We integrate with your favorite tools already

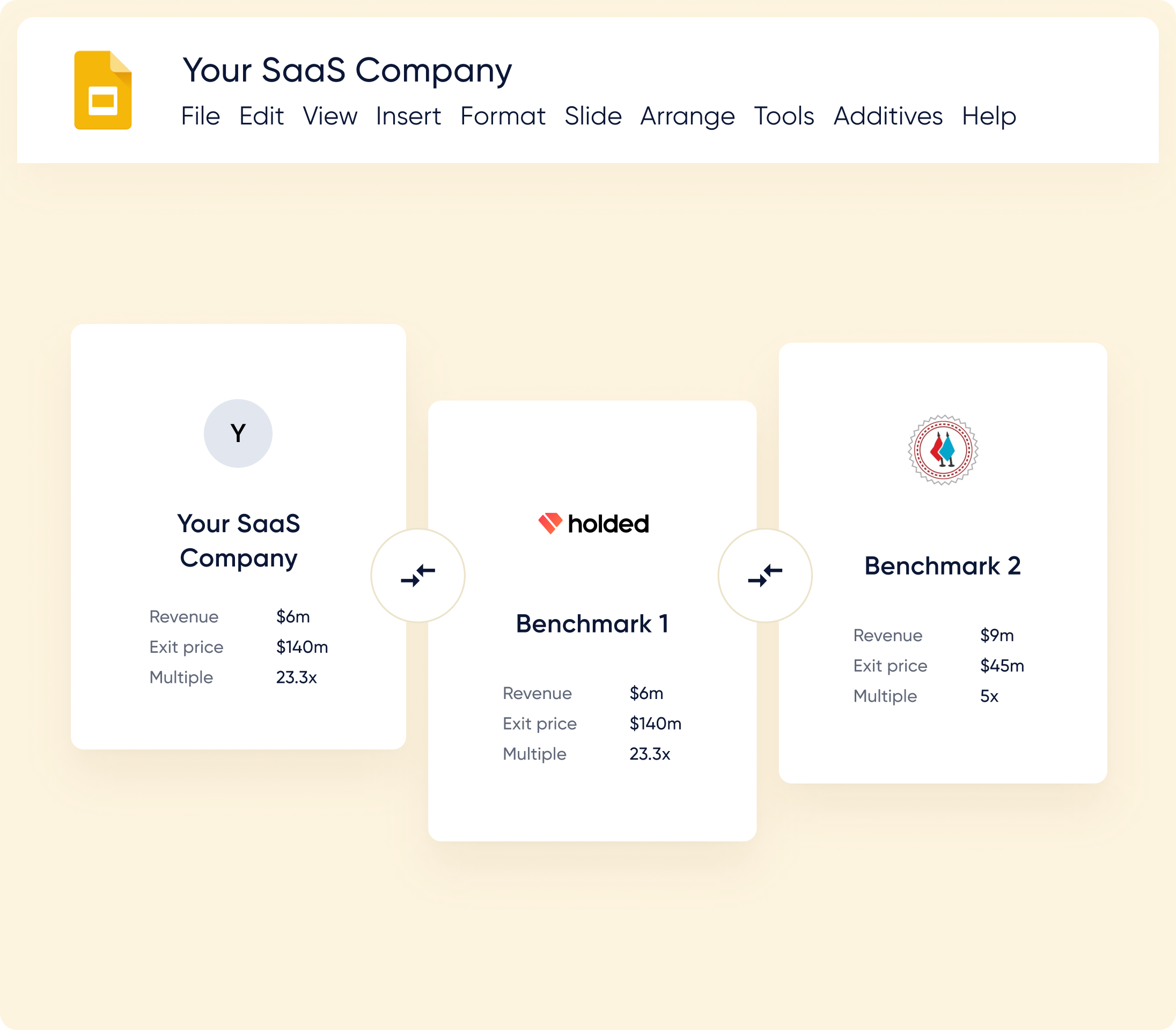

Want to Sell? Here are Recent Exit Multiples

We get valuation data by interviewing founders one by one.

Holded

Holded helps SME's manage their business (Invoices, accounting, team management).

Revenue

$6m

Exit price

$140m

Multiple

23.3x

Try for free. No cc required.

“I’m happy running my company but am curious what my equity is worth. I love checking my valuation graph and include it in my monthly team report.”

Alex, Founder Standuply

Bootstrapped and Looking to Raise?

Here are VC valuations you should know about.

Chilipiper Series A

$15m raised at $60m valuation with $7m in ARR.

+ 185

More recent benchmarks

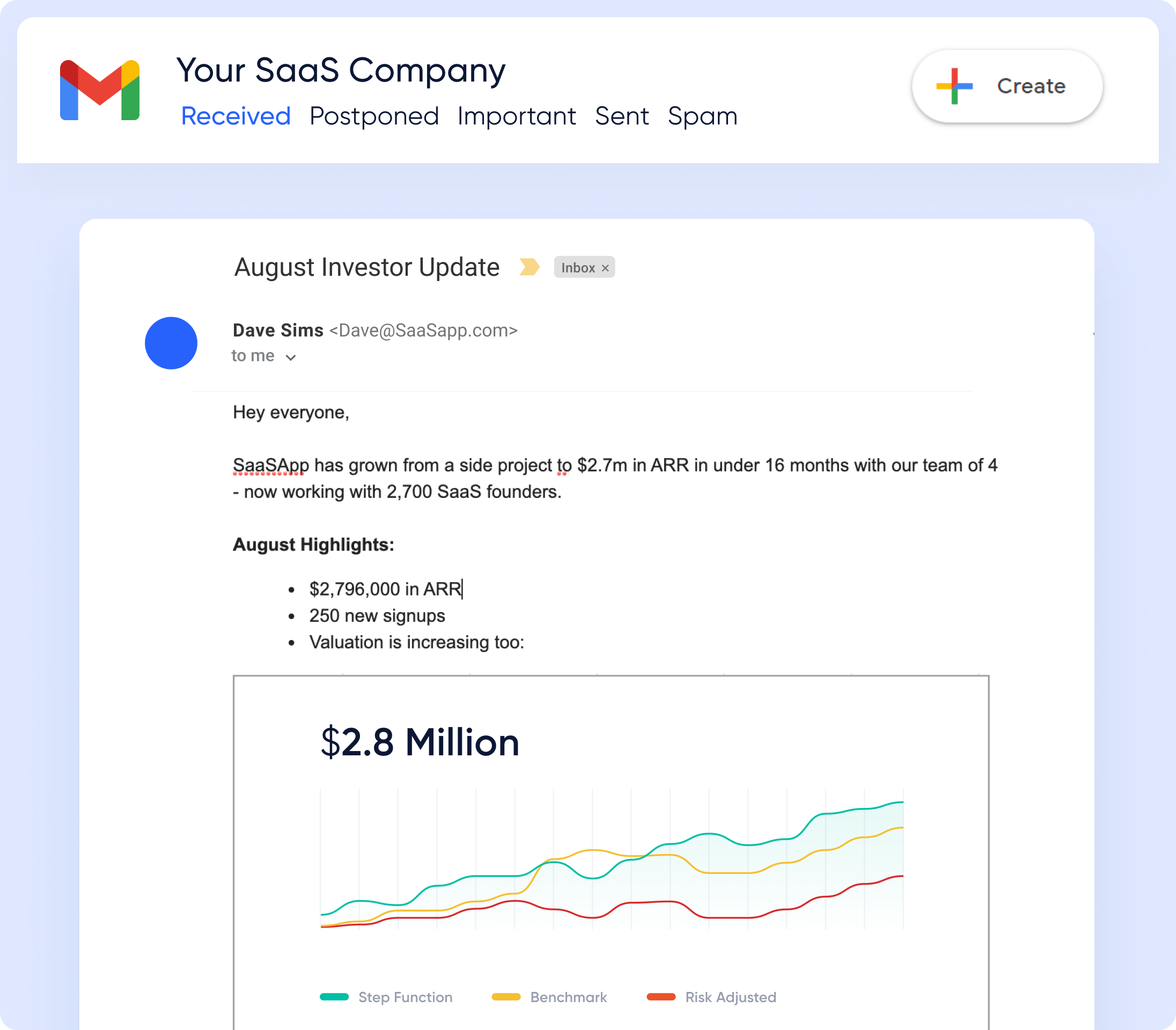

Easily Share Your Valuation in Emails and Slide Decks

Watch your graph real time.

Embed Into Gmail, Outlook: 1 click

Impress your advisors when you include your valuation growth in your next monthly update.

Google Slides, Keynote, Powerpoint

Your valuation is more credible when you include benchmark valuations next to it. Click “export to slide deck” to instantly design.

Do these 3 things to break a $10m valuation

We’ll show you how to increase your valuation fast

Net Dollar Retention

Javi at Holded got a premium valuation because his net dollar retention was 140%. Focus on retention over growth.

Enterprise Customers

Prove you can close a $2k/mo customer. Early sign you have an enterprise opportunity.

Revenue Per Employee

If you’re revenue per employee is higher than $200k, you’ll have a higher valuation.

“I got a lowball offer from a private equity firm and used Founderpath benchmarks as negotiation leverage. I doubled my exit price!”

Chris Devor, Founder DocHub

Find a buyer

A full list of SaaS buyers including target deal size, metrics, and what they'll pay.

Instantly get the full buyer list + contact infoHow to Value Your SaaS Company in 2021

Risk Mitigation

Increase your valuation as you remove risks like customer concentration

Step Function Method

Earn valuation increases as you reach numeric milestones like $2m in revenue

Benchmark Method

Increase your valuation by using similar company valuations in your negotiations

“I needed to add a slide to my board deck showing how we plan to grow valuation. Founderpath’s SaaS benchmarks helped me big time. I couldn’t find this data anywhere else.”

Jeremi, Founder at Truelytics

Full List of SaaS Valuations

Check back each month for new data!

2,700

SaaS founders

$500m

in revenue tracked

$1.851m

Average valuation