Dear SaaS founder, you raised your seed 12+ months ago. Now what?

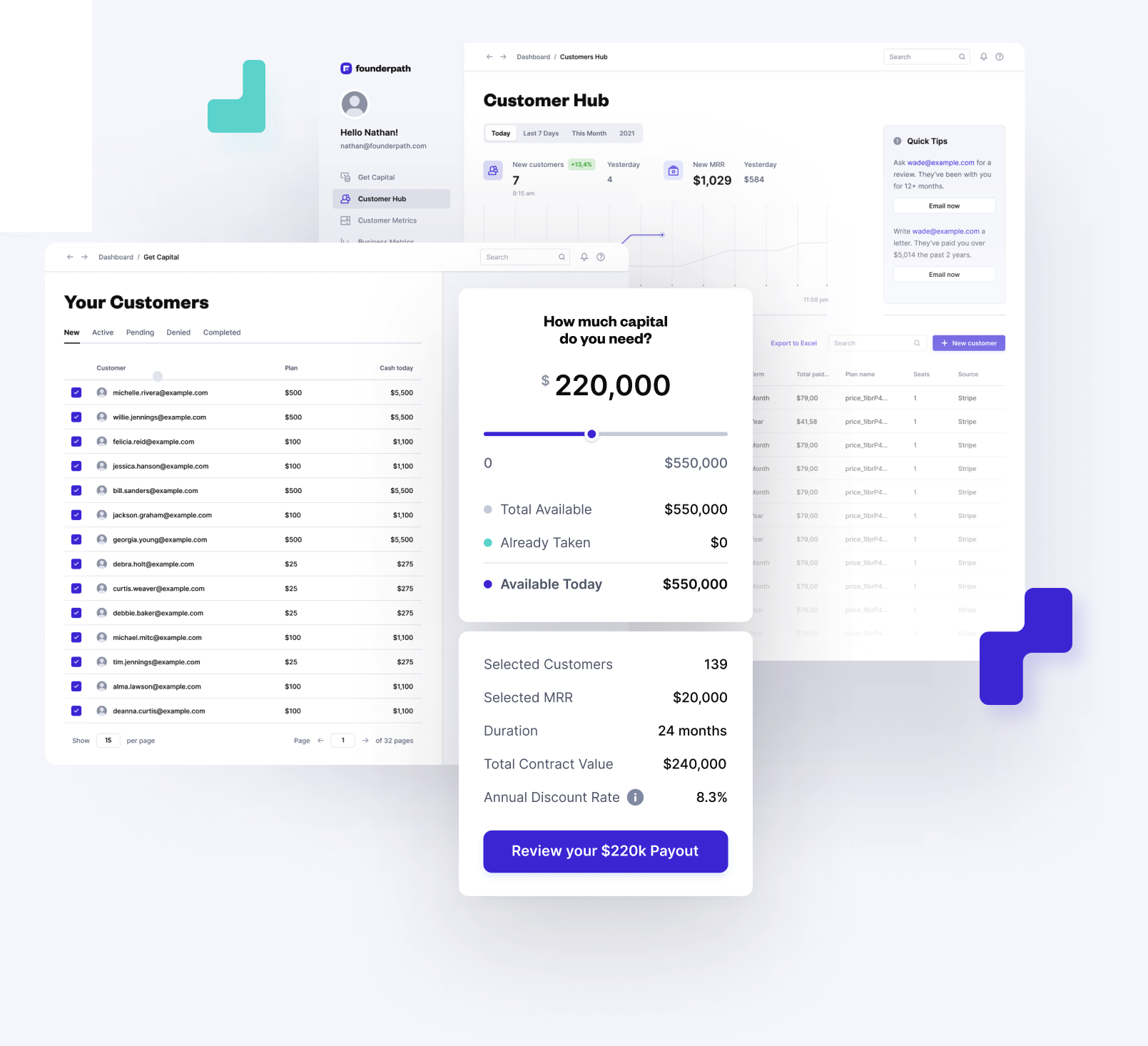

You’ve invested all your seed money but aren’t ready to raise more. Founderpath offers you bridge capital fast:

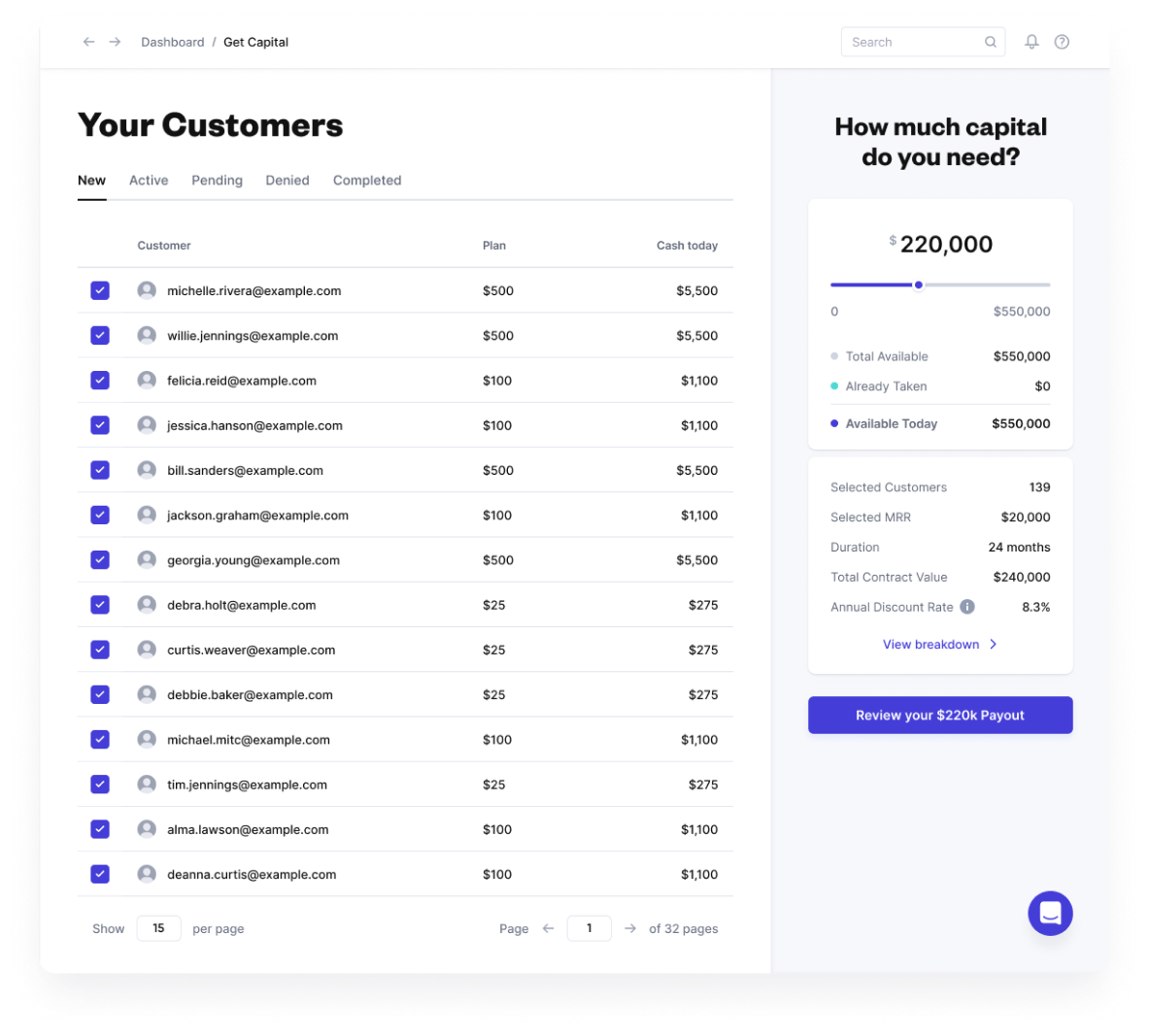

How much capital can I get?

Count On Us

You'll always know how much capital you have available. Unlock more capital at better terms with Founderpath

109 ReviewsExcellent

4.9 out of 5

What's the cost?

Take Your Time Paying Back

12+ months payback

No warrants, covenants, or personal guarantees

No hidden or upfront fees

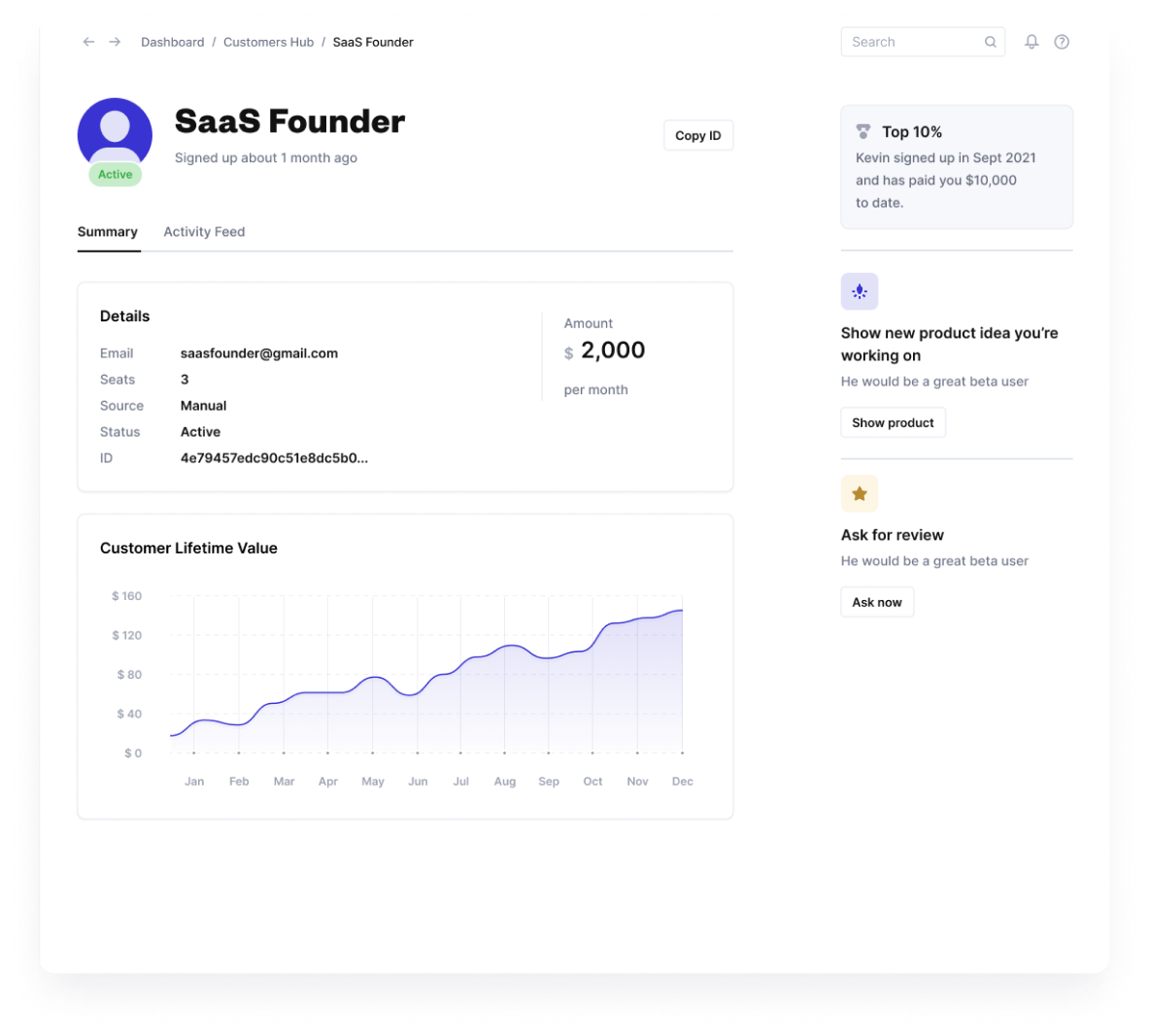

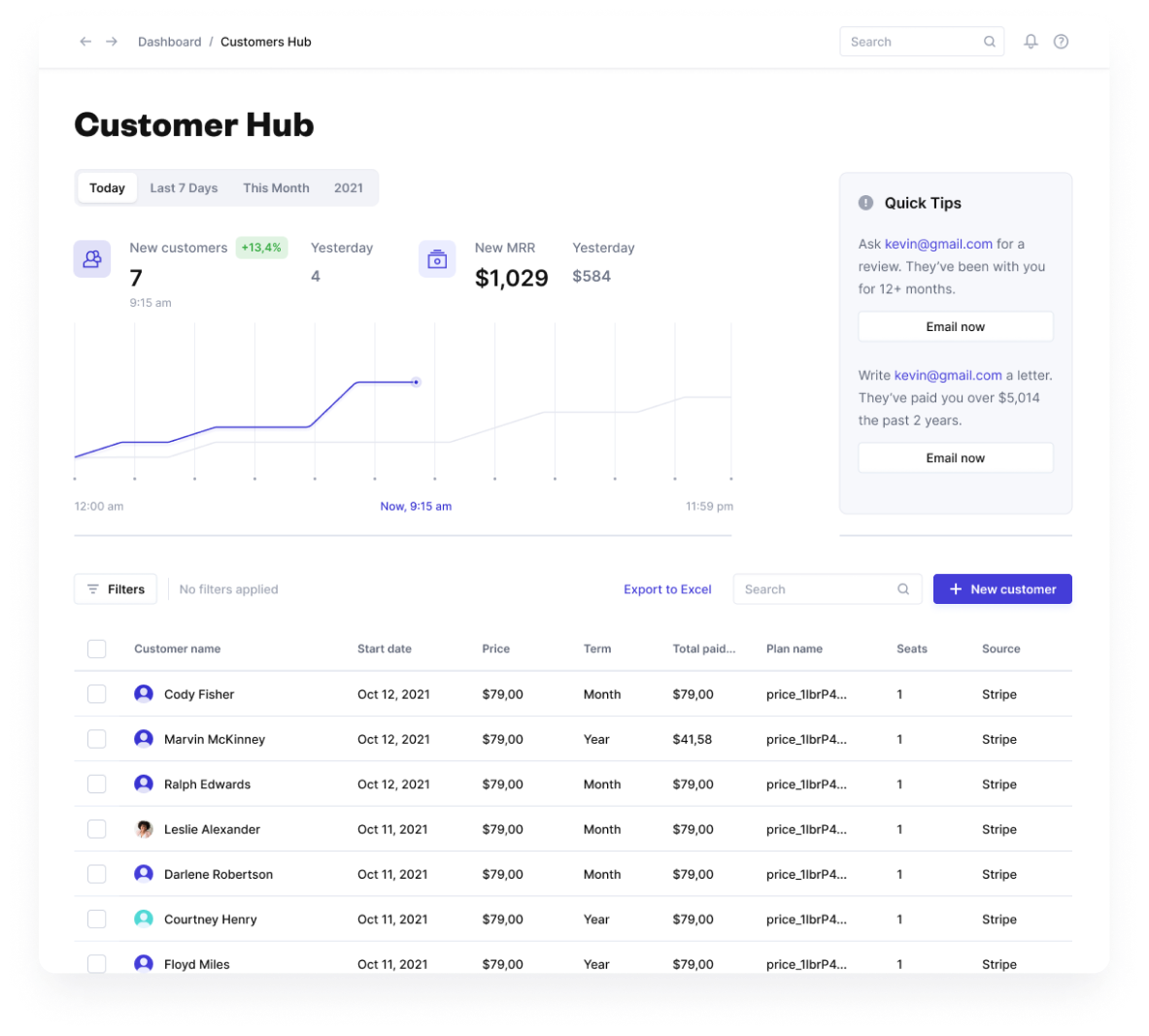

Top SaaS Founders use these 4 tools:

Frequently Asked Questions

Frequently Asked Questions

Founderpath launched in 2021 by investing non-dilutive capital in B2B SaaS companies. Today, Founderpath funds a variety of business models including SaaS, ecommerce, and agency's. Connect your billing, bank, and accounting tools, and within 24 hours you can unlock capital based on your business performance.

Founderpath works with founders running B2B SaaS companies with at least $500k in last year revenue, healthy retention, and recurring subscription contracts. Founderpath also funds ecommerce brands with at least $500k of last year sales and agencies who do more than $1m per year in revenue.

With Founderpath you keep 100% of your equity — no board seats, no dilution, and no long fundraising cycles. Unlike banks, we move fast, don't require personal guarantees, and understand recurring revenue models.

We offer Revenue Financing, Term Loans, and Merchant Cash Advances. All are non-dilutive (we get no equity) and are designed specifically to help founders and business owners keep equity and keep control of their business.

Most founders see funds in their account within 24–48 hours after connecting their data.

No. Founderpath is 100% non-dilutive. You never give up equity, control, or board seats.

Founderpath's revenue financing product offers discount rates on future revenues as low as 7%. Founderpath's term loan product offers interest rates as low as 15%. Founderpath's Merchant Cash Advances offers repayment rates as low as 5% of your monthly revenue. All funding offers are contingent on underwriting.

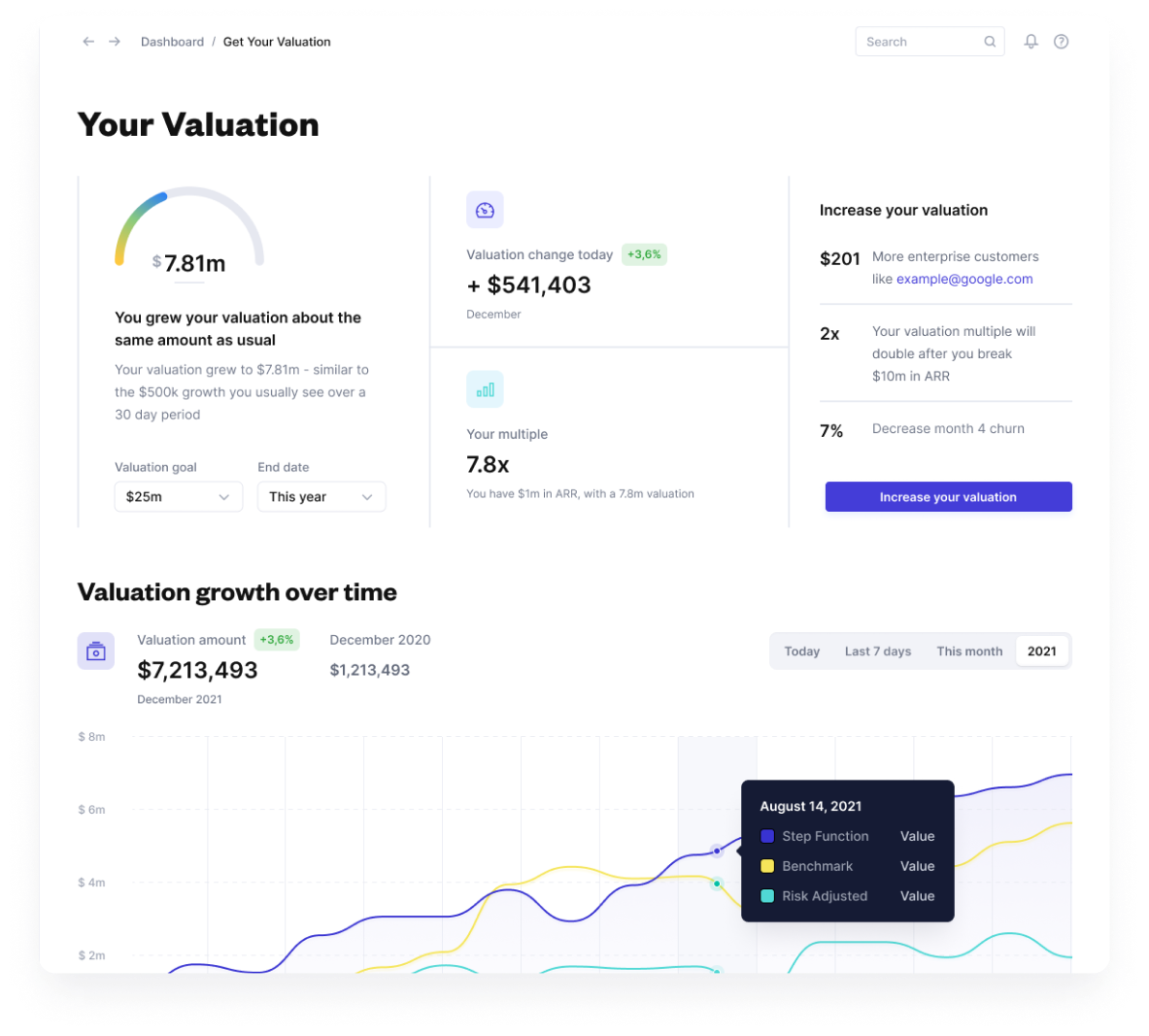

We look at key SaaS metrics like ARR, churn, gross margins, and retention. The stronger your metrics, the more capital you can unlock at better rates. For ecommerce brands, we look at margins, unit economics around customer acquisition, and your ability to scale sustainably.

Founderpath has funded $220m to 550 software founders. Founderpath's average deal size is about $600,000. The strongest companies raise $5m+ from Founderpath.

No full personal guarantees and no warrants. Founderpath takes a lien on business assets only.

Founderpath generally works with founders, within reason, if the business declines or hits trouble.

Yes. Founderpath uses bank-level security and encryption. Your data is private, never sold, and only used to underwrite your capital offer. Visit Founderpath's trust center and view security certificates in the footer of founderpath.com

Yes. You can repay early at any time, and generally save on any future fees or interest.

Founderpath has funded 550+ SaaS Founders including Bettercomp, Kissflow, Reply.io, BadgerMaps, DearDoc, Cybersmart, MobileMonkey, and many more. These founders have scaled faster, extended runway, or avoided dilution by keeping full control of their companies.

Yes. We're available in most countries and have already done deals with founders in Canada, South America, Europe, and Asia.

Yes. You can check by clicking on the GDPR logo in the footer and by visiting https://prighter.com/q/18604028289