This page is for $1-20m ARR SaaS companies who signed a “Loan and Security Agreement” with SVB.

Quickly convert your term loans to Founderpath.

Read what The Information, TechCrunch said about Founderpath over the weekend.

Founderpath Has Already Wired $100,000,000 to 200 SaaS Founders

What founders like you are saying:

Alexandre Paquet

Canada

Needed $500k for the growth

We found a clear way to grow our SaaS but want to grow as soon as we can before the series A. Tried Founderpath out of curiosity and got the capital in under 48 hours. We've grown a bunch since then and are about to take more capital (love that I can login and always know how much more capital I can take as we grow!).

Drew Winship

United States

Highly recommend

Substantially faster and more professional (actually completed diligence in the timeline they provided) than others claiming to provide the same service. These guys make it easy. Cannot recommend Founderpath enough.

Benjamin Dell

United Kingdom

Impressive platform to release SaaS capital

Edwin, Kevin and the team over at FounderPath have been an absolute pleasure to work with. The technical process to release capital is super slick and a breeze - this is then backed up with a solid, but approachable, human-led process. Kudos to the team for creating an incredible system.

Noah Coughlin

United States

Founderpath is value add to our business

Founderpath, Nathan and Edwin where fast, flexible and considerate of our business. They bring a trusted brand and the credibility of the industry. In addition to this they have created a great community of SaaS founders and a knowledge base that is best in class with a variety of tools and resources to operate and analyze our business. We are excited about the future with Founderpath.

Josh

United States

I took $1m at my last SaaS company before our exit. We kept more equity and made more money when we exited.

We had several growth tactics we wanted to try going into Q3 of 2022. As we started executing and growing, we got an M&A offer we couldn't refuse. The extra cash in our bank gave us more confidence going into the negotiation. We got a higher valuation and closed last month. Founderpath's capital was hugely strategic during our M&A process. They let us pay off early without paying any fines once we finalized our acquisition," Josh, SaaS Founder.

Josh LaSov

United States

After interviewing 23 lenders

After interviewing 23 lenders - it was wonderful to meet Founder Path. Their terms, process and understanding of speed was simply incomparable. Within 1 week we had completed diligence (and we aren't a small SaaS company). A few days later a seven figure wire hit our bank account and we were able to turn on the growth engine! In a nut shell, this is how lending should be done - great terms, super fast diligence and super fast to close.

Compare Founderpath and SVB Loan and Security AgreementUse a capital partner that’s run by exited SaaS founders. See why SaaS founders are taking money from Founderpath making it the #1 SVB alternative |  | |

|---|---|---|

Who is your relationship with? | Not clear what FDIC will do | Your own relationship manager |

Floating/unpredictable interest rate? | Floating rate | Fixed Rate |

Monthly Reporting Required? | Not clear who your new SVB rep will be | Automated via API's |

Open a bank account? | Required | Not required |

Spend money how you want? | (See "Use of Proceeds" clause) | Yes (hire, ads, growth) |

Length of paperwork | 25+ pages | 5 pages |

New capital wired under 24 hours | Not clear what FDIC will do | Yes |

Minimum Annual Revenue | $3,000,000 | $1,000,000 |

Take Warrants (Equity)? | Yes | No |

Fee | $10k Closing Costs and Legal Fees | No Fees |

Draw Fee | 1% | No Fees |

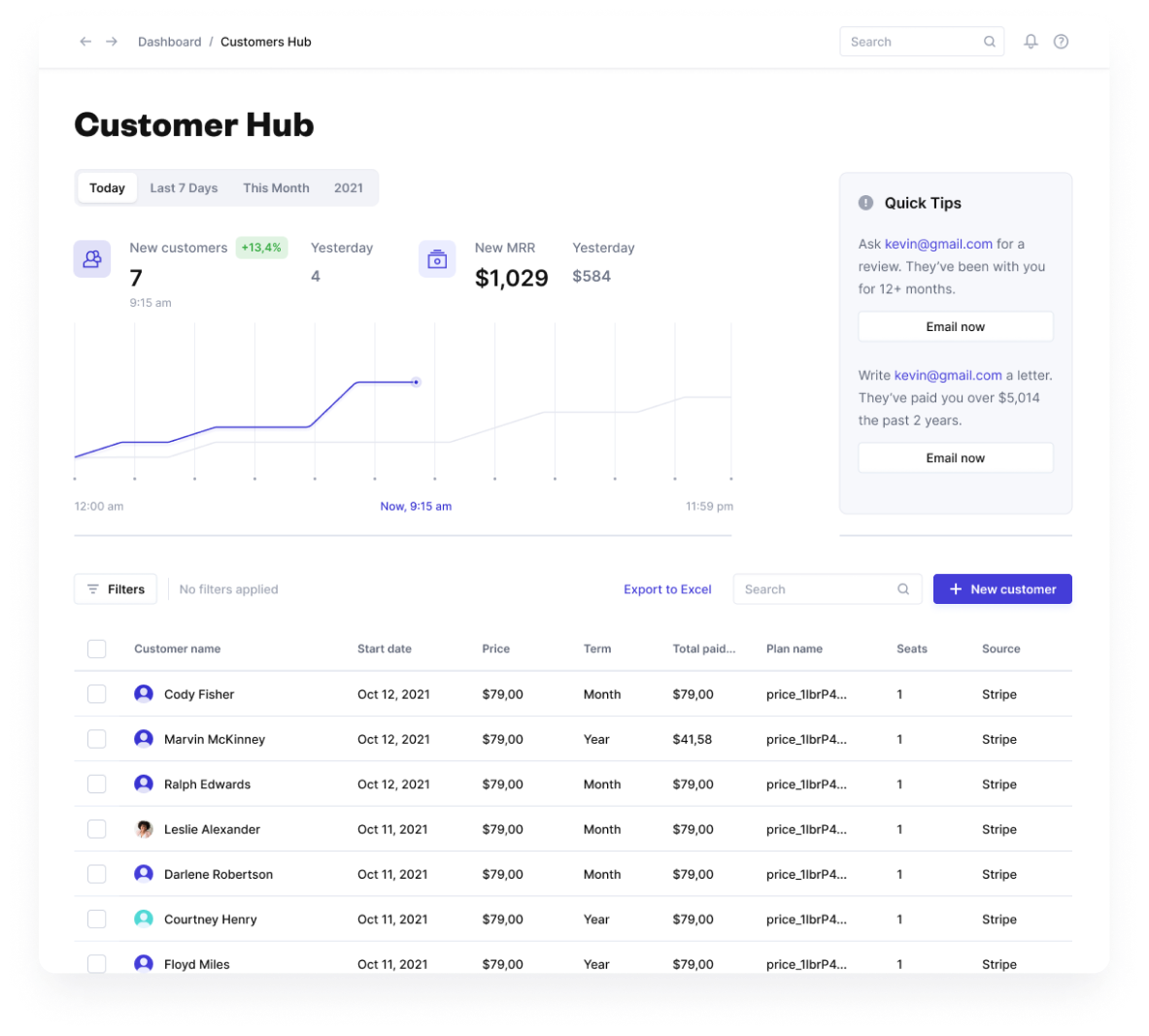

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing SVB Alternative

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform

Joel Ohman

United States

Great Experience with Founderpath; Highly Recommend

We have used Founderpath as an ongoing source of non-dilutive growth capital for our fast-growing B2B SaaS company, Exercise.com, and have been very impressed with the ease of use, quick response times, and flexibility. Nathan and Kevin are great to work with and I look forward to partnering with them in the future. If you are a growing SaaS company that needs capital to fund future growth I would strongly recommend working with Founderpath.