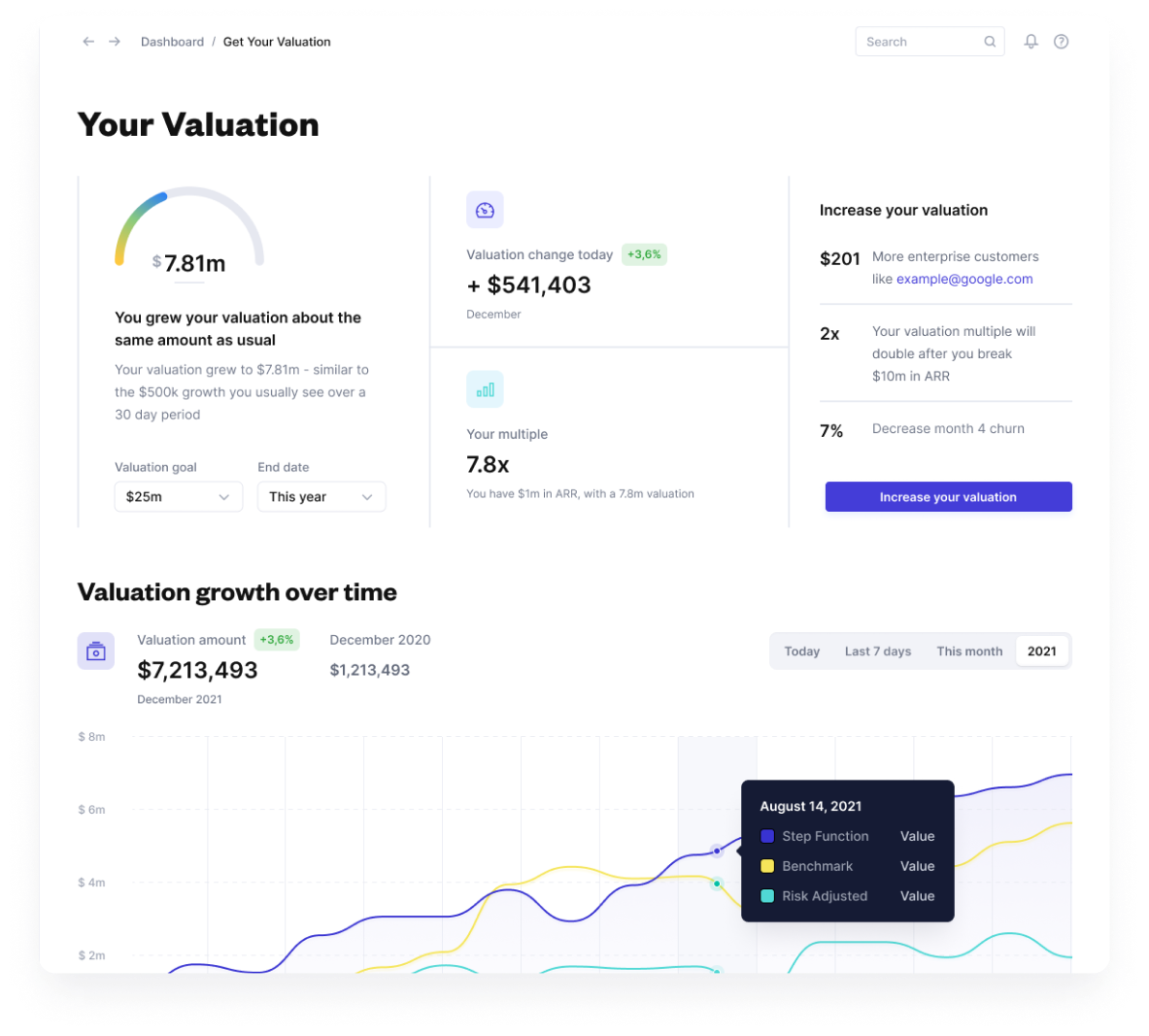

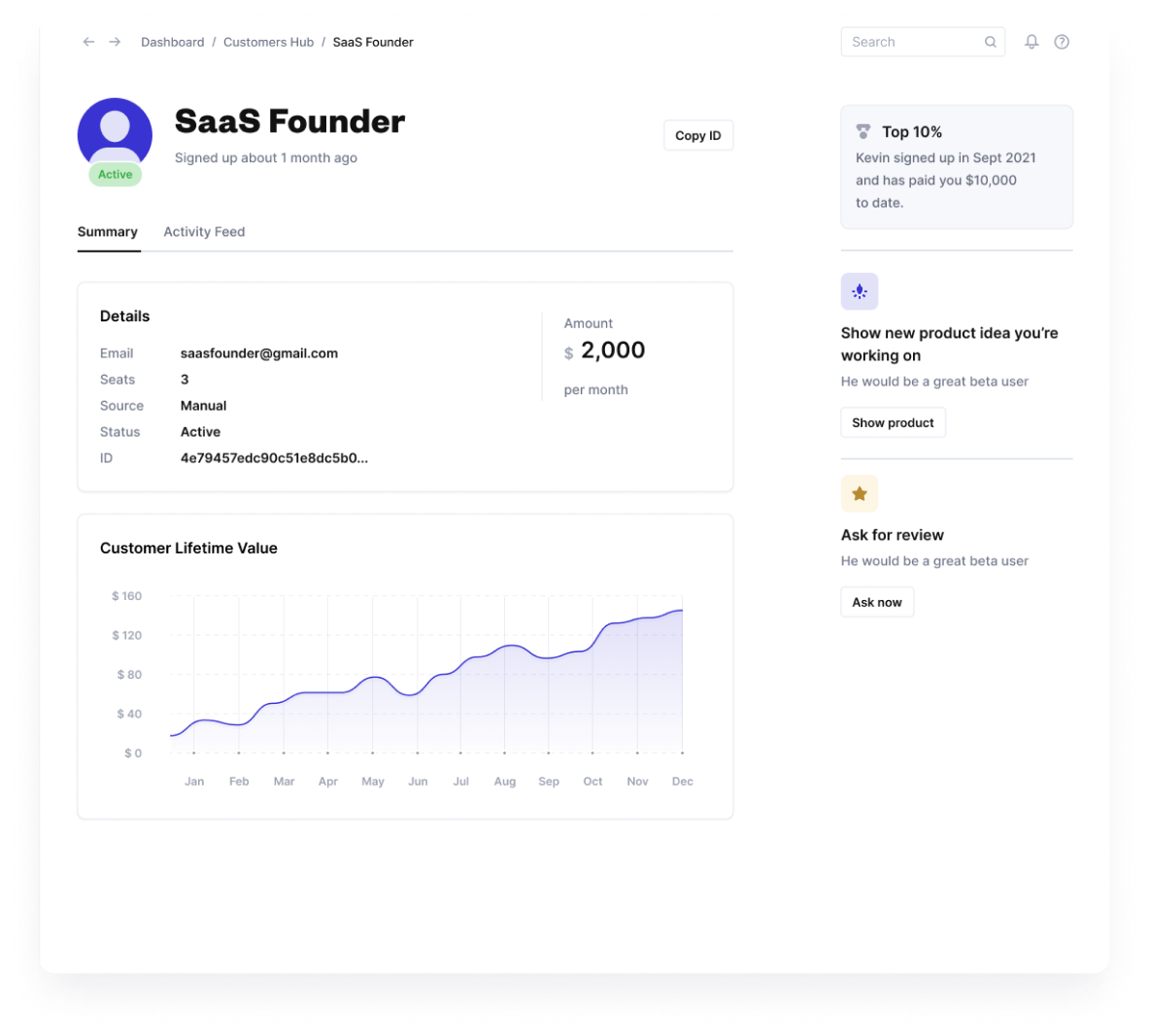

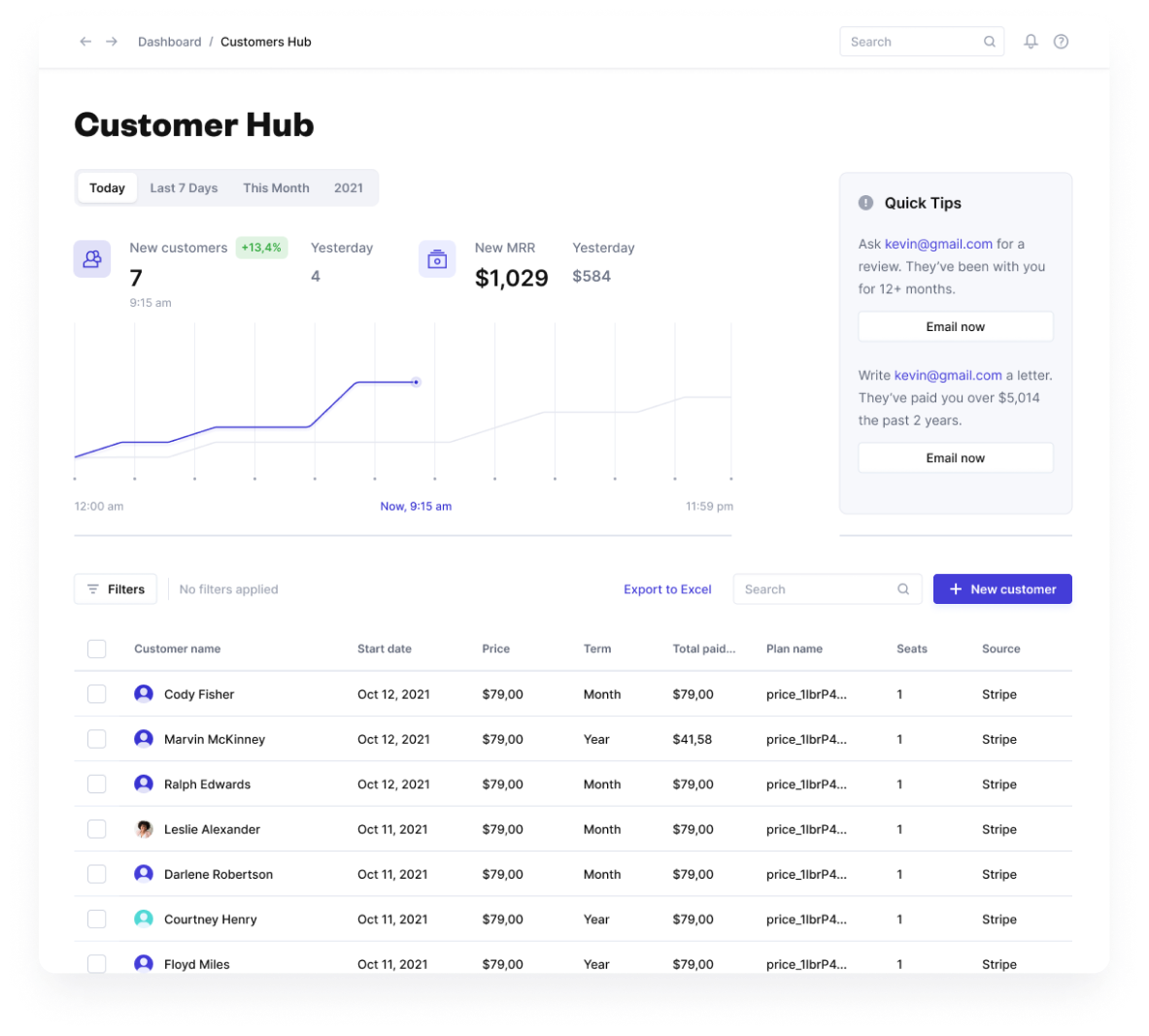

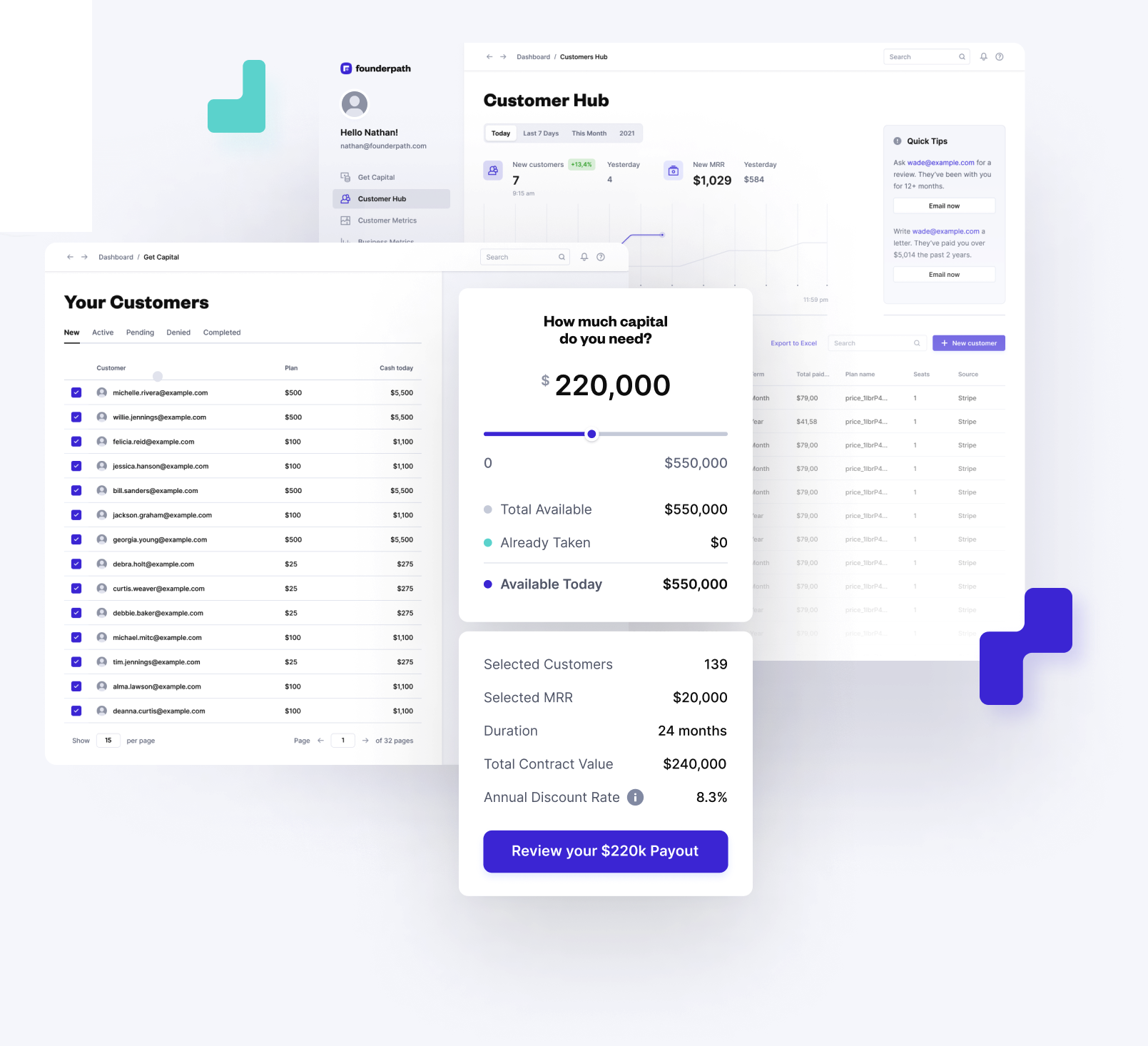

Use SaaS Financing Software that scales with you. See why SaaS founders are taking money from Founderpath and using our valuation and reporting tools to make it the #1 Lighter Capital alternative.

| ||

|---|---|---|

Built by SaaS Founders? | ||

Tech Enabled? | ||

Money wired under 24 hours | Diligence takes up to 3 months | Yes |

Payback Period Length | Up to 3 years | Up to 4 years |

Interest Only Periods | Up to 24 months | |

Structure | Terms around prepayment, expensive closing process, warrants, admin fees | No warrants, admin fees |

Payback Structure | 2-8% of your monthly revenue | Fixed rate, easy to plan |

Fee | $20k closing costs and legal fees (Pay All Lender Expenses Through Close) | As low as $0 |

Payoff early without fees or penalties | ||

Monthly Reporting Required? | Takes 10 hours (email pdf's and excel files) | Automated through platform |

SaaS Valuation Calculator | ||

Free CAC calculator | ||

Free cash flow/profit and loss reporting tool | ||

Free Lifetime value calculator | ||

Free Churn calculator | ||

SaaS Company HQ | US, Canada, Australia | Worldwide |

CEO Retreat | Yes | Yes |

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing Lighter Capital Alternative

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform

Frequently Asked Questions

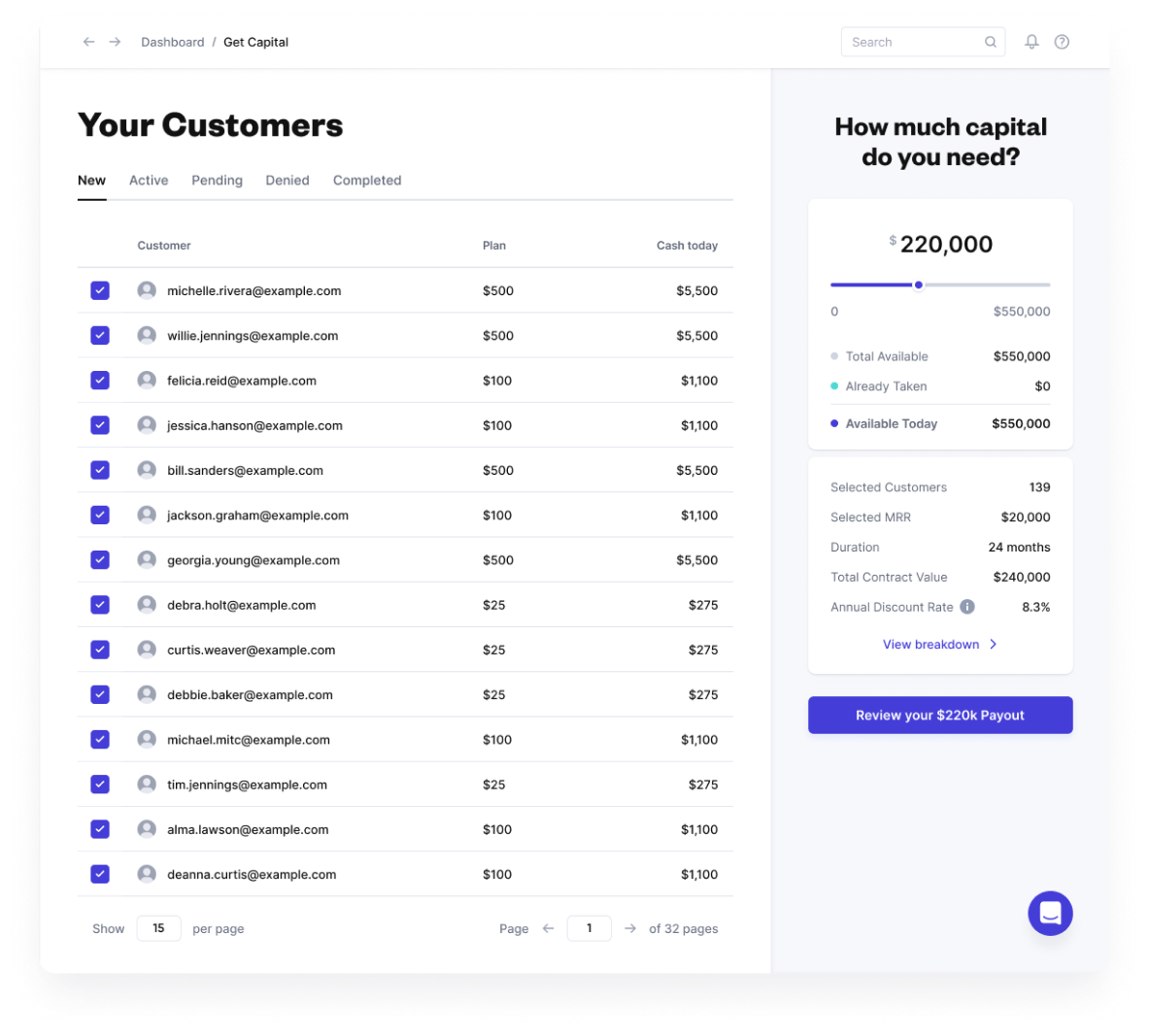

Founderpath launched in 2021 by investing non-dilutive capital in B2B SaaS companies. Today, Founderpath funds a variety of business models including SaaS, ecommerce, and agency's. Connect your billing, bank, and accounting tools, and within 24 hours you can unlock capital based on your business performance.

Founderpath works with founders running B2B SaaS companies with at least $500k in last year revenue, healthy retention, and recurring subscription contracts. Founderpath also funds ecommerce brands with at least $500k of last year sales and agencies who do more than $1m per year in revenue.

With Founderpath you keep 100% of your equity — no board seats, no dilution, and no long fundraising cycles. Unlike banks, we move fast, don't require personal guarantees, and understand recurring revenue models.

We offer Revenue Financing, Term Loans, and Merchant Cash Advances. All are non-dilutive (we get no equity) and are designed specifically to help founders and business owners keep equity and keep control of their business.

Most founders see funds in their account within 24–48 hours after connecting their data.

No. Founderpath is 100% non-dilutive. You never give up equity, control, or board seats.

Founderpath's revenue financing product offers discount rates on future revenues as low as 7%. Founderpath's term loan product offers interest rates as low as 15%. Founderpath's Merchant Cash Advances offers repayment rates as low as 5% of your monthly revenue. All funding offers are contingent on underwriting.

We look at key SaaS metrics like ARR, churn, gross margins, and retention. The stronger your metrics, the more capital you can unlock at better rates. For ecommerce brands, we look at margins, unit economics around customer acquisition, and your ability to scale sustainably.

Founderpath has funded $220m to 550 software founders. Founderpath's average deal size is about $600,000. The strongest companies raise $5m+ from Founderpath.

No full personal guarantees and no warrants. Founderpath takes a lien on business assets only.

Founderpath generally works with founders, within reason, if the business declines or hits trouble.

Yes. Founderpath uses bank-level security and encryption. Your data is private, never sold, and only used to underwrite your capital offer. Visit Founderpath's trust center and view security certificates in the footer of founderpath.com

Yes. You can repay early at any time, and generally save on any future fees or interest.

Founderpath has funded 550+ SaaS Founders including Bettercomp, Kissflow, Reply.io, BadgerMaps, DearDoc, Cybersmart, MobileMonkey, and many more. These founders have scaled faster, extended runway, or avoided dilution by keeping full control of their companies.

Yes. We're available in most countries and have already done deals with founders in Canada, South America, Europe, and Asia.

Yes. You can check by clicking on the GDPR logo in the footer and by visiting https://prighter.com/q/18604028289