Lemlist Bootstraps to $40m Revenue, Uses 30% Profits to Acquire Claap for $25m

October 21, 2024

This article is written from first party data Nathan Latka collected by interviewing: Co-Founder Guillaume Mobueche, Lemlist head of product Kevin, and current CEO Charles.

Nathan interviewed Charles on October 20th, 2025 the day they spent $25m to acquire Claap.

In a move that signals the next chapter of its growth story, Lemlist announced this morning the acquisition of conversation intelligence platform Claap for $25 million. This strategic acquisition marks a significant milestone for the bootstrapped sales engagement platform that has grown to $40 million ARR without taking a dime of outside funding.

The deal, which closed today despite AWS outage challenges, brings together two complementary technologies and showcases how profitable SaaS companies can use acquisitions as a growth lever. For founders watching from the sidelines, this acquisition offers a masterclass in bootstrap growth, strategic M&A, and the power of maintaining profitability while scaling.

The Deal Structure: A Creative Approach to M&A

Charles Tenot, CEO of Lemlist, revealed fascinating details about the deal structure that other founders can learn from. The $25 million acquisition breaks down as follows:

- $15 million upfront consideration, split between:

- ~$5 million in immediate cash

- ~$5 million in vendor financing (deferred payment)

- ~$2 million in convertible bonds for founders

- Up to $10 million in earn-outs based on performance milestones over three years

This creative structure allowed Lemlist to acquire a fast-growing company without depleting their cash reserves, while ensuring the Claap founders remain incentivized to drive growth post-acquisition.

From Zero to $40 Million ARR: The Lemlist Growth Playbook

To understand why this acquisition makes sense, we need to look at Lemlist’s remarkable growth journey. Founded by Guillaume Moubeche and his co-founders, Lemlist has become a case study in efficient, profitable growth.

The Early Days: Building a Memorable Product

Guillaume’s strategy from day one was simple but powerful: build a memorable product with a key differentiator. In a saturated sales engagement market, Lemlist stood out by focusing on ultra-personalization features like custom images and dynamic landing pages.

“We went on marketing sides to focus on a branding that was way more cool,” Guillaume explained. The flashy colors and emojis weren’t just aesthetic choices – they were strategic. When users shared their screens on social media, people instantly recognized Lemlist.

The Bootstrap Launch That Changed Everything

One of the most interesting chapters in Lemlist’s growth story was their AppSumo launch. While many founders debate the value of lifetime deals, Lemlist turned it into a growth catalyst:

- Sold lifetime access for $49

- Generated 8,000+ customers

- Netted approximately $150,000 after fees

- Built a foundation for their community

Guillaume’s perspective on lifetime deal customers reveals their customer-centric approach: “We could be very sneaky and try to upsell them on specific features… but I wouldn’t feel fair. I prefer having them as really strong advocates.”

The All-Bound Strategy: A New Approach to B2B Growth

Kevin, Lemlist’s product lead, introduced the concept of “all-bound” – a hybrid of inbound and outbound strategies that Lemlist believes is the future of B2B growth. This philosophy drives their product suite:

- Outbound Tools: Lemlist and Lemwarm for cold outreach

- Inbound Tools: Taplio and Tweet Hunter for personal branding

- Intelligence Layer: Now Claap for conversation insights

This integrated approach has helped them reach 50,000 customers worldwide while maintaining a focus on SMBs rather than chasing enterprise deals.

The Numbers That Matter

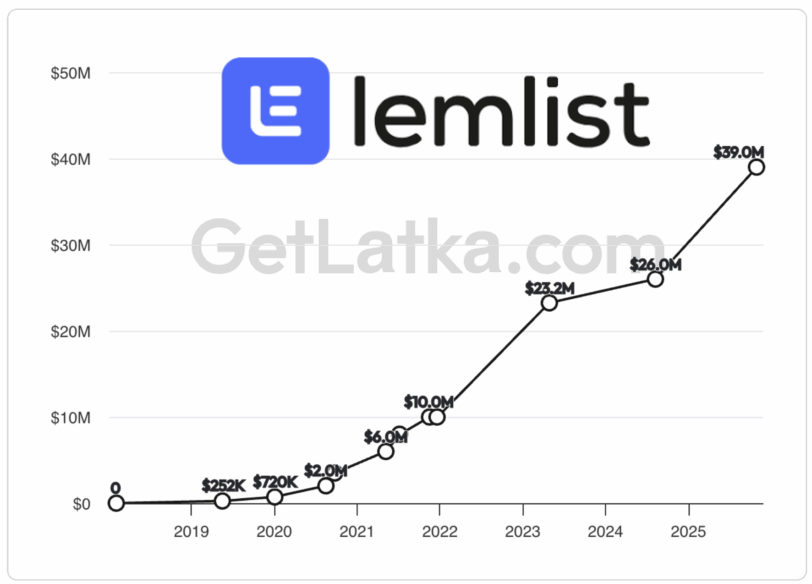

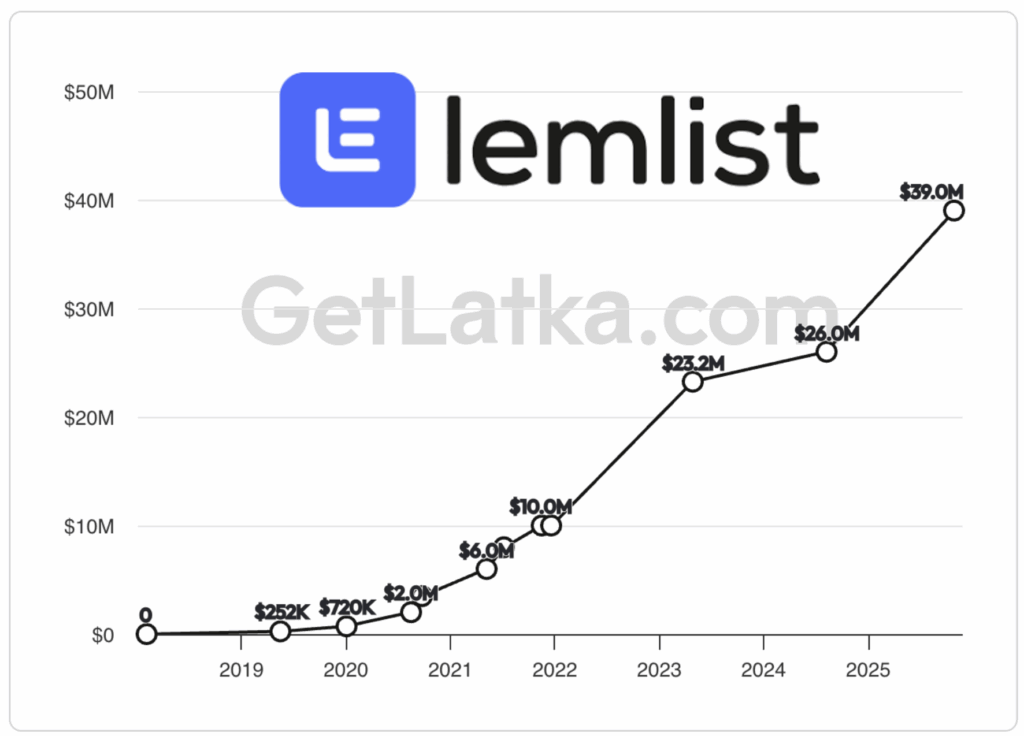

Let’s look at Lemlist’s growth trajectory:

- December 2019: $600K ARR

- March 2020: $250K MRR (approximately $3M ARR)

- September 2020: $2M+ ARR with 12 employees

- 2023: $15M ARR when Charles joined as CEO

- October 2024: $40M ARR with Lempire products

The company has maintained 25-35% EBITDA margins throughout this growth, generating approximately $10 million in annual profit.

Why Claap? The Strategic Rationale

Charles Tenot’s explanation of why they acquired Claap provides insights into strategic M&A thinking:

- Product Excellence: “If you try the product, you’ll be shocked,” Charles noted, emphasizing that Claap’s 7-person team had built technology worthy of a $20M ARR company.

- Perfect Customer Overlap: Both companies target sales teams of 3-50 reps with similar ACVs and buyer personas.

- Distribution Arbitrage: Claap had incredible technology but limited distribution – exactly where Lemlist excels.

- Strategic Vision: The acquisition enables Lemlist to capture “internal intent signals” from sales conversations, making outreach smarter and more targeted.

The Integration Play

The real value comes from integration. As Charles explained: “In the conversation that are not used in most companies, you have a lot of intelligence that you can use to improve prospection and outreach.”

Imagine sales reps who can:

- Access full conversation history when taking over accounts

- Use AI-generated insights to personalize outreach

- Automatically update CRMs with call intelligence

- Coach themselves using conversation analytics

This creates a powerful moat around Lemlist’s core offering while solving real problems for their users. For more on building product moats through strategic features, check out our guide on SaaS competitive advantages.

Lessons in Capital-Efficient Growth

Lemlist’s journey offers several lessons for bootstrap founders:

1. Obsess Over Customers, Not Competitors

Guillaume’s approach to customer obsession went beyond lip service. After a major UX change backfired, the team invested heavily in rebuilding customer relationships. This focus on customer success drives their negative net MRR churn (-5 to -6%) for their core segment.

2. Build in Public, But With Purpose

The Lemlist team mastered the art of building in public:

- Created a 20,000-member Facebook community

- Posted educational content that got reshared (not SEO-optimized)

- Launched courses that generated $200K in 10 days (later made free)

- Leveraged personal branding across 6-10 team members on LinkedIn

3. Say No to Easy Money

Perhaps most impressively, Lemlist turned down both $20 million and $30 million investment offers. As Guillaume explained: “We don’t need a board or investors to force us into a specific direction. We’re very tied to independency and doing what works best for the markets and for the users.”

The Acquisition Playbook for Bootstrap Founders

For founders considering acquisitions as a growth strategy, Lemlist’s approach offers a template:

Step 1: Start as a Customer

Charles reached out to Claap’s CEO in May, starting with: “I love your product, I’ve been using it for one year. Would you be open to sell?”

Step 2: Sell the Vision

Rather than just talking price, Charles focused on the vision of building a world-class sales platform with shared DNA and values.

Step 3: Structure Creatively

The deal structure shows how bootstrap companies can make significant acquisitions:

- Use vendor financing to spread payments

- Include earn-outs to align incentives

- Offer convertible instruments for founder retention

Step 4: Focus on Relationships

“M&A is more about relationship and people than really strategy,” Charles noted. Despite facing competition from a larger AI platform, Lemlist won because of cultural fit.

For more insights on SaaS M&A strategies, see our comprehensive M&A guide for bootstrap founders.

The Power of Profitable Growth

What sets Lemlist apart is their commitment to profitability. With 35-45% EBITDA margins, they’ve proven you can grow fast while generating cash. This profitability enabled them to:

- Make strategic acquisitions with cash on hand

- Maintain complete ownership and control

- Invest in long-term initiatives without investor pressure

- Weather market downturns without layoffs

The Monthly Check-In Model

Lemlist’s approach to maintaining profitability while growing is elegantly simple:

- Monthly EBITDA check-ins

- Minimum 20% EBITDA threshold

- Adjust hiring based on growth rates

- Reinvest profits into growth initiatives

Building a Suite Through Acquisition

Lemlist’s acquisition strategy extends beyond Claap. They previously acquired:

- Taplio: LinkedIn automation tool

- Tweet Hunter: Twitter growth platform

These acquisitions follow a pattern:

- Identify tools that complement the core platform

- Find products with great technology but limited distribution

- Integrate them into the Lemlist ecosystem

- Leverage existing customer base for cross-selling

This approach has helped them build what they call “Lempire” – a suite of tools generating $4-5 million ARR beyond the core Lemlist product.

The Technical Excellence Behind the Growth

Kevin’s presentation revealed the technical philosophy driving Lemlist’s product development:

Simplification at Scale

“As you know when you’re starting a business you’re scaling it you add new features you fail with features you learn new stuff and it just becomes everything just becomes more complex for people,” Kevin explained.

Their solution? A relentless focus on simplification:

- OAuth integration for easier onboarding

- Widget-based reporting systems (inspired by iPhone)

- Unified settings architecture (borrowed from Notion)

- Progressive disclosure of advanced features

The All-in-One Challenge

Moving from a single-purpose tool to a platform requires careful execution. Lemlist’s approach:

- Data Integration: Built lead-finding capabilities directly into the platform

- Waterfall Enrichment: Combined multiple data sources for better coverage

- Unified Workflow: Created seamless flow from finding leads to closing deals

- Channel Expansion: Added LinkedIn, calling, and WhatsApp to email capabilities

Marketing Lessons from the Lemlist Playbook

The marketing strategy that propelled Lemlist’s growth offers valuable lessons:

Content That Converts

Rather than chasing SEO rankings, Lemlist focused on creating “the most actionable guides for people to succeed with cold outreach.” These guides weren’t optimized for search engines but got massive distribution through shares and community engagement.

The Power of Mini-Tools

Lemlist’s engineering-as-marketing approach involves building free tools that provide value while generating leads. These mini-tools offer a “glance of value in exchange for nothing except an email.”

Personal Branding at Scale

Starting with CEO Guillaume and expanding to 6-10 team members, Lemlist leveraged LinkedIn personal branding to drive significant sign-ups and visibility for product updates.

For more on building a content strategy that drives growth, check out our guide to SaaS content marketing.

What This Means for the Sales Engagement Space

The Claap acquisition signals several important trends:

- Convergence of Point Solutions: Expect more consolidation as companies build comprehensive platforms

- AI-Powered Intelligence: Conversation intelligence will become table stakes for sales platforms

- Bootstrap M&A Activity: Profitable SaaS companies will increasingly use acquisitions for growth

The Future of Lemlist and Lessons for Founders

With this acquisition, Lemlist is positioning itself as more than just an email outreach tool – they’re building a comprehensive revenue acceleration platform. For founders, the key takeaways are:

1. Profitability Enables Options

By maintaining strong margins, Lemlist could make strategic moves without dilution or debt.

2. Community Is a Moat

Their 20,000+ member community provides distribution, feedback, and advocacy that money can’t buy.

3. Vision Attracts Talent

The Claap founders chose Lemlist not for the highest price, but for the shared vision and cultural fit.

4. Integration Drives Value

The real value in acquisitions comes from deep integration, not just bolting on new features.

5. Bootstrap Doesn’t Mean Small Thinking

Turning down $30 million in funding to maintain independence while executing $25 million acquisitions shows the power of patient, profitable growth.

Conclusion: The Bootstrap Success Story Continues

Lemlist’s acquisition of Claap represents more than just a business transaction – it’s validation of a different way to build SaaS companies. In an era of growth-at-all-costs funded startups, Lemlist proves that bootstrap companies can compete and win at the highest levels.

As Charles Tenot mentioned, they plan to grow Claap from $2 million to $10 million ARR within a year – an ambitious goal that speaks to their confidence in the integration and go-to-market strategy.

For bootstrap founders watching this unfold, the message is clear: with the right strategy, strong unit economics, and a commitment to customer value, you can build a category-leading company on your own terms.

The sales engagement space will never be the same, and neither will the conversation around bootstrap growth. As Lemlist continues to execute their all-bound vision, they’re not just building a company – they’re creating a new playbook for sustainable SaaS growth.

Want to learn more about scaling your SaaS without dilution? Founderpath provides non-dilutive capital to help bootstrap founders accelerate growth while maintaining control. Join thousands of founders who are building on their own terms.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…