Dear SaaS Founders and CFO's:

We'll give you up to $4m in 48 hours

Term Loans

Factoring Agreements

SaaS Credit Score

Your real-time SaaS credit score is the key to unlocking capital

235 B2B SaaS Founders Brainstorming

Founderpath Customer Retreat 2023.

In 2024, we averaged 4 deals per week

CEO Steve Benson shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

$4,200,000

CEO Scott Pielsticker shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

$1,000,000

CEO Larry Kim shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

$572,000

CEO Jamie Akhtar shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

$1,452,000

CEO Joe Brown shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

Undisclosed

CEO Plarent Ymeri shares why he picked Founderpath to be the exclusive non-dilutive capital partner for

In the amount of

$1,000,000

How Does It Work?

Connect your core platforms.

Manual options available.

We generate your Founderpath Score (high 1,000). Higher score means more capital, better term

Choose our template Term Loan or Factoring Agreement. Money wired in under 48 hours.

Factoring Agreements and Term Loans

Factoring Agreement

9 (simple, quick)

12-30 months

As low as 7% Discount Rate

$500k

None

Customer contracts only

Term Loans

39 (slightly longer, more complex)

12-48 months

As low as 16% Interest Rate

$3m

As low as 0%

More than Customer Contracts

Built by SaaS Founders. For SaaS Founders:

Joel Ohman

United States

Great Experience with Founderpath; Highly Recommend

We have used Founderpath as an ongoing source of non-dilutive growth capital for our fast-growing B2B SaaS company, Exercise.com, and have been very impressed with the ease of use, quick response times, and flexibility. Nathan and Kevin are great to work with and I look forward to partnering with them in the future. If you are a growing SaaS company that needs capital to fund future growth I would strongly recommend working with Founderpath.

11,024 SaaS Companies Use our Free Software

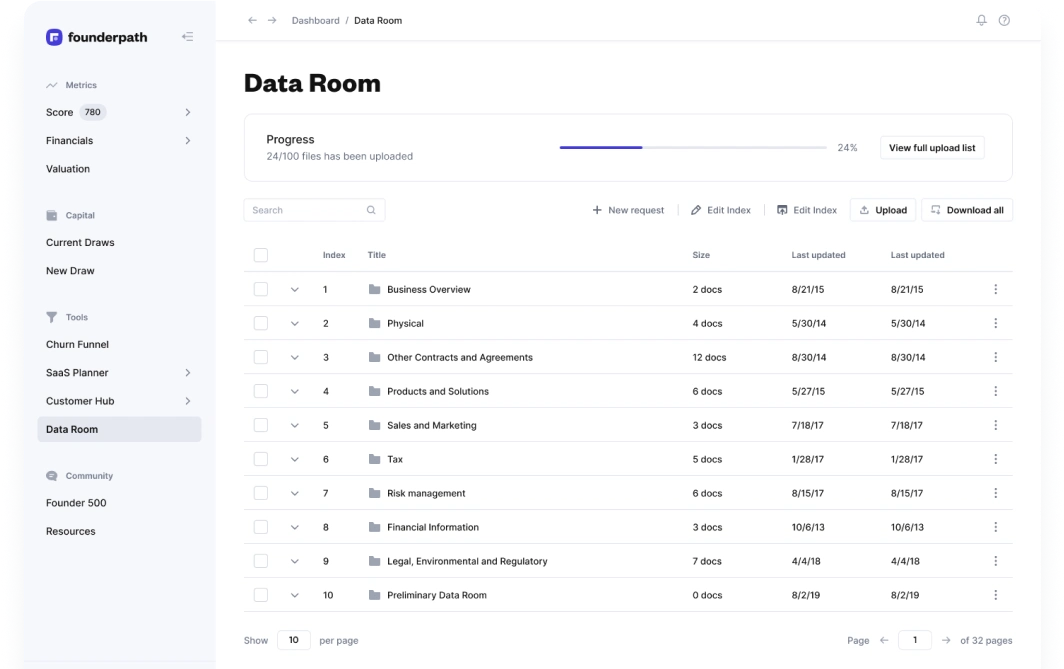

Perfect Data Room

Use our software to automatically keep your data room up to date. When you’re ready to exit, raise equity, or send an update to advisors, you can move faster.

- Stop searching Google Drive

- Single Source of Truth

- You control access

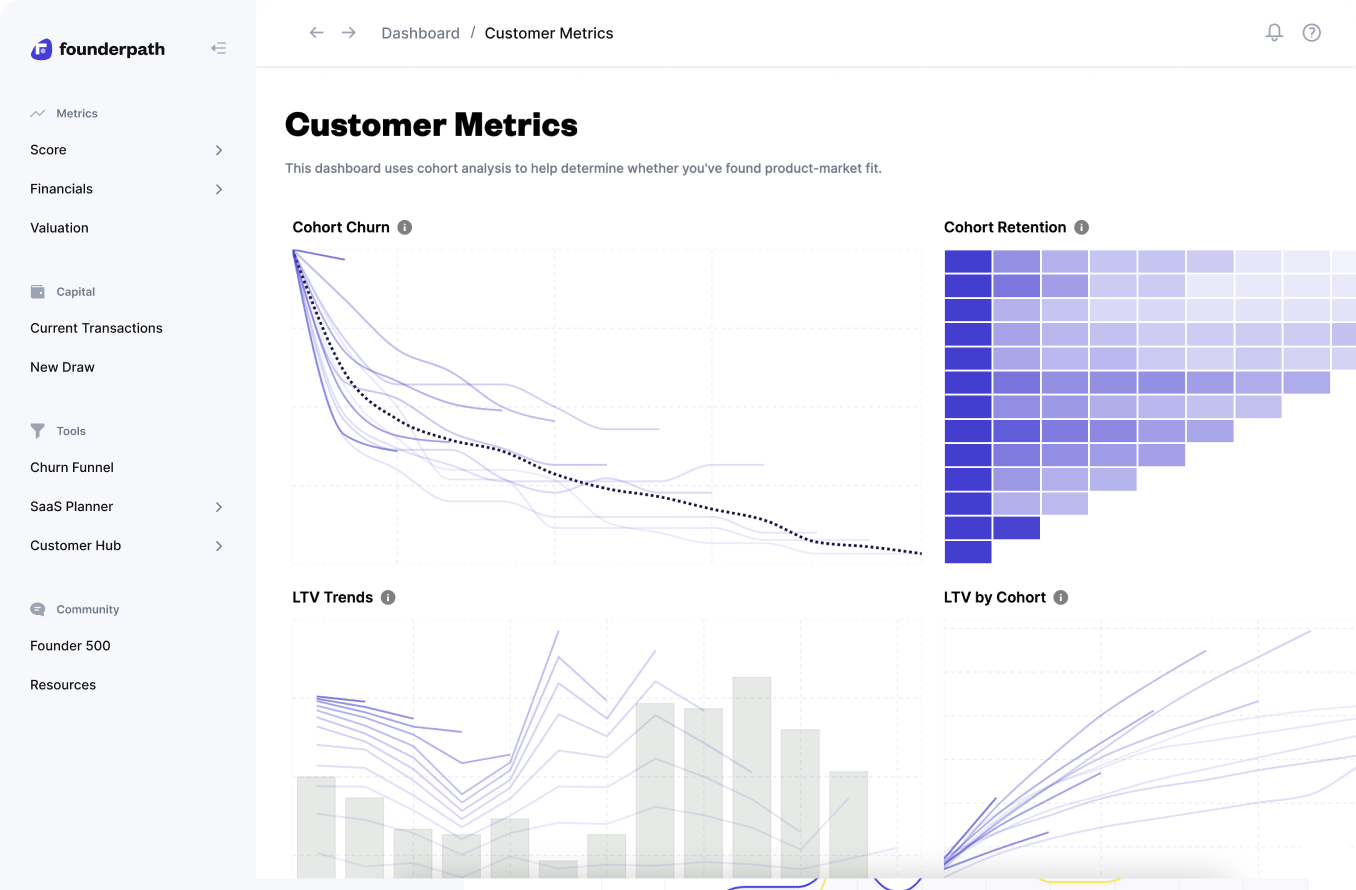

SaaS Metrics and Benchmarking

Over 10,000 software founders use our dashboard for key SaaS metrics and benchmarking.

- CAC, ARPU, Churn Patterns

- Collected LTV cohorts

- Net dollar retention patterns

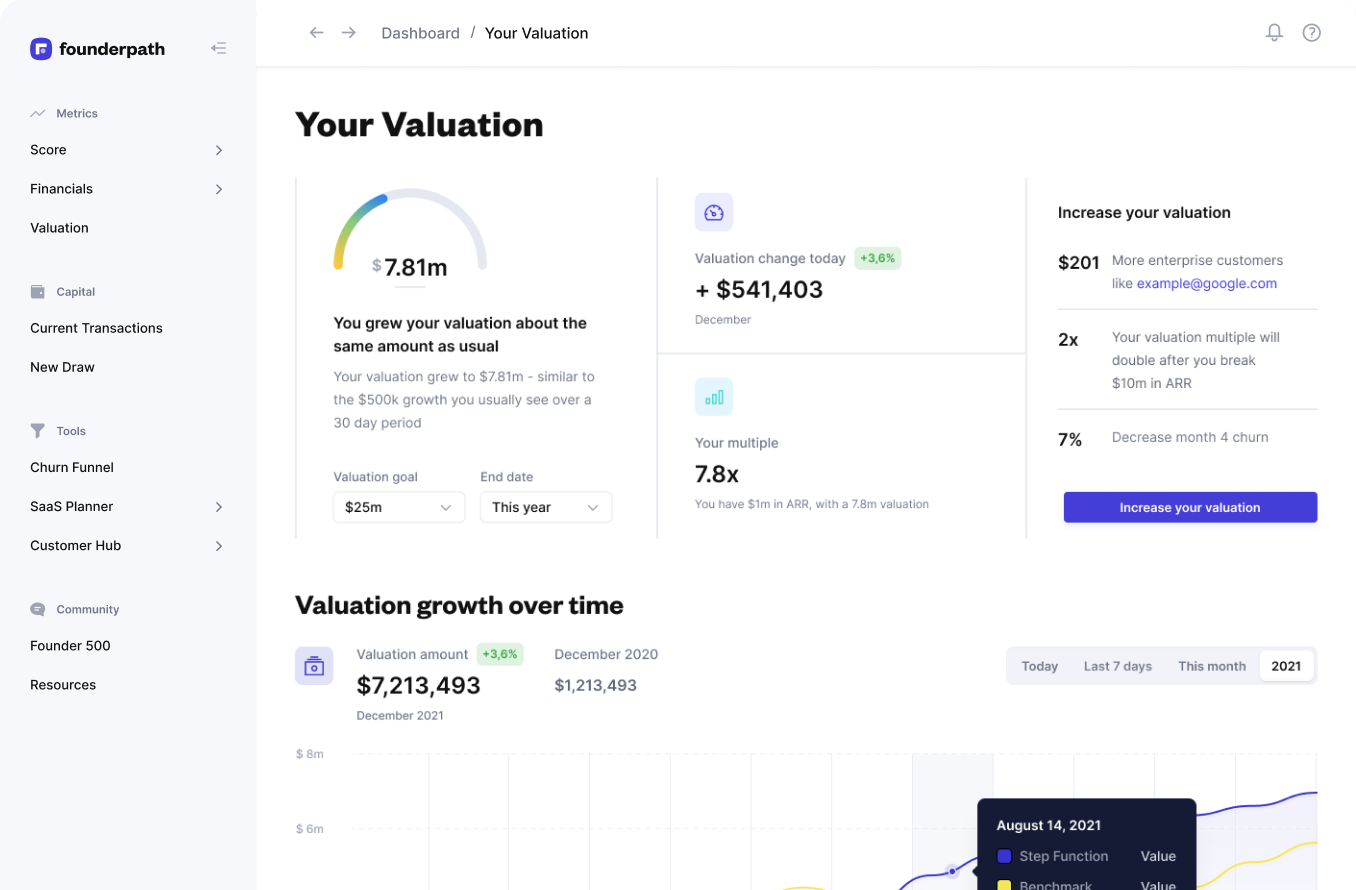

Valuation Optimization Tool

We give you factual data points that allow you to negotiate for a higher valuation. You’ll have market comps at your fingertips allowing you to get a higher multiple.

- See valuation change over time

- Collected LTV cohorts

- Download list of recent multiples

Founderpath CEO’s are Business Friends

Private CEO Strategy Sharing

Henry Schuck (Zoominfo CEO) teaching Founderpath CEO’s how he went from $5m to $500m in revenue. Watch Recording —>

Invite Only CEO Dinners

1 on 1 time with Kim Lecha (Typeform CEO), Godard Abel (G2 CEO), and Greg Galant (Muck Rack CEO). See Inside —>

A lot to learn: $4b ARR in one room

Each year, Founderpath CEO’s get together to discuss tactics, share war stories, and brainstorm solutions.