The Founderpath Story: How a Dorm Room Founder Built the Most Founder-Friendly Funding Platform

The Beginning: A Different Kind of Founder Story

When you’re looking for funding, you want to work with someone who truly understands your journey. Someone who’s felt the weight of making payroll, the stress of trying to grow revenue, and the pain of churned customers. That’s exactly who Nathan Latka is—and why Founderpath exists today.

This isn’t a story about an ex-banker or former VC who decided to “help” founders. This is the story of a founder who built his first company from a Virginia Tech dorm room, made every mistake in the book, and came out the other side determined to build something better for the next generation of bootstrappers.

2008: The Architecture Student Who Would Become a Serial Entrepreneur

In 2008, an 18-year-old Nathan Latka arrived at Virginia Tech with dreams of becoming an architect. He was accepted to the #1 architecture program in the country and added a dual finance degree.

The financial crisis was in full swing, and the architecture industry was collapsing. While his classmates worried about finding internships at firms that were laying off staff by the thousands, Nathan started thinking differently.

If no one was going to hire him, maybe he needed to create his own opportunity. As he would later tell Virginia Tech’s ExperienceVT blog, “Humans live in echo chambers of familiarity. We have to fight those instincts.”

2009: Surviving the Financial Crisis and Finding Opportunity

As the recession deepened in 2009, Nathan watched established architecture firms struggle to adapt to the new digital world. While studying structural engineering and design principles, he noticed something interesting: businesses were desperate to figure out this new thing called “social media,” especially Facebook, which had just opened to the general public.

Nathan saw an opportunity where others saw chaos. While his professors taught him about building physical structures, he started thinking about building digital ones. The entrepreneurial seed was planted, even if he didn’t know it yet. His experience as a Resident Advisor in Barringer Hall taught him valuable lessons about leadership and community building that would serve him well in the years ahead.

2010: The Dorm Room That Launched a Thousand Dreams

At 19 years old, with just $119 in his bank account, Nathan did what any rational college student would do—he started cold-calling executives on Facebook from his lofted dorm bed. His pitch was simple: “I’ll build you a custom Facebook fan page for $700.”

Most people laughed. Some hung up. But a few said yes. Nathan worked 18-hour days, juggling classes, his RA duties, and building Facebook pages for small businesses. Within six months, he’d made $73,000—all while sleeping in a twin XL bed in a shared dorm room.

In November 2010, Heyo was officially born. Nathan built a tool that allowed businesses to create their own custom Facebook fan pages for just $30 a month. It was scrappy, it was imperfect, but it worked. By the end of the year, Heyo had generated nearly $100,000 in revenue, with thousands of monthly paying customers signing up.

2011: The $6.5 Million Mistake That Changed Everything

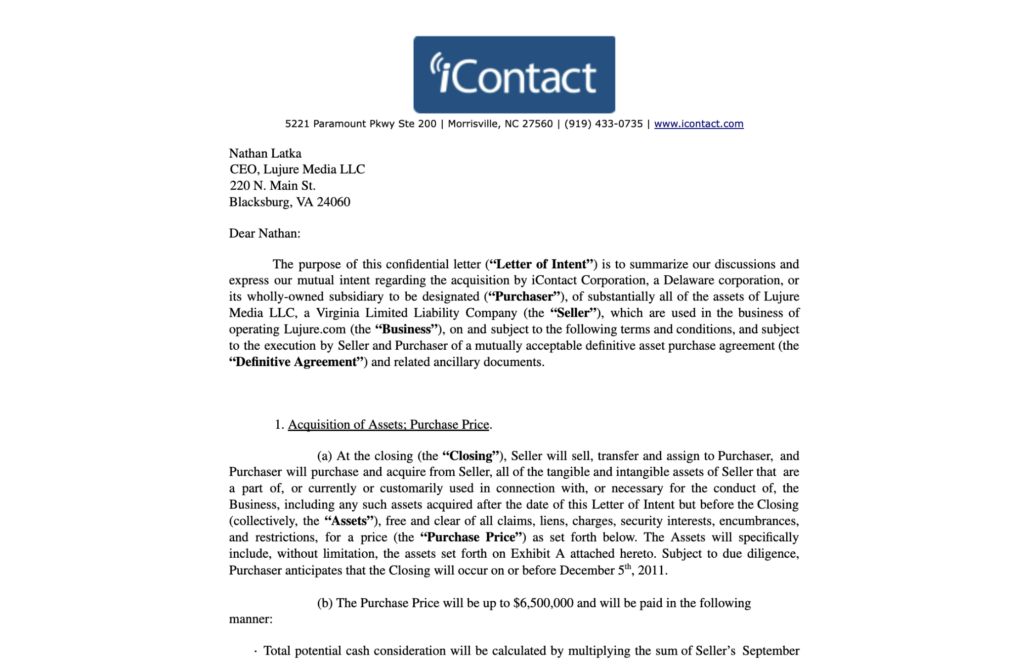

By 2011, Heyo was on fire, hitting $700,000 in annual recurring revenue, and Nathan was managing everything from his dorm room with a small team of fellow students. That’s when iContact came calling with a $6.5 million all-cash acquisition offer.

Picture this: a 21-year-old college student sitting in Barringer Hall with a life-changing offer on the table. Nathan’s advisors told him to take it. His parents told him to take it. Every rational voice said, “Take the money and run.”

But Nathan didn’t. He thought Heyo was worth more. He believed in the vision. He turned down the offer. As he later reflected on his podcast:

“Some founders get rich by selling too early. I waited and waited. Because of that, I didn’t get really rich—I got a little rich, but not really rich.”

Local media outlet WVTF even covered the growing buzz around Heyo, highlighting how the young entrepreneur was disrupting the social media marketing space.

2012-2014: The Venture Capital Rollercoaster

After turning down the acquisition, Nathan decided to go the traditional Silicon Valley route. He raised $2.5 million in venture capital, moved the company out of the dorm room, and started scaling aggressively. The company expanded to 40 employees and moved into professional offices.

These were the grinding years. Heyo expanded from Facebook fan pages to webinars, email marketing, and social media contests. Revenue climbed steadily, but so did the pressure. The VCs wanted hockey stick growth. They wanted a unicorn. They wanted Nathan to swing for the fences. Even Glassdoor reviews from former employees noted the intense, fast-paced culture Nathan created during this period.

But Nathan was learning a different lesson: sustainable growth matters more than growth at all costs. While his VC-backed peers were burning cash to acquire customers, Nathan obsessed over unit economics and profitability. By 2013, the company was doing about $939,000 a year in sales.

2015: The Pivot to Media and Building in Public

In 2015, with Heyo generating $5 million in cumulative revenue, Nathan made an unusual decision for a SaaS CEO: he launched a daily podcast. “The Top Entrepreneurs” started as a simple experiment—15-minute interviews with other SaaS founders about their metrics, revenue, and growth strategies.

The podcast was radically transparent in a way that made some people uncomfortable. Nathan asked questions other interviewers wouldn’t:

“What’s your monthly burn rate?”

“How much did you pay yourself last year?”

“What’s your exact customer acquisition cost?”

Within months, the podcast was averaging 10-15 thousand listens per episode.

More importantly, Nathan was building a database of SaaS metrics and insights that would prove invaluable later. He interviewed founders at every stage, from pre-revenue to IPO, always asking the same core questions about their numbers. The data from these interviews would later be compiled into GetLatka.com, a comprehensive database of private SaaS company metrics.

2016: Selling Heyo and Learning from “Failure”

In February 2016, Nathan finally sold Heyo to Votigo, their biggest competitor. The sale price was a fraction of that original $6.5 million offer from 2011. By traditional Silicon Valley standards, it was a failure. Nathan had raised $2.5 million, built a team of 40 people, generated millions in revenue, and walked away with a modest exit.

But Nathan did something unusual: he recorded the entire sale process and shared it publicly on his podcast. The transparency was unprecedented. He shared the negotiation calls, the due diligence process, the emotional conversations with his team. He wanted other founders to learn from his mistakes.

The response was overwhelming. Hundreds of founders reached out to thank him for his honesty. Episode #171 of his podcast, where he announced the sale, became one of his most popular episodes. Nathan realized something profound: the traditional venture path wasn’t working for most founders. As he noted in the episode, “A big part of selling a business is considering its future profitability and potential.”

2017-2018: The Birth of a New Vision

After selling Heyo, Nathan could have retired to a beach somewhere. Instead, he doubled down on the podcast and started angel investing. But he wasn’t investing like a typical angel. Using insights from his podcast interviews, Nathan started making debt investments in SaaS companies.

By 2017, his podcast had crossed millions of downloads, and he was recognized as a frequent keynote speaker at SaaS events. There was a 6 month waiting list by the worlds top SaaS CEO’s wanting to get on the show:

The model was simple: instead of taking equity, he would lend money to profitable SaaS companies and get paid back from their monthly recurring revenue. No board seats, no control, no pressure to sell. Just founder-friendly capital that let entrepreneurs keep building their businesses.

By 2018, Nathan was personally funding deals from his podcast earnings and Heyo exit. Word spread quickly in the bootstrapper community through his growing Twitter following and Facebook page with over 130,000 likes: there was finally someone willing to fund profitable SaaS companies without forcing them onto the venture treadmill.

2019: Founderpath is Born

On the back of Latka’s hugely successful book launch, Latka needed a system to manage all the debt investments he had made.

The demand for Nathan’s debt investments grew beyond what he could fund personally. Founders were literally calling him at all hours, desperate for growth capital that didn’t require giving up equity. That’s when Nathan decided to formalize what he’d been doing into a real business.

Founderpath (originally called Operation Pie) was incorporated in 2019 with a simple mission: help SaaS founders turn their monthly recurring revenue into upfront capital without dilution. The platform would automate what Nathan had been doing manually—analyzing SaaS metrics, underwriting deals, and deploying capital quickly.

His extensive network from the podcast and years of building in public gave him unique insights into what founders really needed.

The timing was perfect. The venture capital world was becoming increasingly founder-unfriendly, with aggressive terms, board control provisions, and pressure for unsustainable growth.

Nathan’s LinkedIn posts about founder-friendly funding started gaining serious traction. Bootstrapped founders finally had an alternative from someone who understood their journey.

2020: Launching into a Pandemic

Founderpath officially launched in January 2020, just months before the world shut down. While other investors pulled back during COVID, Nathan saw opportunity. SaaS businesses were more important than ever as the world went digital, but many were struggling with cash flow as customers delayed payments.

The platform integrated directly with Stripe and other payment processors, allowing founders to get funding decisions in minutes, not months. No pitch decks, no board meetings, no giving up control. Just connect your accounts, get your Founderpath Score, and receive capital within 24 hours. Nathan’s experience building Heyo had taught him the importance of speed and simplicity in product design.

Despite launching during the most uncertain economic period in decades, Founderpath deployed millions in capital to founders who needed it most. The company’s founder-first approach resonated deeply. These weren’t just loans—they were lifelines from someone who understood the struggle. Nathan’s Twitter announcements about funding bootstrapped founders regularly went viral, with founders tagging each other to spread the word.

2021: Achieving Profitability and Raising Institutional Capital

In February 2021, Nathan announced on Twitter that he’d raised $10 million to fund bootstrapped software founders, but unlike his experience with Heyo, he maintained control. This wasn’t venture capital—it was debt financing that allowed Founderpath to lend more money to more founders without diluting Nathan’s ownership or changing the company’s mission. Active Capital, led by Pat Matthews who had backed Nathan’s first startup, led the round.

By the end of 2021, Founderpath had achieved something rare in fintech: profitability. While competitors burned millions on customer acquisition and fancy offices, Nathan ran the company with just 10 employees. Every dollar saved was a dollar that could be deployed to founders. This lean approach was documented in various interviews, where Nathan emphasized that “Knowledge is most powerful when people don’t know you have it.”

The lean approach wasn’t just about efficiency—it was philosophical. Nathan had learned from Heyo that bloated teams and high burn rates create pressure for bad decisions. His famous quote, “There’s nothing wrong with growing a company at your own pace. $5m bootstrapped growing 30% YOY with profits is a great lifestyle,” became a rallying cry for sustainable founders everywhere.

2022: Fund 3 Raised for $145 Million

2022 was a watershed year for Founderpath. In August, the company raised $145 million in debt and equity funding, with the debt portion specifically earmarked for founder investments. This wasn’t money to build a bigger office or hire a celebrity spokesperson—it was capital to deploy directly to bootstrapped SaaS companies.

By July 2022, Founderpath had deployed over $60 million to 130 SaaS founders. The platform was processing thousands of applications, with founders able to access up to 50% of their annual recurring revenue upfront. Nathan announced on Twitter that they’d figured out how to wire money to founders within hours, not weeks.

But the biggest move came in October when Founderpath acquired SaaSOpen, one of the largest communities for SaaS founders. The acquisition wasn’t about financial engineering—it was about building the most valuable ecosystem for bootstrapped founders. The first SaaSOpen event under Founderpath sold out in 43 minutes, with founders flying in from around the world to connect with peers who understood their journey. As Nathan explained on LinkedIn, “Today, your code can be stolen. Your team can get recruited away. Your VC’s can stop funding you… but if you invest in community, they will never leave you.”

2023-2024: Building the Bootstrapper Movement

As venture capital dried up and “growth at all costs” startups imploded, Founderpath’s thesis was validated.

When SVB crashed in March 2023, the cable networks wanted to know how he was helping so many founders make payroll with their cash stuck at SVB:

The company continued deploying capital at record rates, funding everything from early-stage startups to established SaaS companies looking for growth capital without dilution. Nathan’s prediction that they would deploy $1 billion over 24-36 months seemed increasingly achievable.

The SaaSOpen events grew from intimate gatherings to major conferences, with plans to reach 10,000 attendees by 2024. But unlike typical tech conferences dominated by VCs and consultants, SaaSOpen remained focused on actual operators. Nathan’s LinkedIn updates regularly featured stories of bootstrapped founders who’d successfully exited, like Chris Devor who sold for millions while maintaining 95%+ ownership.

Nathan’s podcast continued to be a cornerstone of the Founderpath ecosystem, surpassing 10 million downloads. Every episode added to the database of SaaS knowledge, helping Founderpath make better funding decisions and founders make better business decisions. His appearance on other podcasts spread the message even further, with hosts often remarking on his unusual transparency about numbers and metrics.

2025: The Future is Founder-Friendly

Today, Founderpath has deployed over $200 million to more than 500 founders, with 200+ five-star reviews from satisfied customers. The company continues to innovate, launching AI-powered tools to help founders double revenue and save time. But the mission remains the same: help founders build sustainable businesses without sacrificing ownership or control.

Nathan’s recent blog posts focus on practical tools and strategies for SaaS founders, from using AI for marketing automation to analyzing Google Analytics data. The company’s review from June 2025 shows continued evolution, with new products like 48-month term loans with 12-month interest-only periods.

The recent news that SaaStock acquired SaaSOpen Austin for $1.6 million while maintaining Nathan’s involvement shows how the ecosystem continues to grow. Nathan will curate the Founderpath Center Stage and host an intimate CEO event, ensuring the founder-first philosophy remains central. His LinkedIn profile now shows over 66,000 followers and connections with founders worldwide.

Why Founderpath is Different

When you work with Founderpath, you’re not just getting capital—you’re getting a partner who’s been in your shoes. Nathan’s story from dorm room to $200 million fund isn’t just inspirational—it’s instructional. He’s lived through every stage of the founder journey.

Customer testimonials consistently highlight the platform’s ease of use, quick response times, and flexibility. Companies like Exercise.com praise Founderpath as a source of non-dilutive growth capital that actually understands their business. The platform’s integration with tools founders already use makes the process seamless.

This isn’t sympathy—it’s empathy born from experience. Every Founderpath team member has either built a company or worked closely with founders. They know that behind every SaaS metric is a human being trying to build something meaningful. Nathan’s philosophy, “Anyone who tells you ‘you must raise VC to scale fast!’ is being silly,” guides every interaction.

Join the Movement

The traditional venture capital model works great for a tiny percentage of companies. For everyone else—the bootstrappers, the profitable growers, the founders who want to build sustainable businesses—there’s Founderpath. Recent data shows that sustainable, profitable SaaS companies are increasingly attractive to acquirers, validating the Founderpath approach.

Whether you need $50,000 to hire your next engineer or $3 million to accelerate growth, Founderpath offers the same transparent terms, fast decisions, and founder-friendly approach. No hidden fees, no surprise terms, no pressure to grow unsustainably. The platform’s security compliance and global availability mean founders from most countries can access funding.

Most importantly, you’ll be joining a community of thousands of founders who’ve chosen a different path. Through Soho House meetups, Napa retreats, and monthly webinars you’ll connect with peers who understand your journey and can help you navigate the challenges ahead.

Nathan Latka didn’t build Founderpath because he wanted to be a financier. He built it because he wanted to create the funding option he wished existed when he was building Heyo from his dorm room.

Today, that vision is helping hundreds of founders build life-changing businesses without sacrificing their independence.

If you’re ready to accelerate your growth without giving up what makes your company special, Founderpath is ready to help. Because the best funding partner isn’t an ex-banker or career VC—it’s a founder who’s been where you are and wants to help you get where you’re going.

Join us in building the future of founder-friendly funding. Your company, your equity, your terms. That’s the Founderpath promise.

Recent Articles

Merchant Cash Advance for Startups: Is It Worth It?

A merchant cash advance can put capital in your hands within 24 hours — making it one of the fastest…

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…