How YouMail Broke $10M ARR Stopping Bots: Alex Quilici's Service vs. Solution Playbook

This article was written and sourced from Alex Quilici’s keynote presentation at Founderpath’s last event. The images embedded below are from their slide deck. The full keynote recording is here.

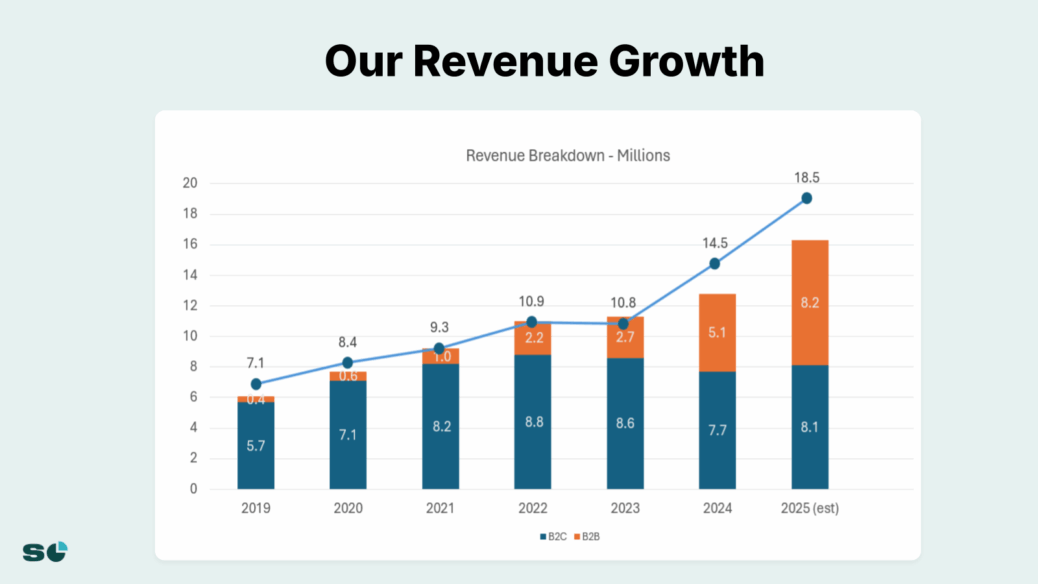

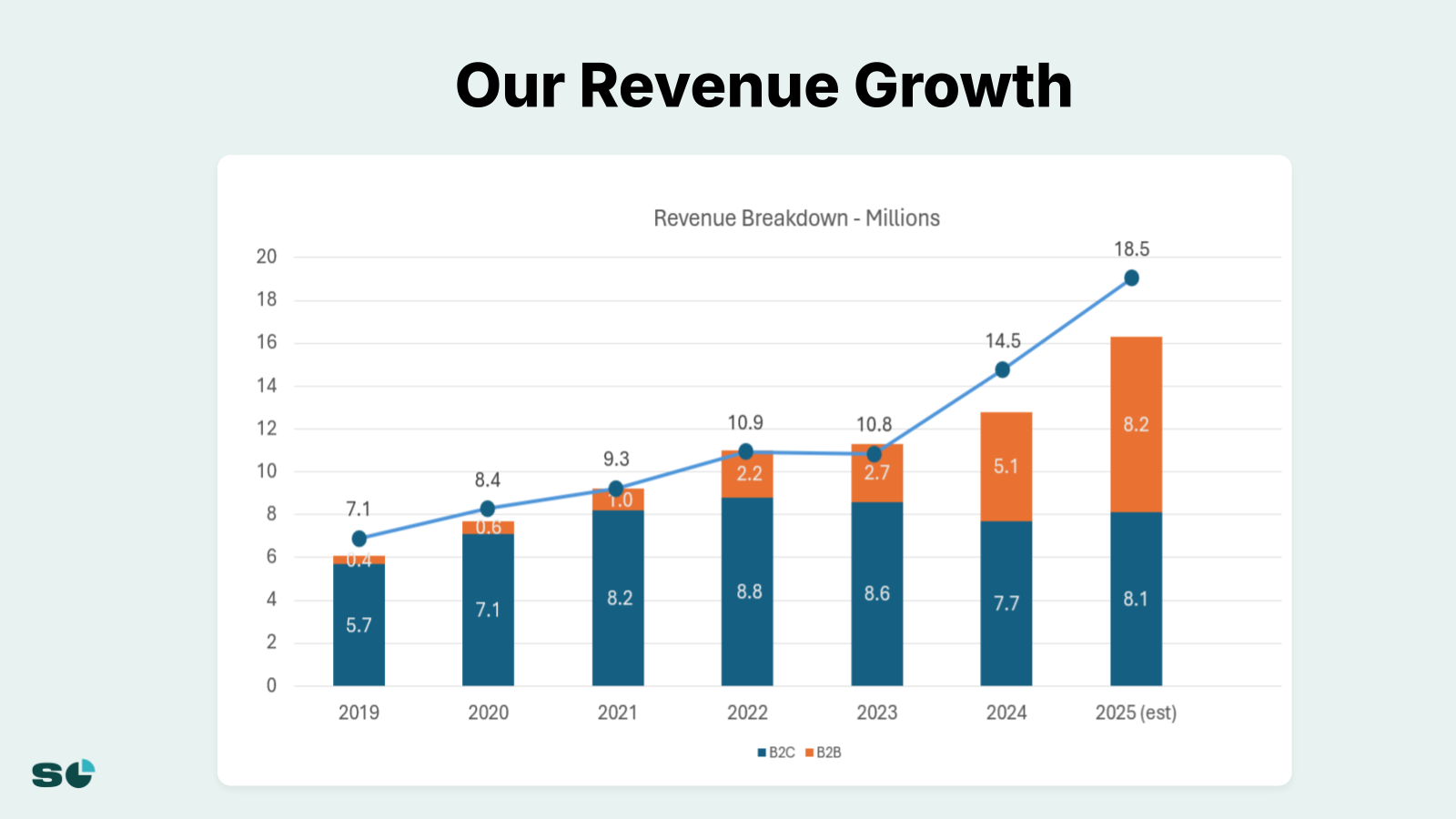

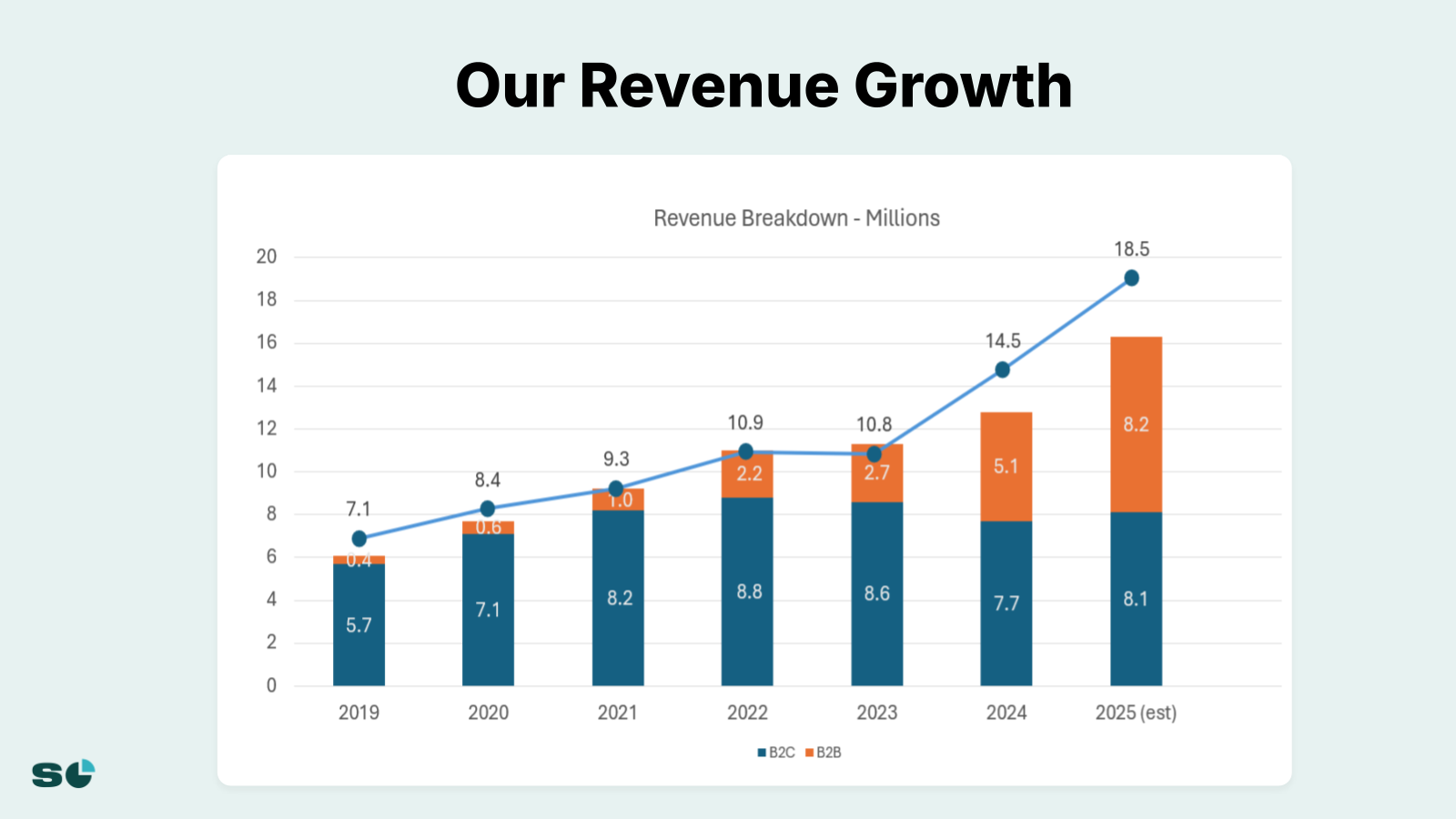

Alex Quilici transformed YouMail from a failed voicemail company into an $18.5 million revenue powerhouse by discovering that bad actors were his best marketers and consumer data was enterprise gold. In his September 2024 keynote presentation, Quilici revealed how YouMail discovered that carriers desperately needed their consumer-generated spam data to clean up their networks. The company now operates a sophisticated dual-revenue model: 50,000-100,000 consumers pay for premium call blocking while enterprises pay quarter-million-dollar contracts for data APIs that identify bad actors on telecom networks.

The Playbook: 5 Lessons from YouMail’s Journey to $18.5 Million Revenue

1. Turn Failed Products into Data Goldmines – Alex co-founded Quack.com, which provided a consumer voice portal service that was essentially SIRI over a 1-800 number before smartphones existed. AOL acquired Quack for $200 million in August 2000, just 18 months after it was founded. This taught him that consumer data has enterprise value. When YouMail’s carrier voicemail pitch failed, they pivoted to mining their consumer call data for B2B insights.

2. Let Bad Actors Drive Your Growth – YouMail discovered robocallers were doing their marketing for them. As spam calls increased to over 50 billion annually in the U.S., desperate consumers searched for solutions, driving organic growth to YouMail’s consumer app.

3. Build Two Symbiotic Businesses – Today, YouMail operates as two symbiotic businesses. The consumer side has 50,000-100,000 paying users generating $7-8 million annually, while millions of free users produce the spam data that powers the B2B business. This consumer base represents a powerful example of virality – users naturally share the app when robocalls frustrate their friends and family.

4. Solve for Carriers, Not Just Consumers – The breakthrough came when Quilici realized carriers needed to stop calls at the source, not at the device. With just 5-10 people on the B2B team, YouMail sells enterprise contracts worth hundreds of thousands of dollars to carriers and enterprises. The company’s “Watch” service shows carriers exactly which customers on their network are making illegal calls, complete with timestamps, phone numbers, and call content.

5. Survive Long Enough to Find Product-Market Fit – YouMail endured multiple failures, lawsuits, and recapitalizations before finding its winning formula. Sometimes the path to success requires extraordinary resilience.

2007: Failed Carrier Voicemail Play Forces Consumer Pivot

YouMail’s origin story began with a fundamental misread of the market. The founding team believed they could sell enhanced voicemail services to carriers, positioning it as infrastructure software. They raised $1.9 million in April 2007 from angels to build this vision. The pitch was simple: voicemail was broken and carriers needed better technology. But carriers weren’t buying. As Quilici explained in the keynote, “The original vision was hey, voicemail sucks, so instead of saying well let’s not use it, let’s go help carriers get better voicemail.”

Within weeks of the funding, it became clear the founding CEO wasn’t right for the role. Quilici, who had invested $50,000 as an angel, stepped in to help. Having previously built AOL’s voicemail service to $50 million in annual revenue, he understood both the opportunity and the challenges ahead.

The company quickly burned through cash trying to sell carriers on enhanced voicemail. By 2010, they were forced to recapitalize, with Quilici leading the round and taking control of the company. This wasn’t the typical Silicon Valley success story – it was a grind.

2011-2014: Three-Year Lawsuit Freeze Nearly Kills the Company

Just as YouMail began gaining traction with consumers, disaster struck. The company had developed an automatic reply feature that sent text messages when someone called – essentially what every iPhone does today. But in 2011, this triggered five class-action TCPA (Telephone Consumer Protection Act) lawsuits.

For three years, YouMail was frozen. They couldn’t shut down, couldn’t grow, and couldn’t raise money. As Quilici explained in the keynote: “We couldn’t shut down the company, we couldn’t grow the company, we couldn’t do anything until that cleared up.”

During this painful period, the team made a crucial discovery. They noticed users weren’t blocking individual stalkers or bad hookups as expected. Instead, millions of users were all blocking the same phone numbers – robocallers. YouMail reported robocallers targeted U.S. consumers with 52.8 billion calls over the course of 2024. Robocalls volume was down 4.2% from the 55.1 billion robocalls recorded in 2023, partly due to carrier-level blocking enabled by YouMail’s data.

This insight would become the foundation of their future success. By collecting data from millions of consumers answering billions of calls, YouMail was building the most comprehensive database of bad actor phone behavior in the industry.

2015-2019: Consumer App Grows to $7 Million ARR Through Viral Anti-Robocall Movement

Once the lawsuits cleared in 2014-2015, YouMail finally had room to run. The company raised $5.5 million in Series B funding and focused entirely on the robocall blocking opportunity. The timing was perfect – Americans report receiving over 50 billion robocalls each year. The USA telecom industry is quickly embracing AI-powered call authentications and blocking solutions. Furthermore, the big carriers – AT&T, Verizon and T-Mobile – spend heavily on robocall mitigation technologies.

The consumer business model was elegant in its simplicity:

- Free Tier: Basic known spammer list blocks common robocalls

- Paid Tier ($5-10/month): Advanced features including “capture” where every unknown caller must press a key to get through

- Data Collection: Every call interaction generates valuable intelligence about bad actors

By 2019, YouMail had reached $7 million in consumer revenue with minimal marketing spend. The robocallers were essentially doing their marketing for them – every spam call created a potential customer searching for solutions. This represents a powerful lesson in virality – when your problem gets worse, your customer acquisition improves.

2019: The $10M Breakthrough – Bad Guys Accidentally Become Best Customers

In 2019, YouMail made a pivot that would double their revenue within 18 months. They built a simple data API to sell their list of bad phone numbers to enterprises. The initial vision was straightforward: carriers and businesses would pay for “dips” (API calls checking if a number is good or bad) to protect their networks.

But something unexpected happened. As Quilici revealed: “Our main customers were the bad guys who wanted to understand when we had a number that we were blocking so they could change and call from another number.”

This created an ethical dilemma but also revealed a massive opportunity. If bad actors desperately needed their data, imagine how valuable it would be to the carriers trying to stop them. YouMail pivoted from selling simple good/bad checks to providing comprehensive intelligence about illegal calling operations.

Watch the complete keynote presentation to see Quilici explain how this accidental discovery transformed their business model.

2020-2024: How YouMail Built a $10M+ B2B Business on Consumer Data

The key insight that unlocked B2B growth was understanding that carriers didn’t want to block calls at the destination – they wanted to stop them at the source. The market size for Robocall Mitigation was valued at USD 4.88 billion in 2024. Robocall Mitigation Market size is projected to grow USD 18.49 bn by 2034, CAGR of 14.23% during forecast period 2025 – 2034.

YouMail’s “Watch” service became their flagship B2B product, providing carriers with:

- Real-time identification of customers making illegal calls

- Detailed call metadata including timestamps, numbers, and content

- Pattern recognition to identify organized fraud operations

- Compliance tools for STIR/SHAKEN regulations

The results were dramatic. YouMail generates $16.7M in revenue. YouMail has 38 employees. They have 65,000 customers and an engineering team of 9. The B2B side of the business now generates roughly half of total revenue with just 5-10 dedicated team members, demonstrating exceptional revenue per employee metrics.

The brilliance of this model is its network effects. More consumer users generate more data about bad actors. Better data attracts more enterprise customers. Enterprise revenue funds consumer app development. And the cycle continues.

Today: $18.5 Million ARR with 13 Million Users Feeding the Data Engine

By 2024, YouMail has built an impressive operation:

- Total Revenue: $18.5 million ARR (approximately 50/50 consumer/B2B split)

- Consumer Metrics: 13 million total signups, millions of active free users, 50,000-100,000 paying subscribers

- B2B Growth: Revenue doubling year-over-year, quarter-million-dollar enterprise contracts

- Team Size: 70 total employees, 25 engineers, 5-10 dedicated B2B team members

- Data Scale: Billions of calls answered, comprehensive bad actor database

Quilici maintains significant ownership at approximately 30%, with co-founder Blaze owning 15% and employees holding another 15%. The remaining equity is split between VCs and a hedge fund that invested in 2015. This ownership structure reflects the company’s bootstrap mentality despite raising over $20 million in total funding.

The company’s success in organic SEO is evident – search for any variation of “stop robocalls” and YouMail dominates the results. Their content strategy focuses on solving the exact problem their users face, generating consistent organic traffic without paid acquisition.

The Future: AI Integration and International Expansion to Drive Next $100M

Looking ahead, YouMail is positioned for significant growth through several strategic initiatives:

AI-Powered Detection: As robocallers use increasingly sophisticated AI to generate convincing scam calls, YouMail is developing advanced machine learning models to identify patterns human reviewers might miss. The market consists of solutions such as call authentication, AI-based call analytics, voice biometrics, and real-time call blocking. The main catalysts behind this evolving landscape are the increase in phone scams, regulatory approaches such as STIR/SHAKEN in the USA, and the increase in spam filters powered by artificial intelligence.

International Expansion: The company recently acquired a UK-based competitor for approximately $750,000, gaining four engineers and a European foothold. As robocalling becomes a global problem, YouMail’s data and technology become increasingly valuable worldwide.

Deeper Carrier Integration: Moving from detection to prevention, YouMail is working with carriers to shut down bad actors before calls even start, potentially accessing even larger enterprise budgets.

At current growth rates, YouMail could reach $50-100 million in revenue within 3-5 years. With the robocall mitigation market expected to reach $18 billion by 2034, YouMail’s unique position with both consumer and enterprise products makes them a prime acquisition target or potential IPO candidate.

The Bottom Line: Failed Voicemail Company Becomes Anti-Spam Powerhouse

Alex Quilici’s journey with YouMail proves that sometimes the best businesses emerge from multiple failures. By surviving a failed carrier pitch, consumer pivots, three years of lawsuits, and a painful recapitalization, Quilici built something unique: a consumer app that generates the data enterprises desperately need.

The key lessons for founders are clear: Let your worst problem (robocallers) become your best marketing channel. Transform consumer data into enterprise value through answer engine optimization and strategic positioning. And sometimes, your accidental customers (the bad guys) reveal your biggest opportunity.

For founders building in regulated industries or facing similar challenges, YouMail’s playbook offers hope. You don’t need perfect execution or a clear path to $100 million from day one. You need resilience, the ability to spot unexpected opportunities, and the courage to pivot when the data tells a different story than your original thesis.

Today, as YouMail blocks billions of robocalls while generating millions in revenue, Quilici has proven that the best revenge against bad actors is building a profitable business on their behavior. With strong ownership, growing revenue, and a massive market opportunity ahead, YouMail’s next chapter may be its most exciting yet.

If you’re an ambitious founder looking for capital to grow, we’d love to consider funding you at Founderpath. Click here to request capital.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…