Efficient Capital Labs (ECL) Review and History: 2025 Overview

Efficient Capital Labs (ECL) is a non-dilutive capital provider for SaaS and B2B companies. The company markets itself around fast access to working capital backed by recurring revenue. ECL was founded by international banking executives who have not founded their own software company. This shapes their underwriting approach around financial risk management rather than founder experience. For context on how ECL compares to other non-dilutive lenders, see also our reviews of Capchase, Hum Capital, and Liquidity Group.

10 Questions Any CFO or Founder Should Ask Efficient Capital Labs (ECL):

- Pay back early: If we want to pay off early in month 5, what sort of penalties are we paying? How does the Early Transfer work?

- Cure Period: If we’re late on a payment, can we have a 30 day cure period or do you push us into default immediately?

- Personal Guarantees and Credit Scores: Do you pull my (founder) personal credit score for any reason? Do you have flexibility on the personal guarantee’s you ask founders to make?

- Sharing our financial data: What third parties does ECL share our company financial data with? How does ECL use borrower billing data and financial information?

- Actual Cost of Capital: What is the effective all-in interest rate of ECL’s offer when you include flat fees, monitoring fees, legal fees, and repayment structure?

- Founder Background: What has ECL done to build a system to support founders since the founding DNA is more focused on big banking and credit backgrounds?

- Other debt: I want to keep my cheap bank line of credit (3-6% interest rates). Will ECL sit in second position or does it require a first position lien?

- Relationship After Funding: Does ECL lend us its money directly or do you sell our paper off to a third party we’ve never met? Is there any scenario where another party would be servicing our loan that is not ECL?

- Collateral Requirements: Does ECL require specific liens, revenue pledges, or covenants tied to churn or cash flow? Are these negotiable?

- Flexibility on Repayment: If ARR fluctuates or churn spikes unexpectedly, how flexible is ECL on adjusting repayment schedules, extensions, or restructuring

What is Efficient Capital Labs?

ECL provides revenue-based financing for companies with predictable subscription or recurring revenue. Their model converts future ARR into upfront capital, repaid through structured monthly payments. This can be useful for companies with steady retention and low churn.

They are primarily based in India:

Here is a quick overview of Efficient Capital Labs ECL

-

Founded date and original name. Efficient Capital Labs was founded in 2022 under the name Efficient Capital Labs with no public rebrand reported. This is consistent with the current positioning on the Efficient Capital Labs website.

-

Total funding raised equity and facilities. ECL raised a 3.5 million seed round led by 645 Ventures in April 2022 as reported in Business Insider. It then raised a 7 million pre Series A led by QED Investors in July 2023 with participation from 645 Ventures and other existing investors, covered in TechCrunch and the Business Wire pre Series A release. In August 2024 ECL announced an 11 million Series A co led by QED Investors and 645 Ventures, detailed in this Business Wire release and in Entrepreneur India coverage. ECL also has a special purpose vehicle facility of about 100 million which grew from an earlier 15 million debt facility to fund its lending book. In total ECL has raised about 21.5 million in equity capital plus the 100 million facility used for originations.

-

Platform scale companies capital deployed and geographies. By late 2022 ECL had lent about 2.35 million to 13 SaaS businesses, according to Business Insider reporting. Between early 2023 and mid 2024 ECL originated more than 70 million in financing to over 100 companies, as noted in the Series A press release and Everywhere VC commentary. As of late 2025 the company site states that it has deployed more than 150 million to over 200 startups operating in more than 20 countries with about 75 percent of founders returning for repeat facilities, figures that appear on the ECL homepage.

-

Key leadership and founders. Co founder and chief executive officer Kaustav Das, former chief risk officer at Kabbage and senior risk leader at Petal and Zip, is profiled in Finsmes and other investor notes. Co founder Manish Arora is the former general manager South Asia at PayJoy. Chief revenue officer Denada Ramnishta previously served as chief growth officer at Lendio and held roles at American Express, as outlined in her appointment announcement. Head of lending and risk Amit Kesarwani, a former director of risk management at American Express and Kabbage, is featured in the AURA underwriting blog post.

Introduction ECL pitch to SaaS founders

Efficient Capital Labs positions itself as a non dilutive capital provider for B2B SaaS and artificial intelligence companies with recurring revenue. The core promise is to use data driven underwriting and multi currency lending to give founders fast access to growth capital without equity dilution. ECL focuses especially on companies with entities in the United States India and Southeast Asia and offers advances of up to 60 percent of annual recurring revenue in a flat fee structure over roughly twelve months. This positioning is reinforced across the company website and its alternative financing guide for founders.

Instead of emphasizing brand marketing ECL focuses on the plumbing of credit decisioning, connecting bank data financial statements and long tail contracts into an underwriting engine that can support frequent repeat draws and cross border structures.

The Efficient Capital Labs timeline from corridor lender to global ARR originator

2022 founding seed capital and early corridor focus

Efficient Capital Labs was founded in 2022 by Kaustav Das and Manish Arora with headquarters in New York and significant operating presence in India. The initial thesis focused on connecting India based SaaS companies that serve United States customers with capital sourced from institutional investors, as described in Business Insider coverage.

In April 2022 ECL raised a 3.5 million seed round led by 645 Ventures with participation from Singh Capital The Fund Operator Partners and others. By late 2022 ECL reported that it had already lent about 2.35 million to 13 SaaS businesses primarily along the India and United States corridor, according to Business Insider.

During the same period ECL secured a 15 million debt facility that would later be expanded into a 100 million special purpose vehicle used to fund originations, a sequence summarized in Entrepreneur India.

2023 pre Series A upsized facility and expansion beyond India

In July 2023 ECL announced a 7 million pre Series A round led by QED Investors with continued participation from 645 Ventures and other early backers. The round and focus on B2B SaaS companies along the South Asia and United States corridor were detailed in TechCrunch and in the Business Wire announcement.

At the same time the company began positioning itself as a cross border lender rather than an India only lender. ECL underwrote borrowers with multiple entities and revenue streams across India the United States and other markets and began to highlight multi currency capabilities with loans in both United States dollars and Indian rupees for the same customer.

2023 to mid 2024 scaling to more than 70 million in financing and over 100 companies

Investor commentary and company press releases indicate that between early 2023 and mid 2024 Efficient Capital Labs originated more than 70 million in financing and expanded its portfolio to more than 100 companies. The company cites six times growth in accounts receivable outstanding from 2022 to 2023, default rates below industry norms and a roughly 70 percent repeat rate among borrowers, as summarized in Everywhere VC analysis and the Series A release.

QED Investors and other backers noted that ECL unit economics compare favorably within the non dilutive funding space, suggesting disciplined underwriting and relatively low loss ratios.

2024 Series A and Southeast Asia expansion

In August 2024 Efficient Capital Labs raised an 11 million Series A round co led by QED Investors and 645 Ventures. Proceeds were earmarked for scaling its cross border recurring revenue financing offering and expanding into new regions including Singapore and other Southeast Asia markets, as detailed in the official Series A release and regional coverage such as BW Disrupt.

At this stage ECL began to highlight its multi currency roadmap more explicitly. The company describes itself as able to offer loans in several currencies for the same customer and to support cross border revenue streams, messaging that features across its main site and educational blogs.

2025 the AURA engine and a more global go to market

In 2025 ECL introduced AURA which stands for agentic underwriting risk analytics as its next generation artificial intelligence driven underwriting platform. AURA is designed to read bank statements financial statements contracts and counterparty information across entities currencies and document formats then generate a unified credit view and an internal ECL score. The approach is explained in detail in the company post Introducing AURA artificial intelligence engine for smarter underwriting.

Also in 2025 ECL appointed Denada Ramnishta as chief revenue officer with a mandate to expand distribution across the United States Europe and Southeast Asia, per her appointment release. By late 2025 ECL public metrics show more than 150 million deployed to over 200 startups in more than 20 countries with about three quarters of founders returning for repeat financing.

The ECL platform software and capital stack

Efficient Capital Labs operates primarily as a specialized balance sheet lender rather than as a pure marketplace that only brokers loans between outside investors and borrowers. The platform combines three layers, a software and data ingestion layer, an artificial intelligence assisted underwriting engine and a capital stack that includes its own special purpose vehicle facility and embedded finance programs for partners. These themes come through in multiple posts on the ECL blog.

Underwriting and data ingestion AURA

The AURA engine is presented as the center of ECL underwriting approach. It is divided into several components, all described in the AURA product write up.

-

Banking AURA. Banking AURA ingests bank statements including portable document format files and application programming interface feeds, normalizes transactions, reconciles multiple currencies and builds a decision ready cash flow view.

-

Financial AURA. Financial AURA converts income statements balance sheets and cash flow statements into structured time series that allow underwriters to analyze trends and volatility rather than isolated snapshots.

-

Contract AURA. Contract AURA parses software as a service contracts and related documents to understand payment terms renewals obligations and the durability of revenue streams.

-

Counterparty AURA. Counterparty AURA analyzes the network of customers and vendors behind a borrower and evaluates their strength and reliability.

-

Decisioning AURA. Decisioning AURA combines all of the above into a credit narrative and an internal ECL score with explainable reasoning and the ability for human underwriters to override or refine decisions.

The company does not publish a complete checklist of underwriting metrics but public information makes it clear that decisions are anchored around recurring revenue quality. This includes annual recurring revenue and monthly recurring revenue levels, growth rates and concentration patterns, bank statement cash flows and liquidity, contractual revenue and renewal terms and the cross border entity structure including foreign exchange exposure.

How the loan product works in practice

Based on site copy and case studies the standard product for a typical SaaS borrower can be summarized as follows.

| Term | ECL stated range or structure |

|---|---|

| Maximum facility size | Up to 2.5 million per borrower depending on recurring revenue profile, consistent with limits discussed in their own blog article. |

| Advance rate | Up to about 60 percent of annual recurring revenue determined by underwriting capacity as described on the ECL homepage. |

| Pricing | Flat fee typically around 10 to 12 percent over a term of about twelve months, stated as a single fee rather than an annual percentage rate with no warrants, based on examples in ECL funding comparison blogs. |

| Tenor | Usually twelve months, repaid in monthly installments of principal and fee over the term with the possibility of refinancing or repeat facilities. |

| Currencies | United States dollars, Indian rupees and in some cases Singapore dollars with the ability to offer multiple currencies for the same customer, noted in Entrepreneur India and on the company site. |

| Security | Secured primarily against recurring revenue and receivables rather than hard assets which is typical for revenue based funding structures. |

| Timeline to funds | Application in roughly twenty minutes and funding in as little as about seventy two hours after approval, based on time to funding claims on the ECL homepage. |

| Founder dilution | No equity or warrants, founders retain ownership while using debt capital for growth, emphasized throughout ECL founder education content. |

For a founder the journey looks like this. First the company connects banking accounting and other systems to the ECL platform. Second AURA processes the data and generates an internal score and recommended facility. Third the founder receives a flat fee term sheet describing the advance as a percentage of annual recurring revenue and the fee over the term. Finally funds are wired and the company repays through monthly installments with the option to renew or expand the facility if performance is strong.

ECL earns revenue from the flat fees charged to borrowers and from the spread between the cost of its debt facilities and the returns it earns on its lending book. In some embedded finance arrangements it may also earn revenue sharing or platform fees with partners who use ECL as their underlying lending infrastructure.

How much Efficient Capital Labs has actually wired to founders

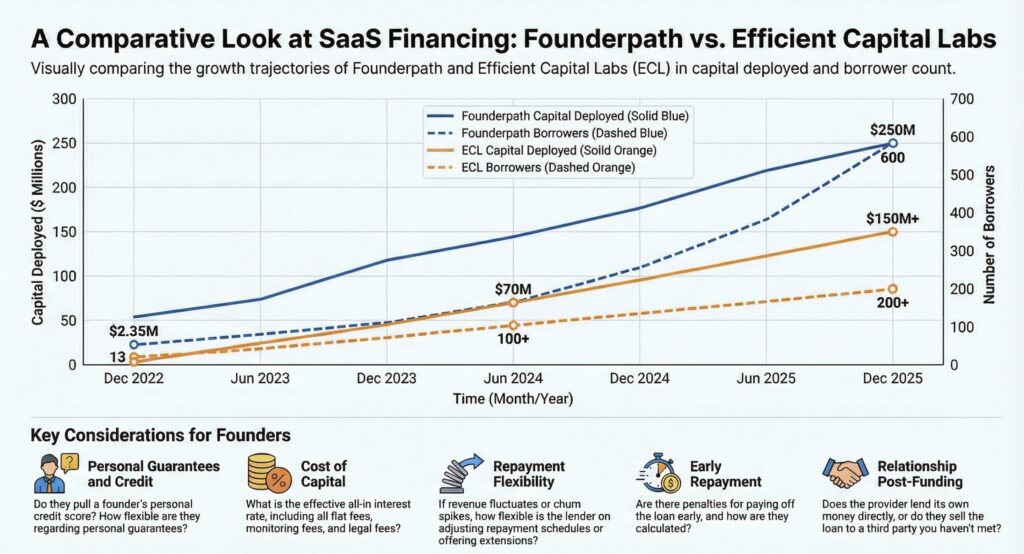

Efficient Capital Labs has published several concrete metrics on the volume of capital deployed across press releases and investor notes.

-

In late 2022 ECL had lent about 2.35 million to 13 SaaS companies primarily along the India and United States corridor, according to Business Insider.

-

Between early 2023 and mid 2024 the company reports more than 70 million in financing originated serving more than 100 companies with around 70 percent choosing to borrow again, figures highlighted in Everywhere VC commentary and the Business Wire Series A release.

-

By late 2025 ECL public metrics show more than 150 million deployed to over 200 startups across more than 20 countries with about 75 percent returning founders, as stated on the ECL homepage.

ECL does not publish a full portfolio level schedule of non performing loans or charge off ratios but its statements emphasize default rates below typical industry ranges and strong repeat usage. For a founder these metrics indicate that ECL has moved beyond the experimental stage and into nine figure deployment, although comparative pricing and effective annual percentage rate still need to be modeled against alternatives such as Founderpath structures other revenue based funders venture debt and traditional term loans.

Executive bench beyond the founders

The leadership team at Efficient Capital Labs is built around credit risk and go to market experience rather than ex founder operating backgrounds. This has implications for how the platform approaches risk pricing and relationship management.

Founders

Kaustav Das co founder and chief executive officer. Das brings more than two decades of experience in consumer and small business credit. He served as chief risk officer at Kabbage which was acquired by American Express and held senior roles at Petal and Zip. His background is described in investor profiles such as Finsmes.

Manish Arora co founder. Arora has operated across B2B SaaS and fintech and most recently served as general manager South Asia at PayJoy, a company focused on smartphone financing and credit in emerging markets. His biography appears in several funding round announcements including Finsmes.

Key executives

Denada Ramnishta chief revenue officer. Appointed in 2025 Ramnishta previously served as chief growth officer at Lendio where she helped facilitate more than 12 billion in funding for small businesses and onboarded hundreds of lending partners. At ECL she leads global revenue strategy channel partnerships and ecosystem development across founder communities in North America Europe and Southeast Asia, according to her appointment press release.

Amit Kesarwani head of lending and risk. Kesarwani leads underwriting and risk management at ECL. He previously held director level roles in risk management at American Express and Kabbage and has about fifteen years of experience in commercial and small enterprise lending in both the United States and India. He is also closely associated with the design and rollout of the AURA underwriting platform, which is visible in the acknowledgments in the AURA blog post.

Public materials around AURA also reference a number of engineering and data leaders, indicating that ECL is investing heavily in codifying underwriting logic into software rather than relying only on manual spreadsheet driven analysis.

In 2024 and 2025 two shifts became clear

From corridor lender to global artificial intelligence and SaaS lender

Early coverage described Efficient Capital Labs mainly as a lender focused on the South Asia and United States lane providing United States dollar funding to Indian SaaS companies with international customers, as in TechCrunch and related articles.

By 2024 and 2025 the company describes itself as a provider of growth capital for global artificial intelligence and SaaS companies with case studies from Israel the United States India Singapore and other markets. The ability to advance capital in multiple currencies and underwrite multi entity structures is now a core part of the value proposition, as seen across the ECL blog and newer thought leadership pieces such as how to vet a capital partner.

From manual underwriting to artificial intelligence assisted infrastructure

The introduction of AURA marks a deliberate move away from manual and fragmented underwriting processes toward artificial intelligence assisted infrastructure. Rather than treating bank portable document format statements contracts and financial statements as separate workflows AURA is meant to read reconcile and reason across all of them and then present a unified narrative to human underwriters, as detailed in the AURA announcement.

The philosophy is that artificial intelligence performs the heavy data lifting while experienced credit teams make final decisions. In parallel ECL has been promoting its embedded finance capabilities which allow investors and SaaS companies to use ECL technology and capital stack to launch their own financing programs. This nudges the company from being solely a direct lender toward also being a lending infrastructure provider.

Other SaaS Funding Alternatives

If ECL’s cross-border focus or flat fee structure doesn’t match your needs, several other providers serve the non-dilutive SaaS funding space. Capchase offers revenue-based financing with a B2B BNPL product for companies with $1M+ ARR. Hum Capital combines an AI marketplace with direct balance-sheet lending through a $200M facility. Liquidity Group provides large-scale venture debt ($5M–$100M) backed by institutional partners like MUFG.

Conclusion what Efficient Capital Labs has built and what to watch next

In just a few years Efficient Capital Labs has evolved from a niche lender serving India and United States SaaS companies into a multi currency balance sheet lender with significant capital deployment, an artificial intelligence assisted underwriting platform and an embedded finance offering.

For B2B SaaS founders ECL currently sits in the non dilutive short to medium term growth capital category. The model advances up to about 60 percent of annual recurring revenue in the form of one year facilities priced with a flat fee structure and repaid in monthly installments. That places it alongside other revenue based funding providers and Founderpath style structures while differing from traditional venture debt that may include warrants covenants and board level oversight.

Differentiation comes mainly from three areas, the ability to underwrite cross border multi entity businesses and lend in multiple currencies, the use of the AURA engine to process large volumes of heterogeneous data and the move toward embedded finance infrastructure that lets other institutions build credit products on top of ECL stack.

Looking ahead founders evaluating Efficient Capital Labs should watch several things closely. One is how quickly the headline figure of 150 million deployed grows toward 300 million and beyond and whether performance remains stable as volume scales. Another is how the company balances being a direct lender versus a behind the scenes infrastructure provider. A third is whether ECL begins to disclose more detail on loss rates effective annual percentage rates and facility structures which would make it easier to compare directly with banks venture debt providers and other recurring revenue lenders.

For now ECL represents a meaningful option for recurring revenue businesses, especially those with cross border operations that want to trade some yield for speed flexibility and preservation of founder equity.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…