Do you really want to sell 15% of your SaaS business to NextView?

VC’s take forever to pitch, make you give up 15% equity, and require board meetings. Founderpath offers:

Join 3,021 Bootstrapped SaaS Founders

NextView Reviews

Erik Pfannmöller

Founder of Solvemate

Our Competitors raised VC. We kept 100% and doubled MRR w/ Founderpath

We first took Founderpath capital back in May 2021. Since then, we've nearly doubled our MRR and kept 100% equity. We're in a competitive space (customer support SaaS) with competitors who are raising tons of VC. It makes me happy inside that I'm able to compete with them, while keeping all our equity. Founderpath helps us grow faster without dilution.

My Ugly Cap table - Loved the press. Hated the dilution.

I’m Nathan. I launched a SaaS company when I was 19 and raised a seed round from a billionaire.

“parent” COO to watch over the business

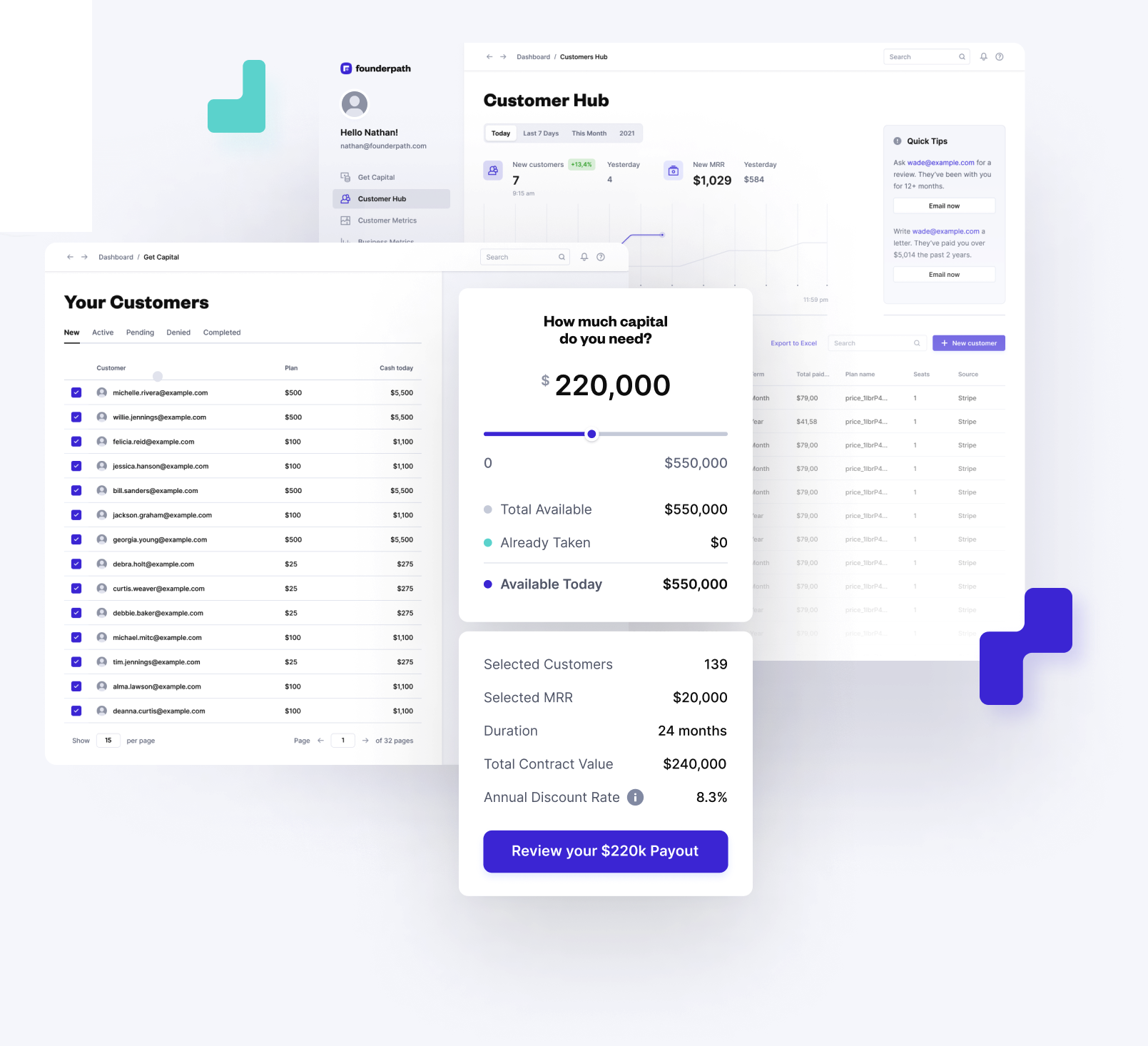

How it works?

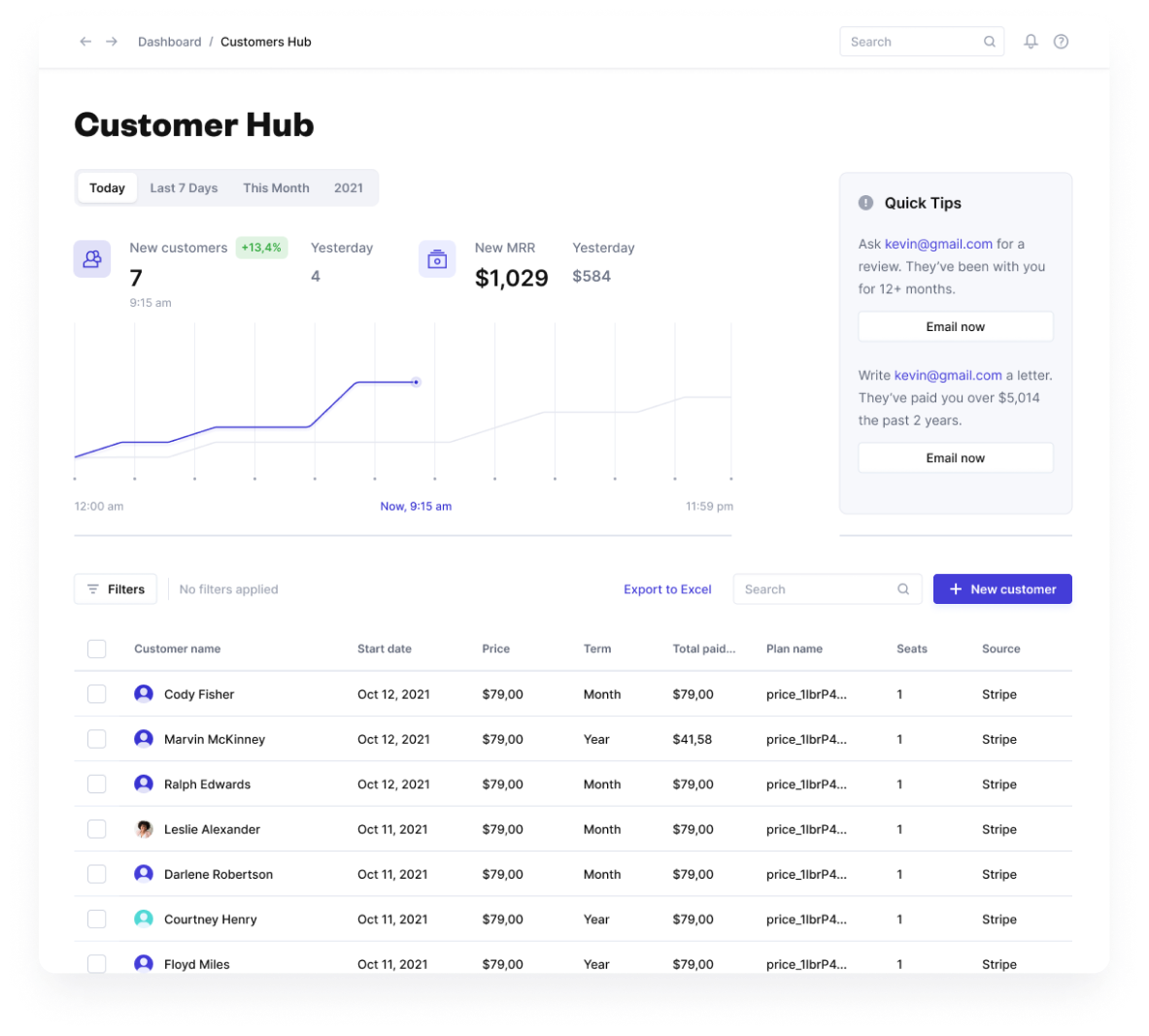

Connect Your Favorite Tools

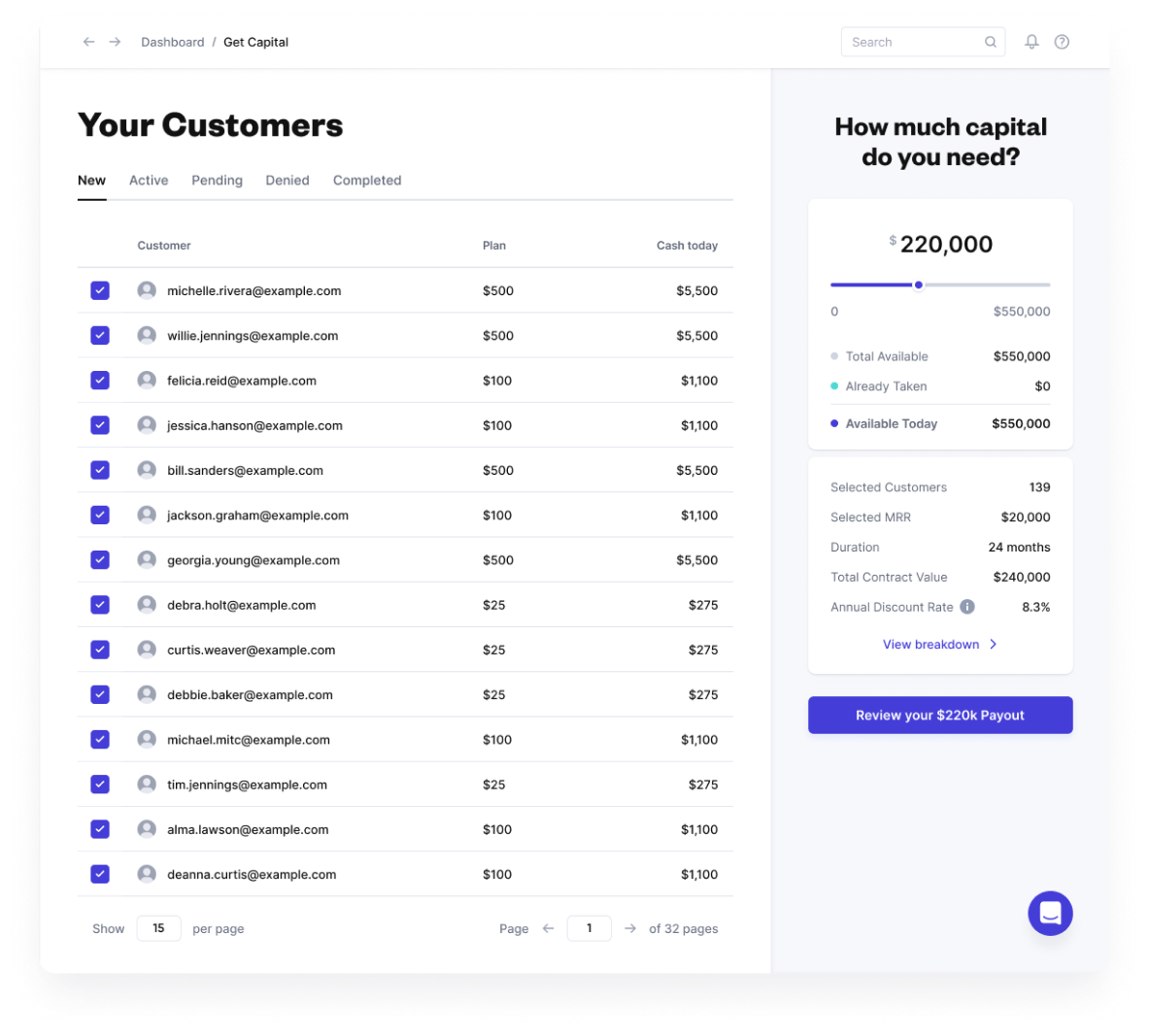

Get an offer in under 5 minutes

We give you capital by turning your MRR into upfront cash

Josh LaSov

Founder of Satori Reporting

We had a 7 figure wire in our bank in under a week

After interviewing 23 lenders - it was wonderful to meet Founder Path. Their terms, process and understanding of speed was simply incomparable. Within 1 week we had completed diligence (and we aren't a small SaaS company). A few days later a seven figure wire hit our bank account and we were able to turn on the growth engine! In a nut shell, this is how lending should be done - great terms, super fast diligence and super fast to close.

Why choose Founderpath over a VC?Save 1-2 months of time from pitching VC’s. Keep 100% of your equity, scale without worrying about board meetings. See why SaaS founders call Founderpath the #1 alternative to a Seed Round: | VC Fund | |

|---|---|---|

Give up equity? | Yes, 15% | Keep 100% of your equity |

Cost of capital | Very expensive when you grow | Pay back 1.1x over 3 years |

Board meetings | Yes (4 hours each) | No |

Legal Fees | $10k | None |

Time to close | 4-8 weeks | Avg 34.8 hours from signup to wire |

Employee stock option pool required? | ||

Liquidation preference | ||

Discount to next round (if Convertible Note) | 20% | No right to invest |

Interest rate (if Convertible Note) | 6-8% until convert to equity | Not debt |

Monthly reporting required | ||

SaaS Founder Slack Group (Invite-Only, 1,987 founders) | ||

Annual SaaS Bootstrapper Conference | ||

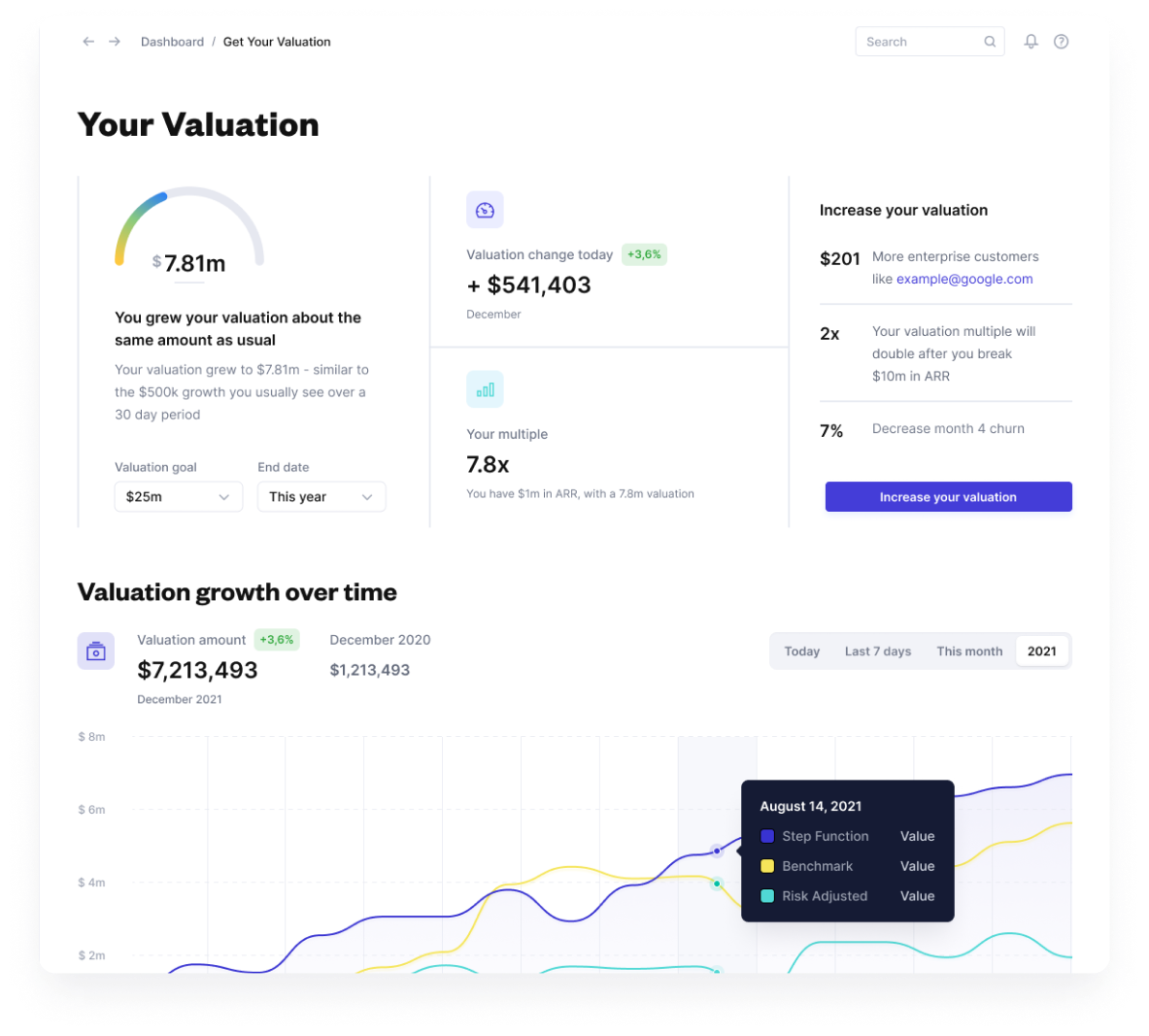

SaaS Valuation Calculator | ||

Free CAC calculator | ||

Free cash flow/profit and loss reporting tool | ||

Free Lifetime value calculator | ||

Free Churn calculator |