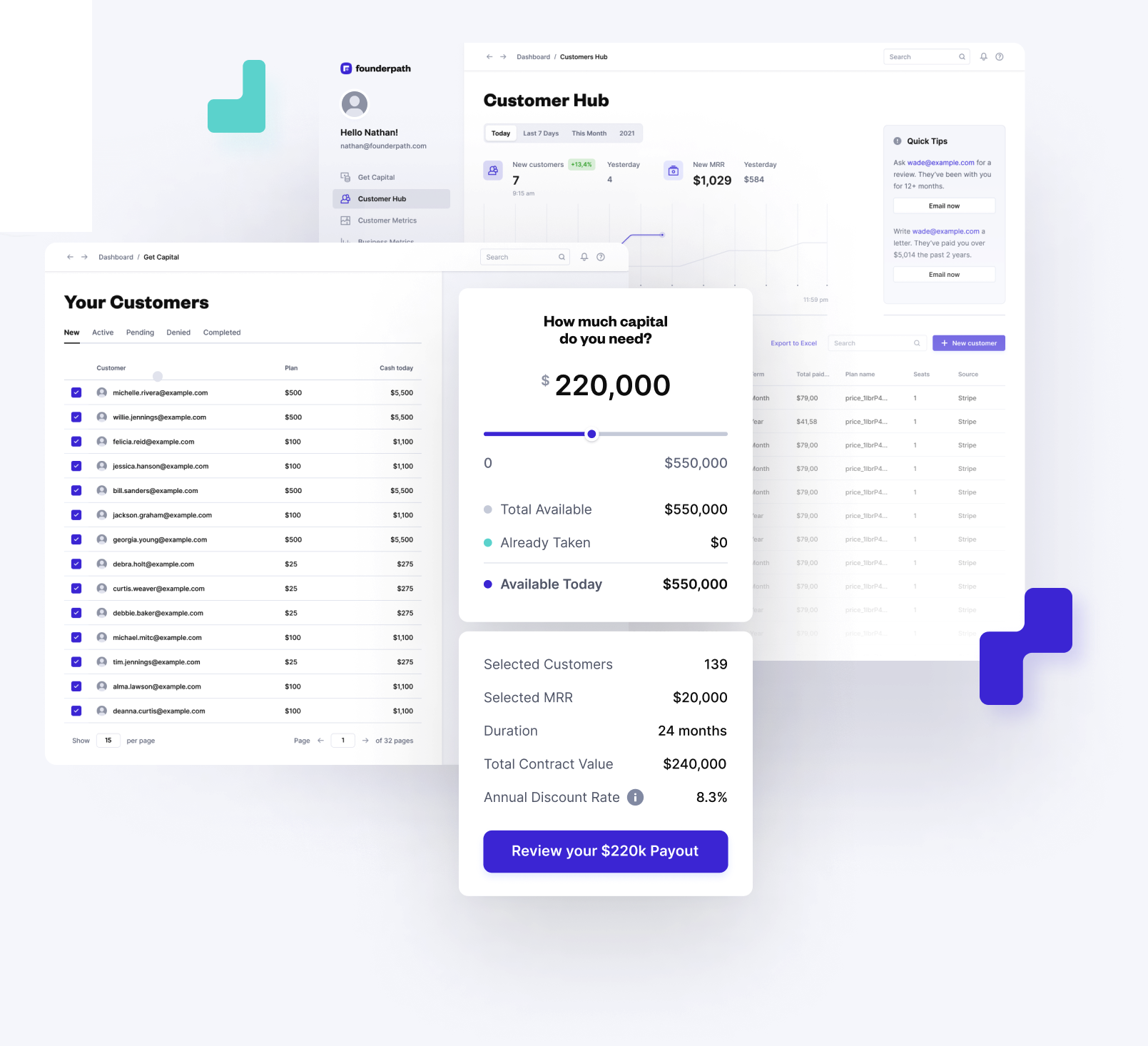

The larger loan amount, tech enabled alternative to River SaaS Capital

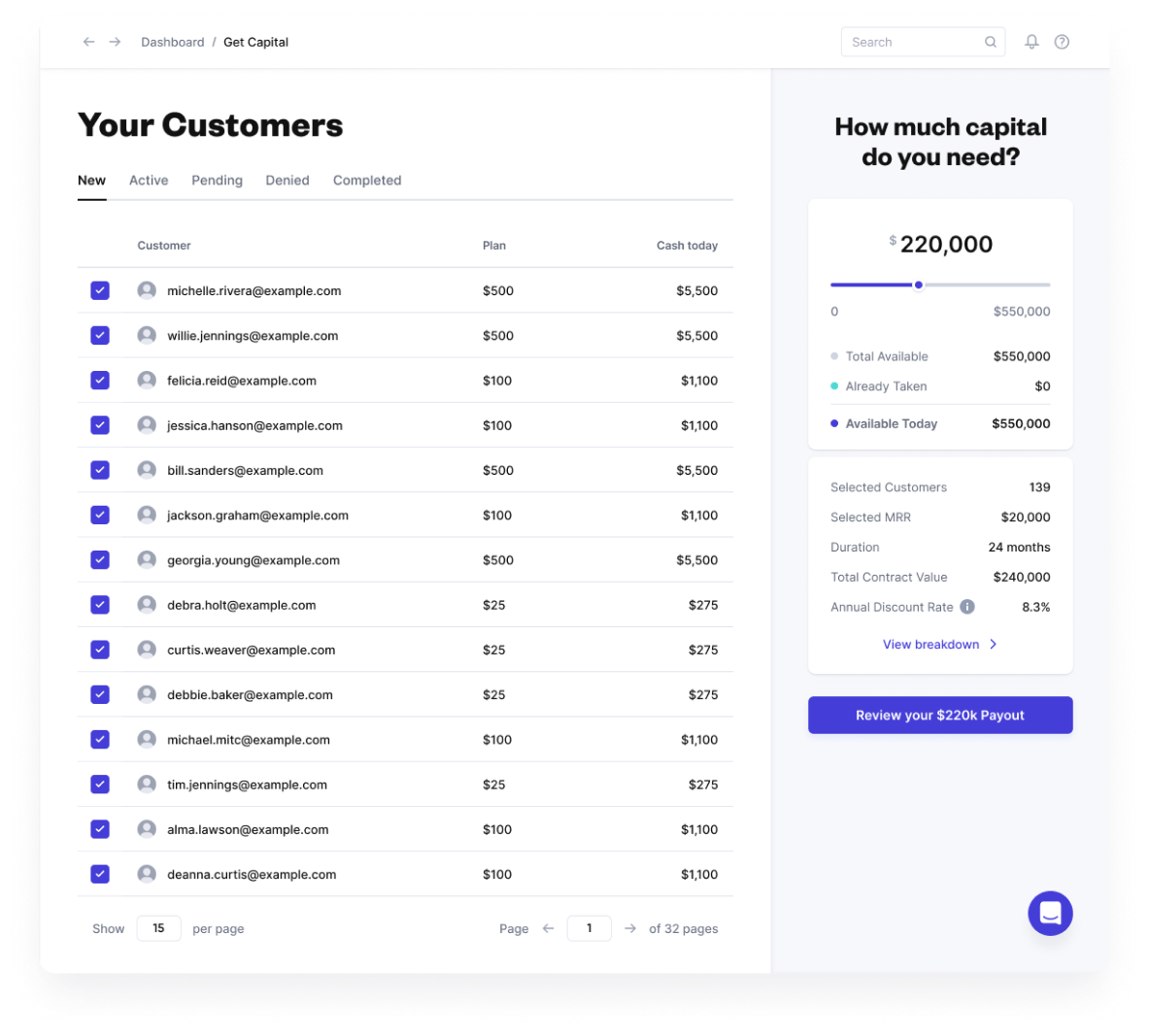

SaaS founders can start with Founderpath at just $500k ARR and get up to 7x their MRR.

Join 3,021 Bootstrapped SaaS Founders

River SaaS Capital Reviews

Josh

United States

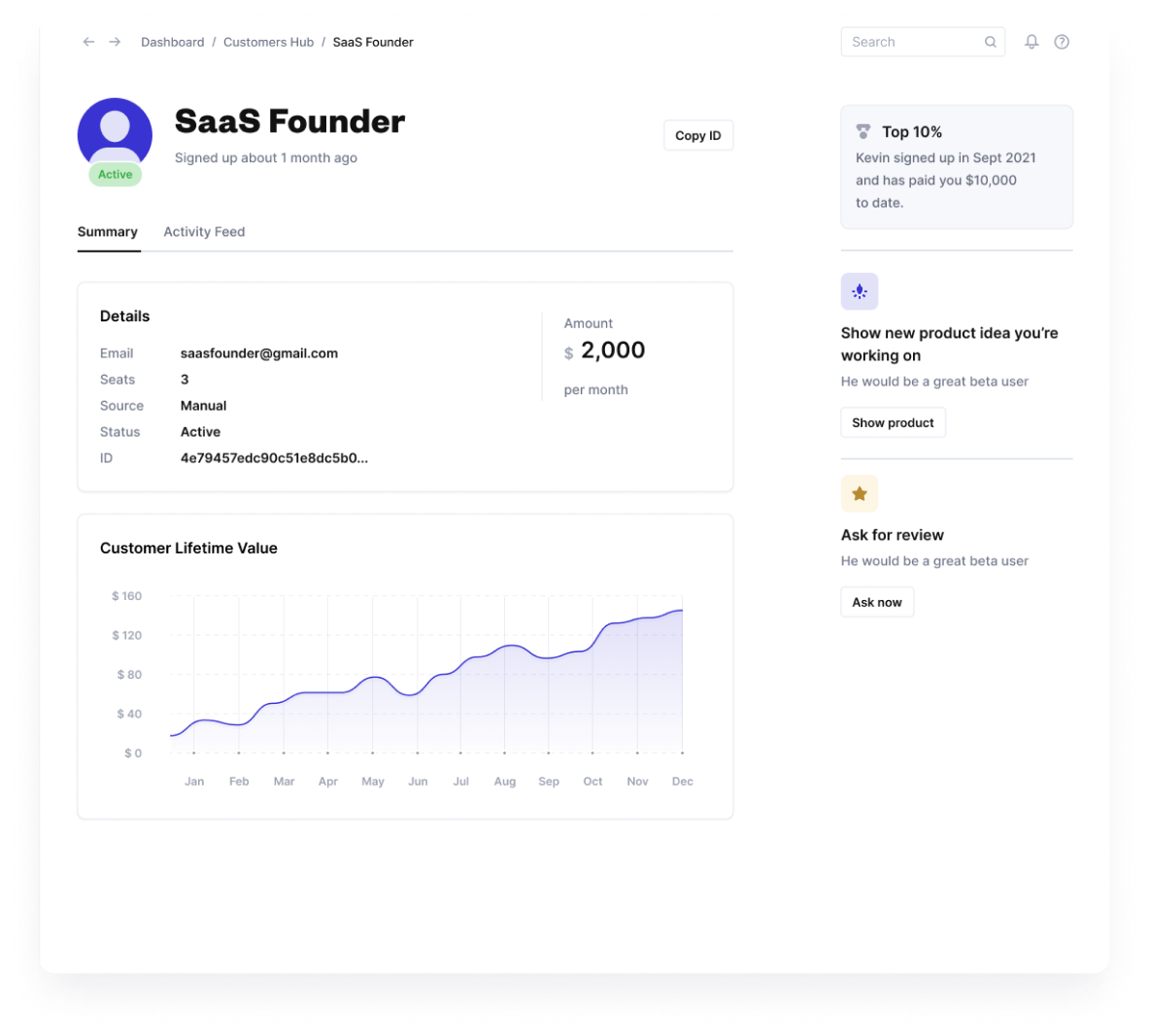

I took $1m at my last SaaS company before our exit. We kept more equity and made more money when we exited.

We had several growth tactics we wanted to try going into Q3 of 2022. As we started executing and growing, we got an M&A offer we couldn't refuse. The extra cash in our bank gave us more confidence going into the negotiation. We got a higher valuation and closed last month. Founderpath's capital was hugely strategic during our M&A process. They let us pay off early without paying any fines once we finalized our acquisition," Josh, SaaS Founder

Erik Pfannmöller

Germany

Founderpath is awesome

We first took Founderpath capital back in May 2021. Since then, we've nearly doubled our MRR and kept 100% equity. We're in a competitive space (customer support SaaS) with competitors who are raising tons of VC. It makes me happy inside that I'm able to compete with them, while keeping all our equity. Founderpath helps us grow faster without dilution.

Why choose Founderpath over River SaaS Capital?

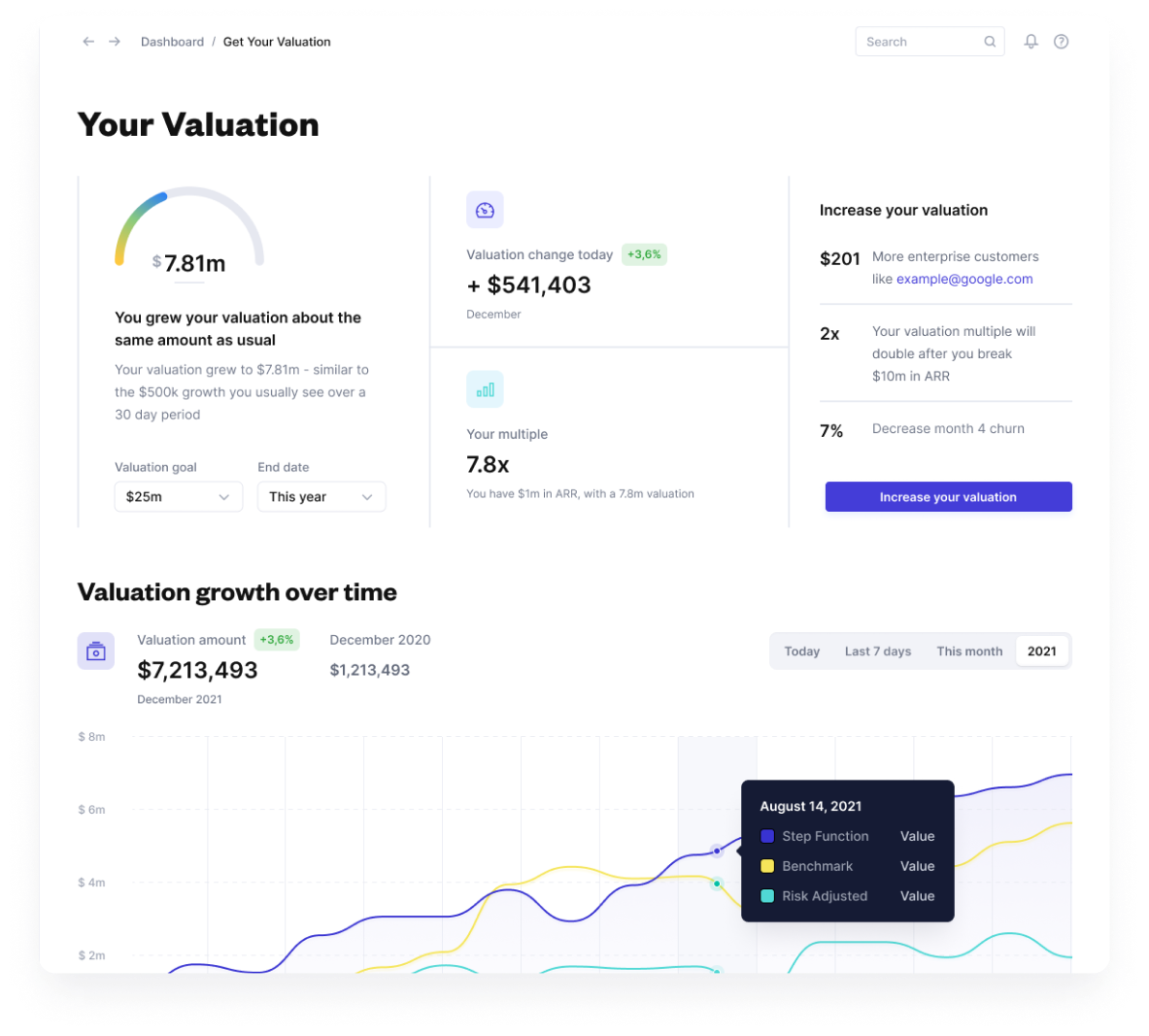

Use SaaS Financing Software that scales with you. See why SaaS founders are taking money from Founderpath and using our valuation and reporting tools to make it the #1 River SaaS Capital alternative.

River SaaS Capital River SaaS Capital | ||

|---|---|---|

Duration | 36-48 months | 12-48 months |

Growth Requirement | Must be "High Growth" | None |

Minimum Revenue | $1,500,000 | $500,000 |

Deals Done | 7 | 212 |

Tech Enabled | ||

Built By SaaS Founders | Yes | |

Products | Loan, Step Up | Term Loans, Factoring |

SaaS Company HQ | US Only | Worldwide |

SaaS Valuation Calculator | ||

CEO Retreats | ||

Covenants | Yes | No |

Equity Investores Required? | No | No |

Max Amount | 4x MRR | 7x MRR |

Board Seat Required | No | No |

Legal Fees | $5k | None |

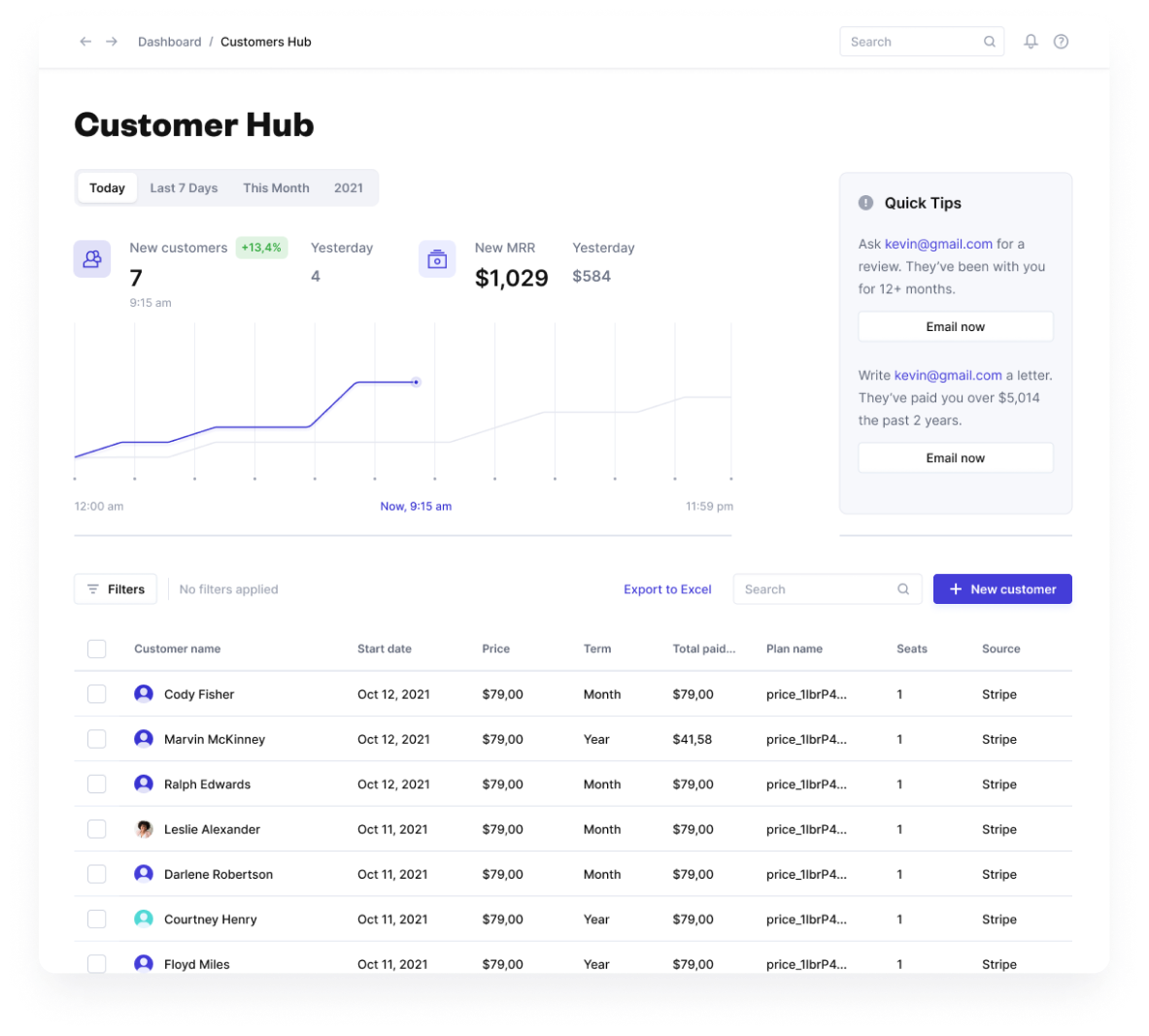

Integrate with your favorite SaaS tools instantly

Founderpath is the Fastest Growing River SaaS Capital Alternative

Founders Will Take $250m This Year. So far:

3,124

Offers made

$504m

Revenue on platform

Jacob Wright

Founder of Dabble

Longer terms than others, & a personal touch

I've had dealings with Pipe and Capchase, and Founderpath has been the best experience. You aren't just dealing with a sales rep who then hands you off to someone else who hands you off to someone else. Founderpath has a more personal touch.They also have longer and more flexible terms, allowing you to pay off early if needed without penalty like the others.Overall, a great experience.Note that Discount Rate isn't the same as APR you get with a bank loan, so don't compare them apples-to-apples. All these companies use Discount Rate which ends up converting to ~2x APR, so bear that in mind when making decisions.