How Adam Robinson Grew Retention.com to $22 Million Revenue with Just 6 Employees: The Controversial LinkedIn Playbook That Launched RB2B

This article was written and sourced from Adam’s keynote presentation at Founderpath’s last event. The images embedded below are from his slide deck. His keynote recording is here.

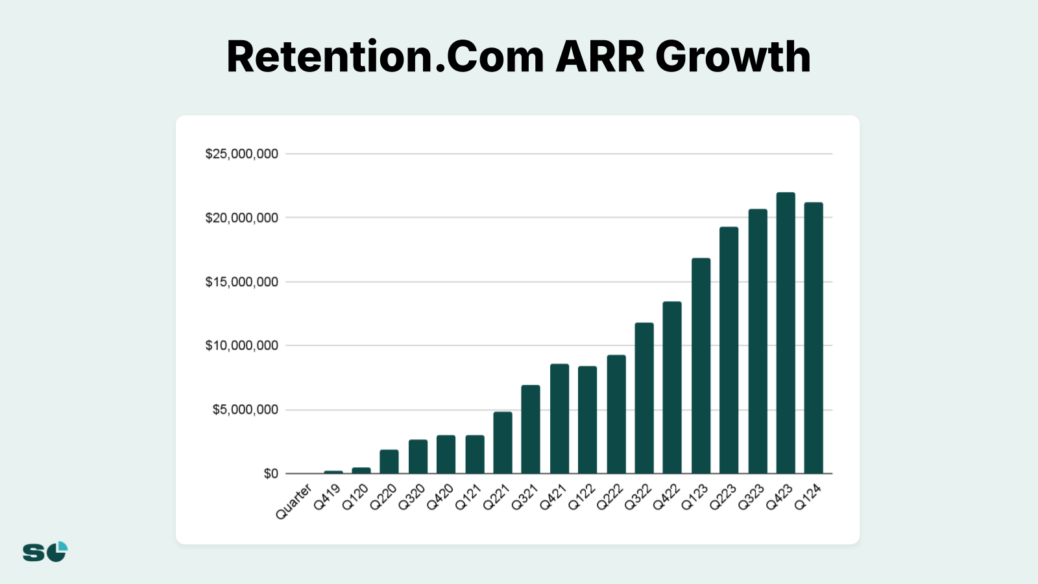

When Adam Robinson stepped onto the SaaSOpen stage in September 2024, attendees knew they were in for something special. The CEO had built Retention.com to $22 million annual recurring revenue with just six employees—a staggering $2 million in revenue per employee—while bootstrapping without any external funding.

But what really captivated the 1,000 SaaS founders in attendance wasn’t just his lean operation. It was Robinson’s willingness to share everything: his profit and loss statements, his controversial marketing tactics that risked legal action, and exactly how he was adding $60,000 in new monthly recurring revenue to his latest venture, RB2B. For founders exhausted by vanity metrics and venture capital theater, Robinson offered something refreshingly real: a blueprint for building profitable SaaS companies without playing by Silicon Valley’s rules. Access the full keynote presentation and resources at Founderpath’s Resource Page.

The Playbook: 5 Lessons from Adam Robinson’s $22 Million Journey

1. Revenue Per Employee Beats Headcount: Robinson achieved $2 million in revenue per employee at Retention.com, proving that efficiency trumps size. Before scaling, focus on maximizing output from a lean team.

2. Turn Legal Threats Into Marketing Gold: When 6sense sent Robinson a cease and desist letter, he posted it publicly on LinkedIn, generating viral attention and establishing RB2B as the scrappy alternative to enterprise incumbents.

3. Simple Tools Beat Complex Tech Stacks: Robinson generated 1,600 qualified leads using just LinkedIn posts and a Google Form—no fancy marketing automation required for early traction.

4. Founder FOMO Is Your Biggest Enemy: After watching Jasper AI scale rapidly, Robinson tried to replicate their growth but learned that bootstrapped discipline beats venture-backed expansion every time.

5. Pivot Fast When Markets Shift: When e-commerce struggled in 2023 with high churn and contraction, Robinson quickly pivoted to B2B with RB2B rather than doubling down on a declining market.

November 2019: Former Lehman Brothers Banker Launches GetEmails to Identify Anonymous Website Visitors

Adam Robinson’s journey began as a finance professional at Lehman Brothers, but his career took an unexpected turn after the 2008 financial crisis. Inspired by roommates who had created Vimeo in their shared apartment, Robinson embraced his inner marketing wizard. His first venture, Robly, grew to $5 million in revenue in just two years, earning the #1 spot in customer satisfaction.

The key insight came when Robinson added a feature called Robly ID that could identify the email addresses of website visitors even if they didn’t fill out a form—legal in the US but not Europe. This identity resolution technology became so popular with users that Robinson realized it deserved to be its own company.

In November 2019, he launched GetEmails (later rebranded as Retention.com), focusing initially on e-commerce stores. The timing proved perfect—online retailers desperately needed ways to recover abandoned carts and reconnect with anonymous visitors. Robinson’s technology could identify 20-30% of anonymous website traffic and automatically trigger personalized email campaigns.

2023: How Sharing an Office with Jasper AI Nearly Destroyed Robinson’s Bootstrapping Religion

By 2023, Retention.com had reached $12 million ARR with just six employees. But Robinson’s confidence was shaken by proximity to rocket ship growth. He convinced Santosh Sharan, who’d helped ZoomInfo grow from $8 million to $100 million ARR and turned Apollo.io from being stuck at $6 million to a billion-dollar valuation, to join as COO.

The Jasper AI team, sharing Robinson’s office space, had exploded from zero to $50 million ARR in 12 months with just six people. “I thought I could do that too,” Robinson admitted during his keynote. He abandoned his bootstrapping principles and started hiring aggressively, burning through free cash to build what he envisioned as a unicorn company.

The expansion proved disastrous. Despite adding expensive senior and junior employees, the churn problem persisted. Robinson discovered a hard truth: honing in on an ideal customer profile doesn’t automatically solve retention issues, especially in a struggling e-commerce market. By early 2024, he’d learned his lesson and returned to profitable, lean operations.

January 2024: Robinson Achieves $6 Million Annual Profit Run Rate After Cutting Back to Basics

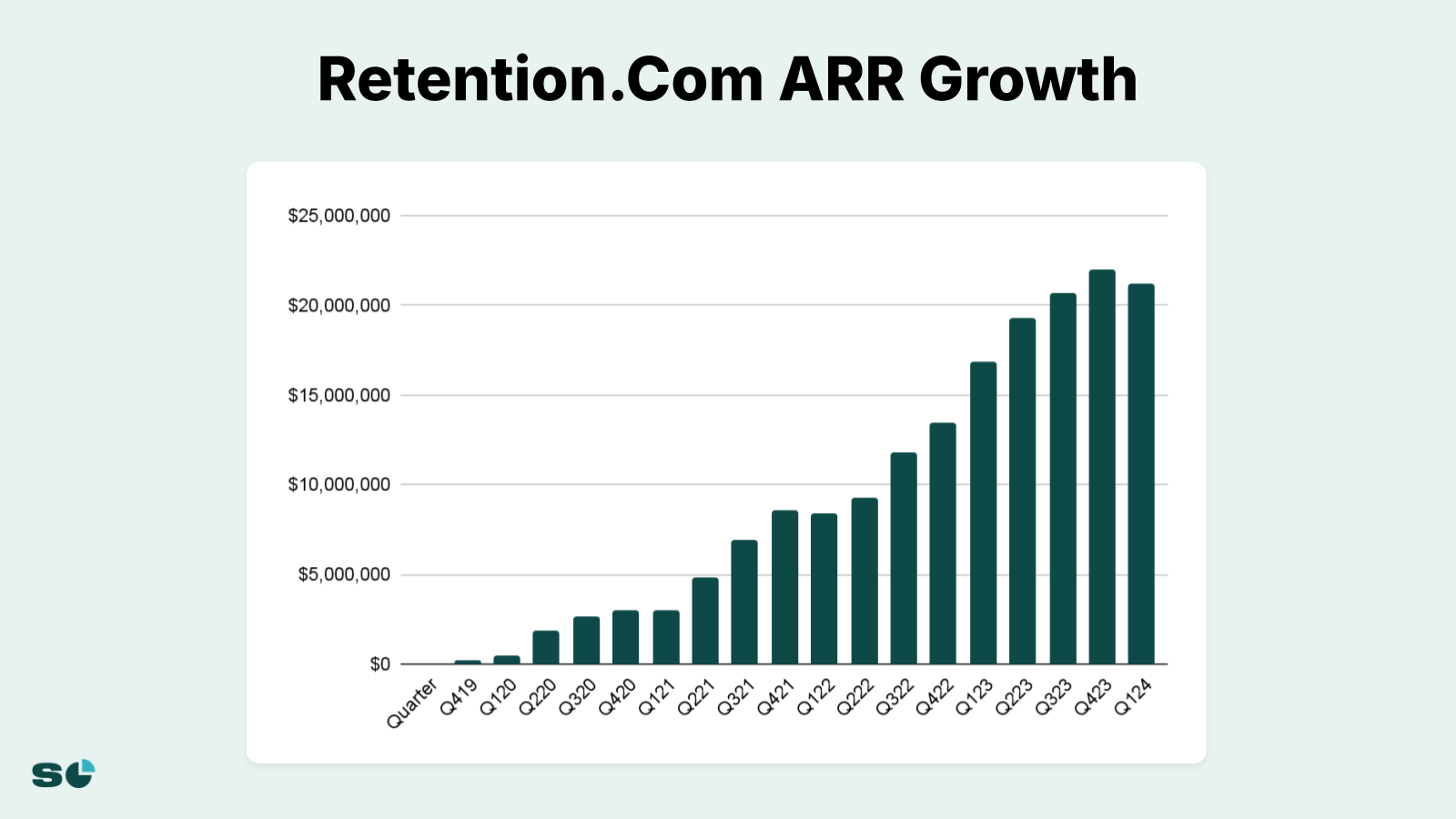

In January 2024, Retention.com generated $1.7 million in monthly revenue with just $204,000 in total operating expenses. The P&L Robinson shared at SaaSOpen revealed remarkable efficiency: 87% gross margins, well above the typical 75-80% for SaaS companies.

The secret? Robinson’s data business model created inherent advantages. Unlike traditional SaaS, the costs of compiling data remained relatively fixed as revenue scaled. With just $346,000 in monthly general and administrative expenses covering six executives, the company was printing cash—approximately $6 million in annual net income.

This financial discipline gave Robinson something precious: the freedom to experiment. While retention.com’s growth had plateaued in the struggling e-commerce market, the strong profit margins meant he could explore new opportunities without external pressure or investor oversight.

March 2024: RB2B Launches After 300 Discovery Calls Validate B2B Visitor Identification Need

Before writing any code for RB2B, Robinson validated the concept thoroughly. He called 300+ marketing leaders, asking if they needed person-level website visitor information. The response was overwhelming—B2B marketers craved deep, personal data far more than just company names. By launch day, 3,000 people were already on the waitlist.

The product itself was elegantly simple: identify anonymous B2B website visitors and push their LinkedIn profiles directly to Slack in real-time. Unlike competitors like 6sense, Demandbase, and Clearbit that stopped at the company level, RB2B provided the actual person visiting your site.

Robinson’s founder brand strategy proved crucial for the launch. He’d been building his LinkedIn audience for months, sharing transparent updates about Retention.com’s journey. This authentic community building created a warm audience ready to try his new product the moment it launched.

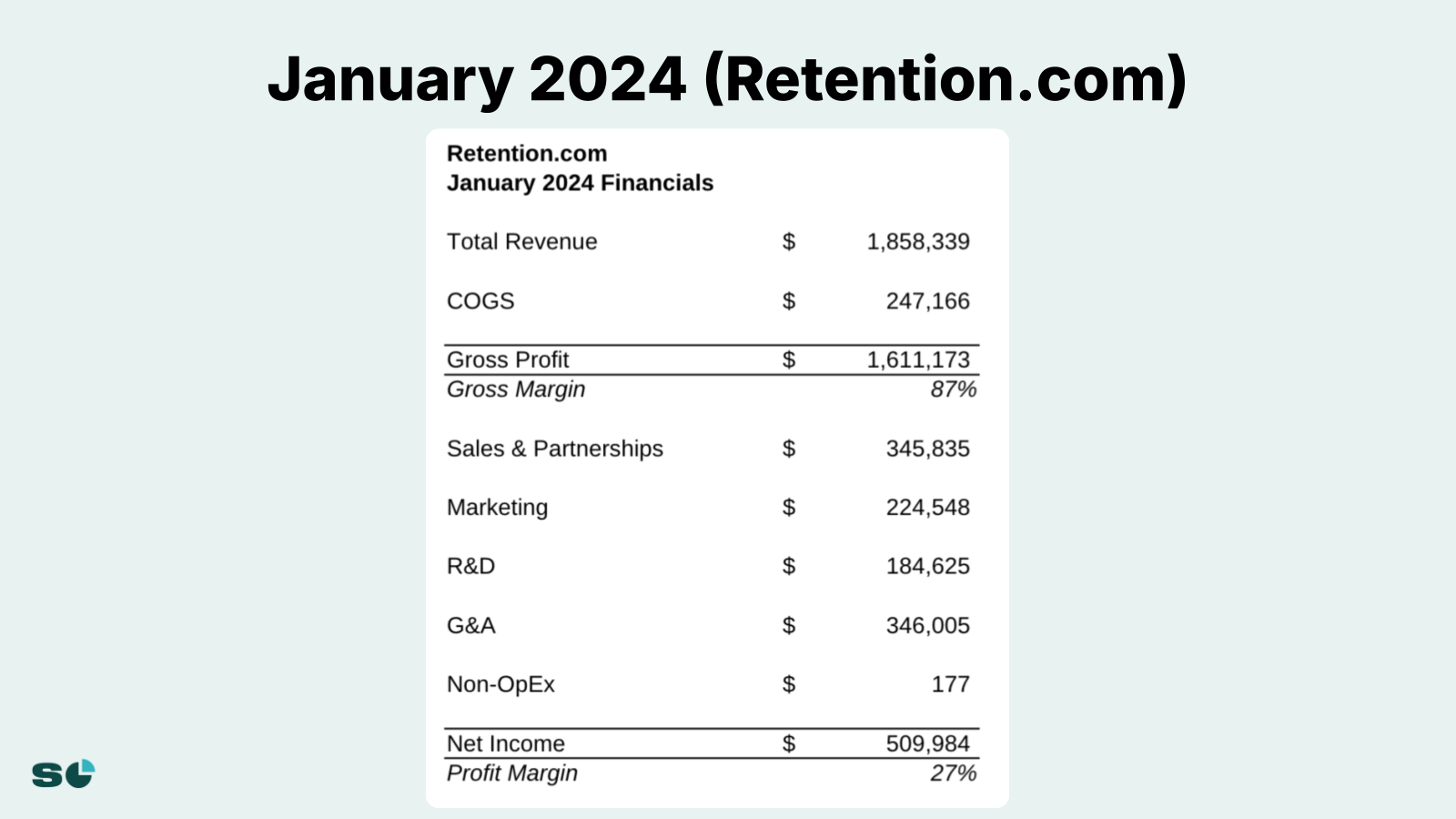

April 2024: The $400,000 Gamble—How a Cease and Desist Letter Generated 1,600 Qualified Leads

The turning point for RB2B came from an unlikely source. When 6sense tried to triple the price of their website visitor identity tool that Robinson wasn’t even using—demanding agreement six months before contract expiration—Robinson got irritated and wrote a LinkedIn post sharing his thoughts about how underwhelming their product was.

The post went viral, triggering a cease and desist letter from 6sense’s legal team. Most founders would have quietly complied. Robinson saw opportunity. His lawyer warned that fighting it could cost $300-400,000 over three years in legal fees. Robinson’s calculation: worth every penny for the marketing value.

The subsequent LinkedIn post featuring the actual cease and desist letter generated explosive engagement: 1,600 likes, 913 comments, and hundreds of thousands of impressions. More importantly, it delivered 1,600 qualified leads through a simple Google Form—prospects who appreciated Robinson’s transparency and wanted to support the David in this David-versus-Goliath story.

The LinkedIn Megaphone: Converting 90,000 Followers Into 10% Free-to-Paid Conversion

Robinson’s LinkedIn following exploded from 20,000 to 40,000 in a single week in September 2023, eventually reaching over 90,000 followers. But unlike influencers chasing vanity metrics, Robinson focused on quality: approximately 75% of his commenters and engagers fell within his ideal customer profile.

The strategy was deliberate. Rather than posting viral content for broad appeal, Robinson wrote deep thought leadership pieces about specific B2B marketing pain points. This approach grew his audience slower but ensured high concentration of potential customers in his engagement.

The results spoke for themselves: 85% of RB2B users installed the tracking script on their website without ever talking to sales, and the platform achieved a remarkable 9% free-to-paid conversion rate with zero human touch. For context, most B2B SaaS companies celebrate 3-5% conversion rates with extensive sales involvement.

September 2024: RB2B Adds $60,000 New MRR Monthly While Facing 10% Monthly Churn Challenge

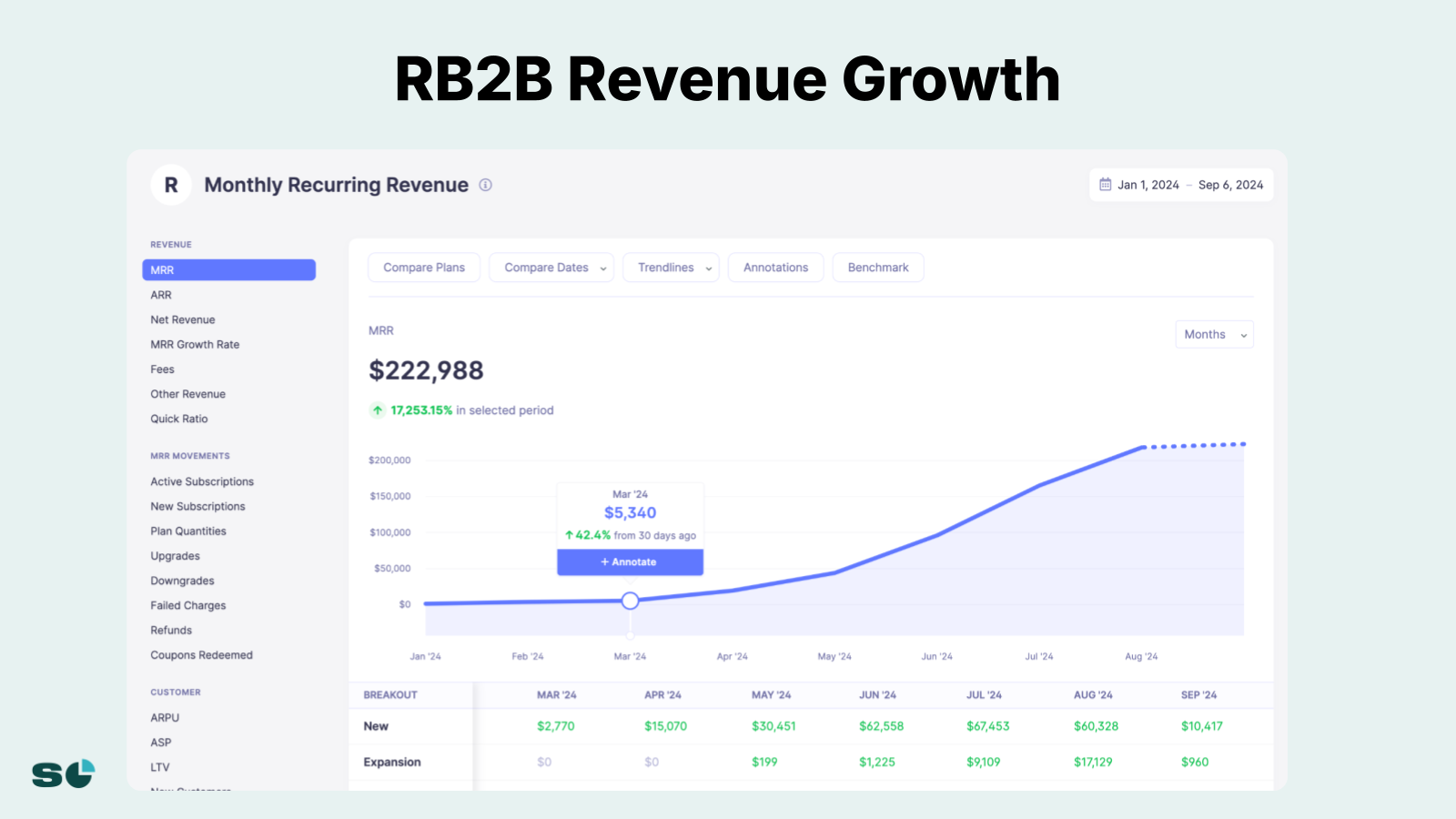

By September 2024, RB2B’s growth trajectory was undeniable. After reaching approximately $1 million ARR by June-July 2024 (just 4 months after launch), ARR climbed to $1.6 million by the end of July. The company was consistently adding $60,000 in new MRR each month.

The pricing model contributed to rapid adoption: a credit-based system starting at $99/month for 200 leads, scaling up to $300-1,000/month for larger volumes. The average new customer paid $270 per month, making it accessible for growing B2B companies while still generating meaningful revenue.

However, Robinson faced a critical challenge: monthly churn hovering around 10%, resulting in just a 9-month customer lifetime value. His strategy? Rather than panicking, he embraced the reality. Drawing parallels to Nathan Barry’s ConvertKit journey (which also had 10% churn at similar revenue levels), Robinson focused on adding complementary products for different departments rather than forcing RB2B into a system-of-record role it wasn’t designed for.

The Two-Company Dilemma: Managing a Cash Cow While Building a Rocket Ship

By late 2024, Robinson faced an unusual challenge: managing two companies with vastly different trajectories. Retention.com had plateaued around $23 million ARR but was generating over $1 million in annual profit. RB2B was growing explosively but bleeding customers almost as fast as it acquired them.

The psychological challenge proved as difficult as the operational one. “Even if something is making you $1 million, if it’s not growing, the thing that’s growing from one to two is more exciting,” Robinson explained. “It’s like a baby is more exciting than an 80-year-old.”

Robinson’s solution was radical transparency with his team. He constantly reminded them that Retention.com represented 85% of total revenue and 120% of profit (since RB2B was still burning cash). This profitable foundation enabled the experimentation and virality that made RB2B possible—a lesson in how bootstrapped companies can use profits from one product to fund innovation in another.

The Future: Building a Venture Studio Model on Bootstrapped Profits

Robinson’s vision extends beyond just two companies. He sees Retention.com’s steady profits as funding for a venture studio model, where he can continue launching new products without diluting ownership or losing control to investors. This approach mirrors his previous success—he’d actually incubated GetEmails (now Retention.com) within Robly before selling the email marketing company.

The next frontier? Expanding RB2B beyond marketing to sales enablement, though Robinson admitted fear of the M&A process keeps him focused on building rather than buying. He’s also exploring how to monetize the large free user base through content, courses, and community—tactics that could potentially reduce churn below the product’s natural rate.

As Robinson noted, there’s tremendous authority in being the CEO of both Retention.com and RB2B on LinkedIn. This dual leadership position, combined with radical transparency about metrics and challenges, has created a powerful platform for continued growth.

Why Robinson’s Playbook Matters: The New Rules of B2B SaaS Growth

Adam Robinson’s journey from $0 to $22 million with Retention.com, followed by the explosive launch of RB2B, challenges every assumption about how to build successful SaaS companies. In an industry obsessed with headcount, funding rounds, and vanity metrics, Robinson proved that discipline, transparency, and organic SEO combined with authentic storytelling can compete with—and often beat—venture-backed competitors.

The cease and desist incident perfectly encapsulates Robinson’s approach: where others saw legal risk, he saw marketing opportunity. Where others would hire PR firms and craft careful responses, he posted the raw letter and let authenticity drive engagement. This willingness to be radically transparent—sharing real P&Ls, admitting mistakes, discussing churn openly—builds trust that no amount of polished marketing can match.

For founders evaluating their own growth strategies, Robinson’s playbook offers crucial lessons: Revenue per employee matters more than total headcount. Legal controversy can become your best marketing campaign. Simple tools and authentic stories beat complex tech stacks. And sometimes, the best response to FOMO is returning to what made you successful in the first place: building profitable, sustainable businesses that solve real problems for real customers.

The story continues to unfold. With RB2B adding $60,000 in new MRR monthly and Retention.com providing the profitable foundation for continued experimentation, Robinson is proving that the future of SaaS might not belong to the biggest teams or deepest pockets—but to those willing to be transparent, take calculated risks, and build in public. As the SaaS industry evolves beyond growth-at-all-costs toward sustainable, profitable growth, Robinson’s approach offers a blueprint for the next generation of bootstrap founders.

If you’re an ambitious founder looking for capital to grow, we’d love to consider funding you at Founderpath. Click here to request capital.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…