How Reveleer Grew From $1 Million to $100 Million Revenue: Jay Ackerman's Value-Based Care Playbook

This article was written and sourced from Jay Ackerman’s keynote presentation at Founderpath’s last event. The images embedded below are from the 13 page slide deck. The full keynote recording is here.

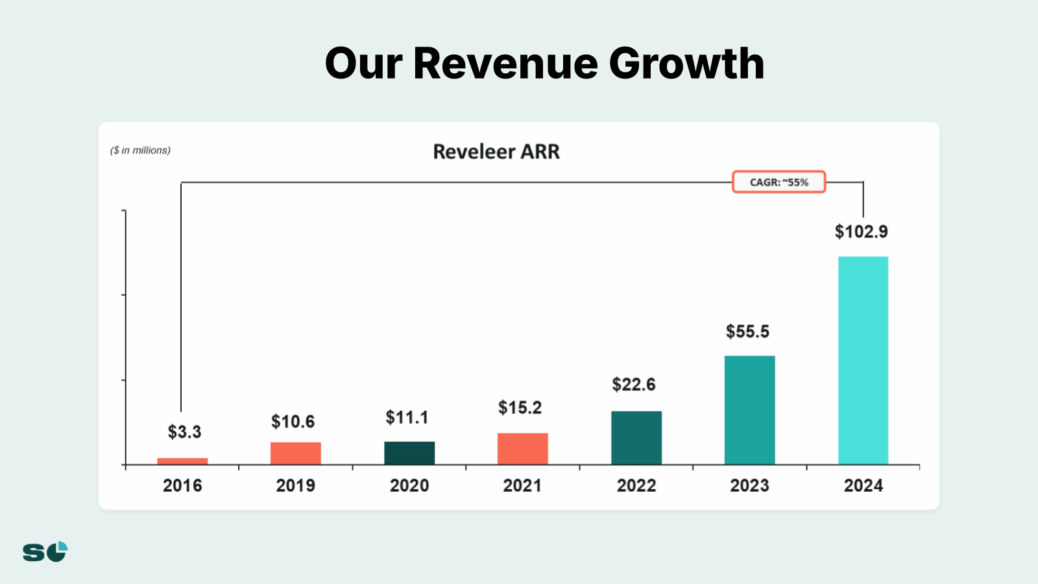

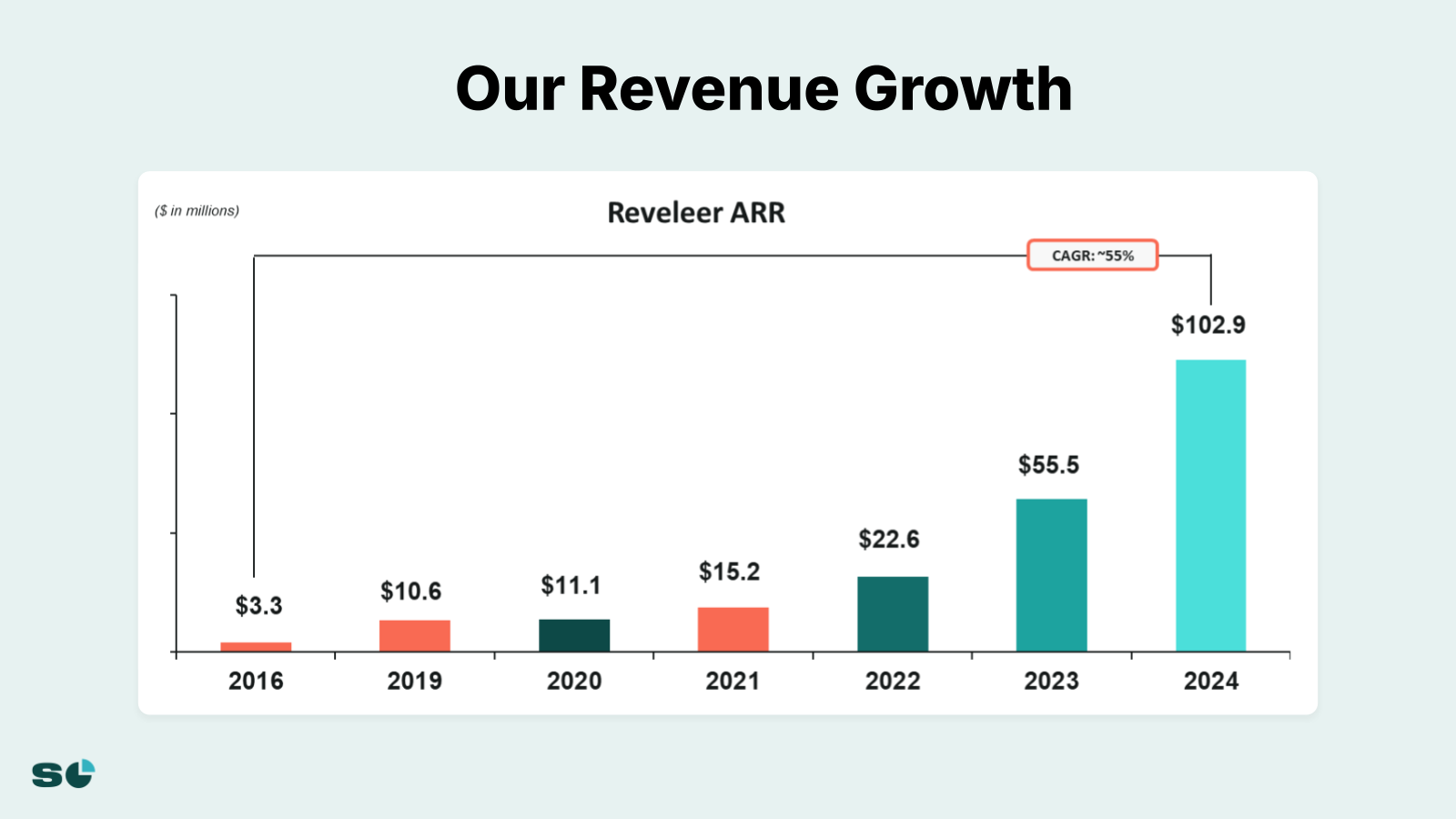

Jay Ackerman transformed Reveleer from a struggling $1 million startup into a $100 million healthcare technology powerhouse by automating the value-based care industry. In his September 2024 keynote at SaaSOpen, Ackerman revealed how his company processes nearly a billion medical records annually while maintaining strong unit economics and approaching a billion-dollar valuation.

The Playbook: 5 Lessons from Reveleer’s Journey to $100 Million

1. Build Relationships Years Before Acquisitions: Every company in Reveleer’s M&A pipeline involves relationships built over multiple years. Ackerman’s team talked to 60 unique companies in 2024 alone, with some conversations starting three years before closing.

2. Upgrade Talent Continuously: The average tenure of Reveleer’s executive team is just 1.75 years. Ackerman steadily upgrades leadership as the company reaches new revenue milestones – from sub-$5M to $10M to now $100M+.

3. Transform Tech-Enabled Services to Software: Reveleer replaced armies of offshore workers manually digesting clinical data with AI automation. This shift from services to software enabled massive scalability.

4. Expand TAM Through Strategic Acquisitions: Starting with a $2 billion TAM, Reveleer expanded to $20 billion through targeted acquisitions that added complementary products while serving the same buyer personas.

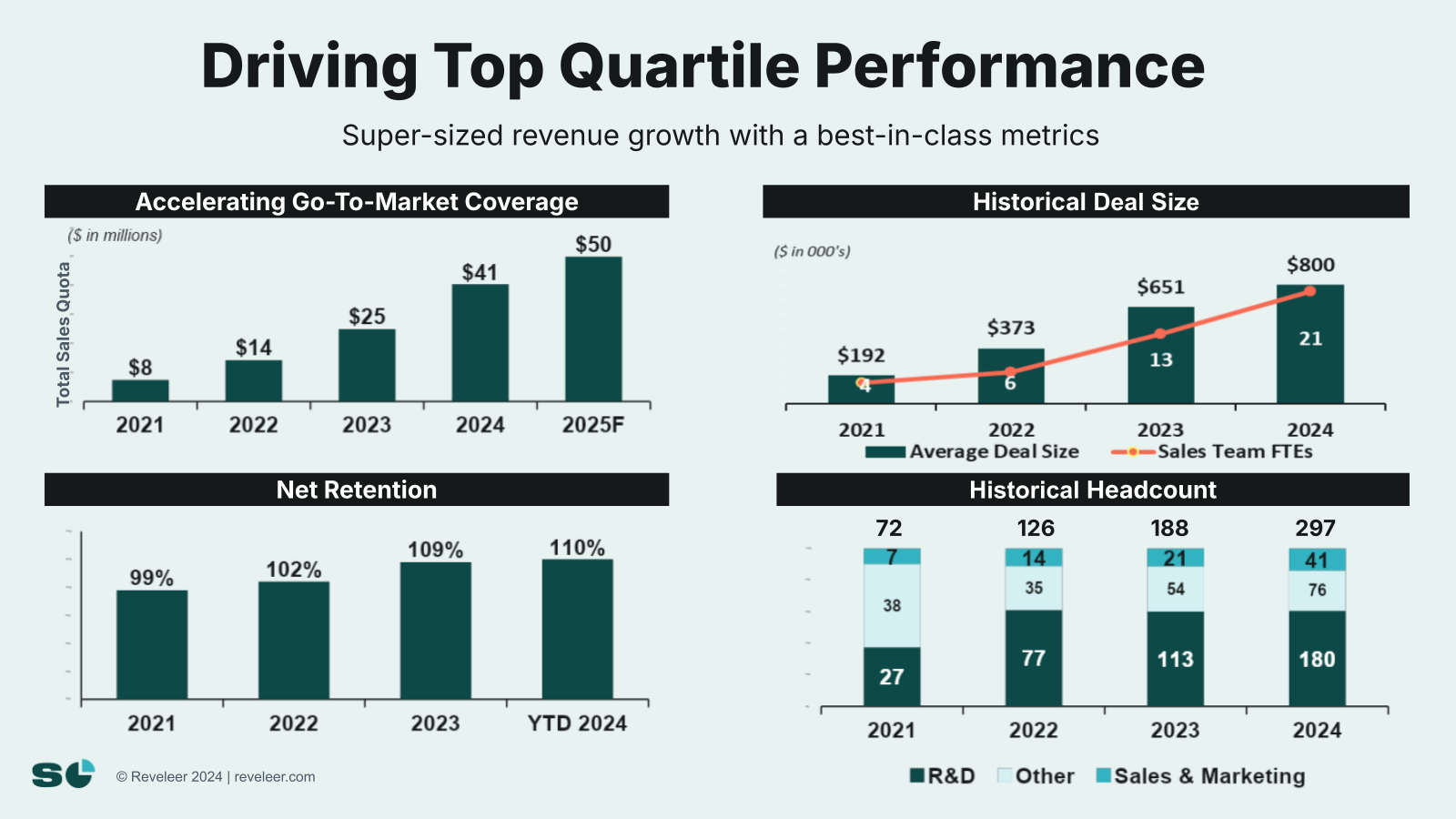

5. Master Go-To-Market Coverage: Ackerman obsesses over quota coverage, compensation plans, and sales efficiency. Reveleer went from 2 sales reps in 2021 to a full enterprise sales organization with $65 million in quota coverage by 2025.

2016-2019: Six Years to Reach $25 Million Through Multiple Near-Death Experiences

Ackerman’s journey with Reveleer began with significant personal risk. In 2018, after buying what he thought would be his “last house,” he put that same property up as collateral when the company couldn’t make payroll. “That’s what you do when you believe in the vision,” Ackerman explains.

The early years involved stuffing invoices in drawers and paying the loudest vendors first. Multiple times, the team thought they had reached their hockey stick moment, only to face new setbacks. Watch Ackerman’s complete keynote presentation to understand how they survived these challenges.

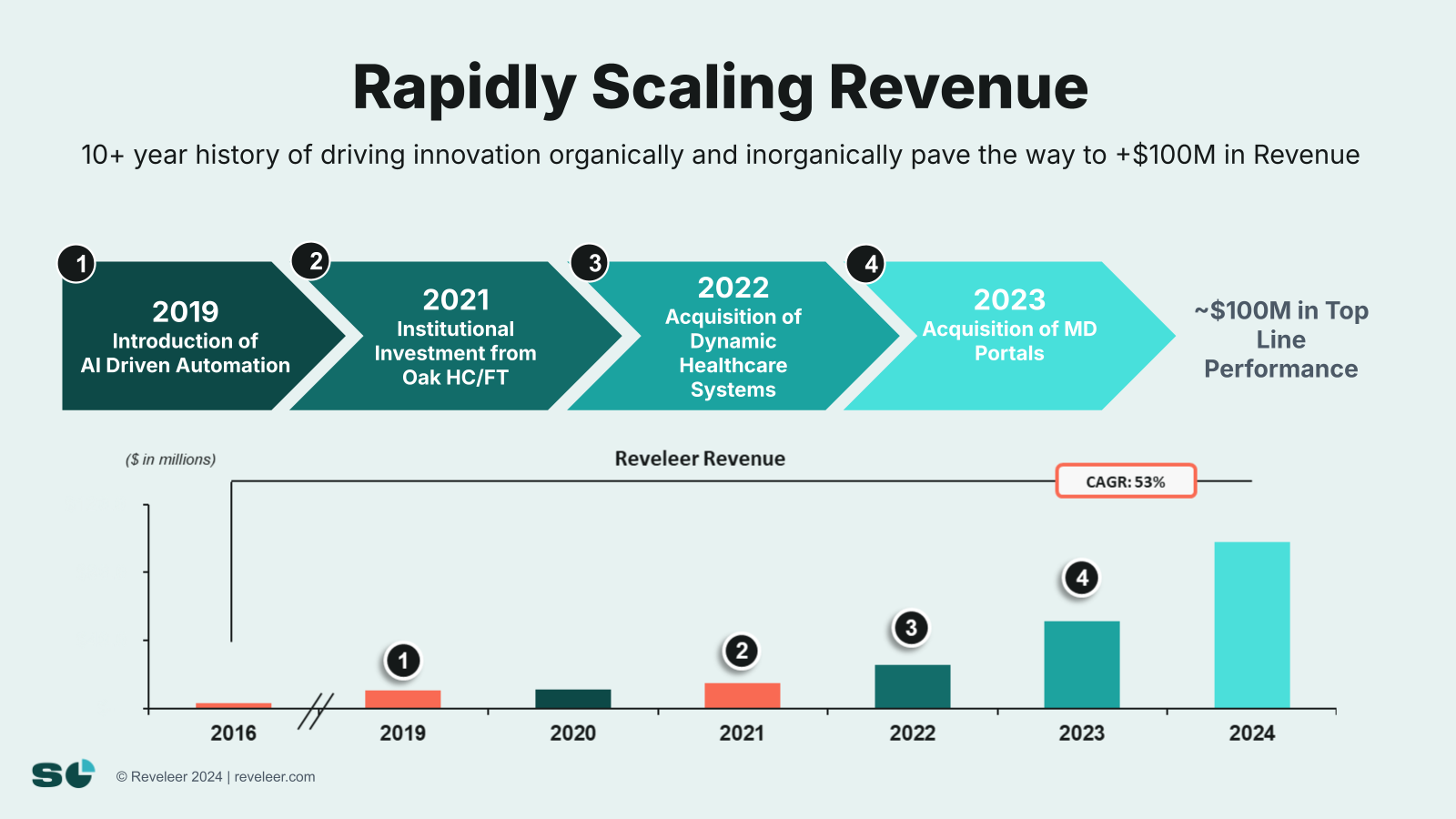

The breakthrough came in 2019 when Reveleer introduced machine learning into their product. While everyone now calls it AI, Ackerman emphasizes it was rules-based machine learning that could read medical records at scale. This innovation led to signing their first national health plan.

2020: How COVID Almost Killed a Healthcare Company

When COVID hit in 2020, Reveleer’s leadership initially thought they were safe. “We’re in healthcare, we’re in a government-sponsored part of healthcare, it’s not going to impact us,” Ackerman recalls. Then the government shut down many of their markets.

The company took a strategic pause but used the time to refine their product and prepare for the eventual recovery. This period of forced reflection proved valuable as they emerged stronger in 2021.

2021: Oak HC/FT Investment Unlocks $25 Million to $50 Million Growth

November 2021 marked a turning point when Oak HC/FT invested in Reveleer. “It’s more than the money,” Ackerman emphasizes, though he admits when you really need capital, that matters most. Oak shared his vision for building a value-based care platform.

The partnership immediately delivered results:

- First acquisition closed in March 2022 (just 4 months after funding)

- Shifted from playing defense to offense in talent acquisition

- Upgraded executive team with enterprise-caliber leaders

- Revenue doubled from $25 million to $50 million in one year

2022-2023: Strategic M&A Expands TAM from $2 Billion to $20 Billion

Reveleer’s M&A strategy focused on filling product gaps rather than buying revenue. The first acquisition, Dynamic Healthcare Systems, rounded out their solution set. The second, MD Portals, moved them from serving only payers into the provider space.

The financial engineering behind these deals showcased sophisticated capital management:

- First Deal: 75% cash, 25% equity

- Second Deal: 50% cash, 50% equity

- Third Deal (in progress): 100% debt-funded

Acquired revenue represents only 10% of Reveleer’s $100 million total, but the strategic value proved immense. Within 12 months, both acquired companies doubled their revenue under Reveleer’s ownership. The expanded product suite also increased average deal size from under $200K in 2021 to over $800K in 2024.

The Superpower: Processing 1 Billion Medical Records Annually with AI

Reveleer’s core innovation transforms how healthcare companies handle clinical data. The platform ingests almost a billion pages of medical records annually – approximately 3,000 pages per minute. This data comes from 120+ sources including electronic health records, labs, pharmacies, and clinical networks.

The AI system accomplishes in 10 minutes what traditionally required armies of offshore workers weeks to complete. It extracts critical insights from both structured and unstructured data, then delivers 3-5 actionable recommendations when a patient visits their doctor.

This technological advantage creates a powerful moat in the value-based care market, where accurate risk assessment directly impacts reimbursement rates.

2024: Scaling from $50 Million to $100 Million with Strong Unit Economics

Reveleer’s 2024 performance demonstrates the power of combining organic growth with strategic acquisitions:

- Revenue: $100 million (doubled from $50M in 2023)

- Year-end ARR: $105-110 million

- Average Deal Size: $800K+ (up from $200K in 2021)

- Customer Logos: 70-80 enterprise accounts

- Net Revenue Retention: 120%+

- Team Size: 250+ FTEs

The company secured a $65 million debt facility from Hercules Capital, demonstrating strong cash generation and EBITDA positivity. This debt financing, combined with existing equity partners Oak HC/FT and Upfront Ventures, positions Reveleer for continued growth without dilution.

Go-To-Market Excellence: From 2 Sales Reps to $65 Million in Quota Coverage

Ackerman considers go-to-market his personal superpower. In 2021, Reveleer had just two sales reps – a precarious position where losing one meant 50% capacity reduction. By 2025, they’ll have $65 million in quota coverage across multiple specialized teams.

The sales organization now includes:

- Payer-focused enterprise reps

- Provider-focused field sales

- Strategic account managers for large deals

- Customer success managers preventing churn

- Specialized teams for install base expansion

Ackerman regularly interviews sales reps from competing companies at conferences, discovering many lack proper commission plans. “If you have a bonus, you’re not a sales rep,” he argues, emphasizing the importance of proper sales compensation.

Customer Success Crisis: How One Non-Renewal Almost Led to 30% Layoffs

Despite Ackerman’s background in customer success, Reveleer faced a near-catastrophic retention crisis. A lighthouse customer grew increasingly demanding, and Reveleer responded by pushing pricing higher. On July 3rd, right before the holiday, the customer sent a non-renewal notice.

This single loss threatened 30% of the company’s jobs. Reveleer launched an emergency project over July 4th weekend and successfully signed a replacement customer four times larger within 60 days. The lesson was clear: in lumpy B2B enterprise businesses, every major account requires white-glove service.

The company now heavily invests in customer success to prevent similar situations, maintaining 120%+ net revenue retention.

2025 Vision: Scaling to $200 Million and Beyond

Looking ahead, Reveleer projects $200 million in revenue for 2025 based on current momentum. The company’s positioning in value-based care capitalizes on massive tailwinds:

- 37 million lives expected in Medicare Advantage by 2026

- Medicaid reform increasing insured populations

- Payer reimbursement increasingly tied to risk assessment accuracy

- Healthcare consolidation driving demand for scaled platforms

The recent Change Healthcare breach that shut down parts of the healthcare market reinforced why scale matters. Point solutions face extinction as health systems and payers consolidate vendors to reduce PHI risk.

The Path to Billion-Dollar Valuation: Platform Strategy in Vertical SaaS

Reveleer’s journey from near-bankruptcy to approaching billion-dollar valuation offers crucial lessons for vertical SaaS companies. Through careful use of partner co-marketing and strategic acquisitions, they expanded from a narrow $2 billion TAM to a $20 billion opportunity.

The company maintains discipline around capital efficiency – never raising at unsustainable valuations and transitioning from equity-funded to debt-funded acquisitions as cash generation improved. This approach preserved founder and investor ownership while fueling aggressive growth.

Ackerman’s philosophy on talent remains controversial but effective: continuously upgrade leadership as the company scales. Combined with obsessive focus on go-to-market metrics and strategic M&A, this approach positioned Reveleer to build a half-billion-dollar business in a traditionally slow-moving healthcare market.

Key Takeaways for SaaS Founders

Reveleer’s story demonstrates that reaching $100 million in revenue often requires multiple pivots, near-death experiences, and constant evolution. The company’s success came from:

- Personal commitment: Ackerman put his house up as collateral during cash crunches

- Strategic patience: Building M&A relationships years before transactions

- Talent evolution: Upgrading executives at each revenue milestone

- Market timing: Riding the value-based care transformation wave

- Technical moat: Processing data at scale competitors can’t match

For founders in vertical SaaS markets, Reveleer proves that combining organic product innovation with strategic M&A can accelerate growth from linear to exponential. The key is maintaining capital discipline while aggressively expanding your addressable market through complementary acquisitions.

As healthcare continues its digital transformation, Reveleer appears well-positioned to achieve Ackerman’s billion-dollar valuation goal, proving that even in complex regulated markets, focused execution and strategic thinking can build massive outcomes.

If you’re an ambitious founder looking for capital to grow, we’d love to consider funding you at Founderpath. Click here to request capital.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…