How PAR Technology Grew From $180M to $450M Revenue: Savneet Singh's Turnaround Playbook for Building a $2 Billion SaaS Giant

This article was written and sourced from Savneet Singh’s keynote presentation at Founderpath’s last event. The images embedded below are from their slide deck. The full keynote recording is here.

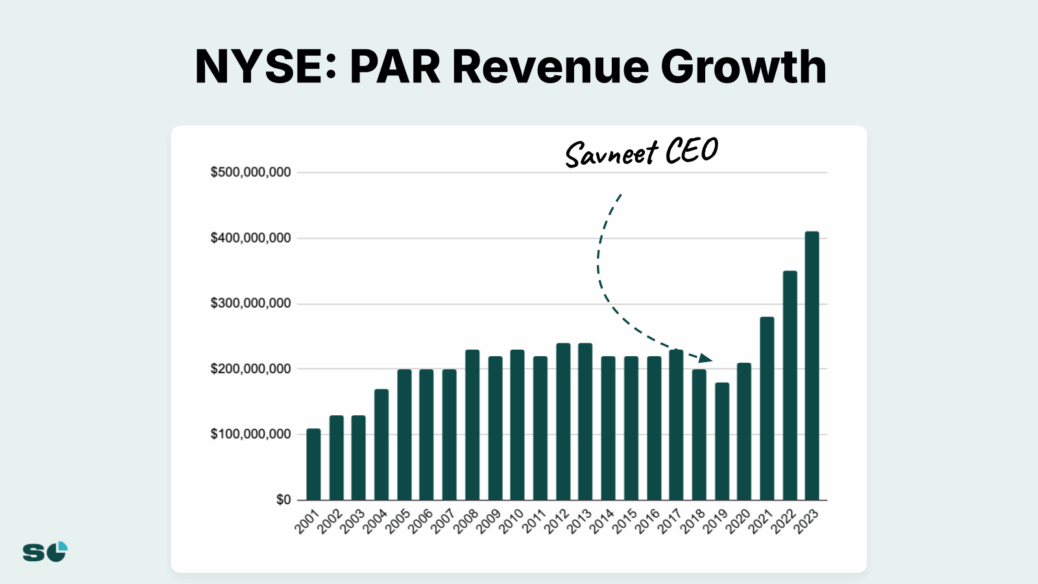

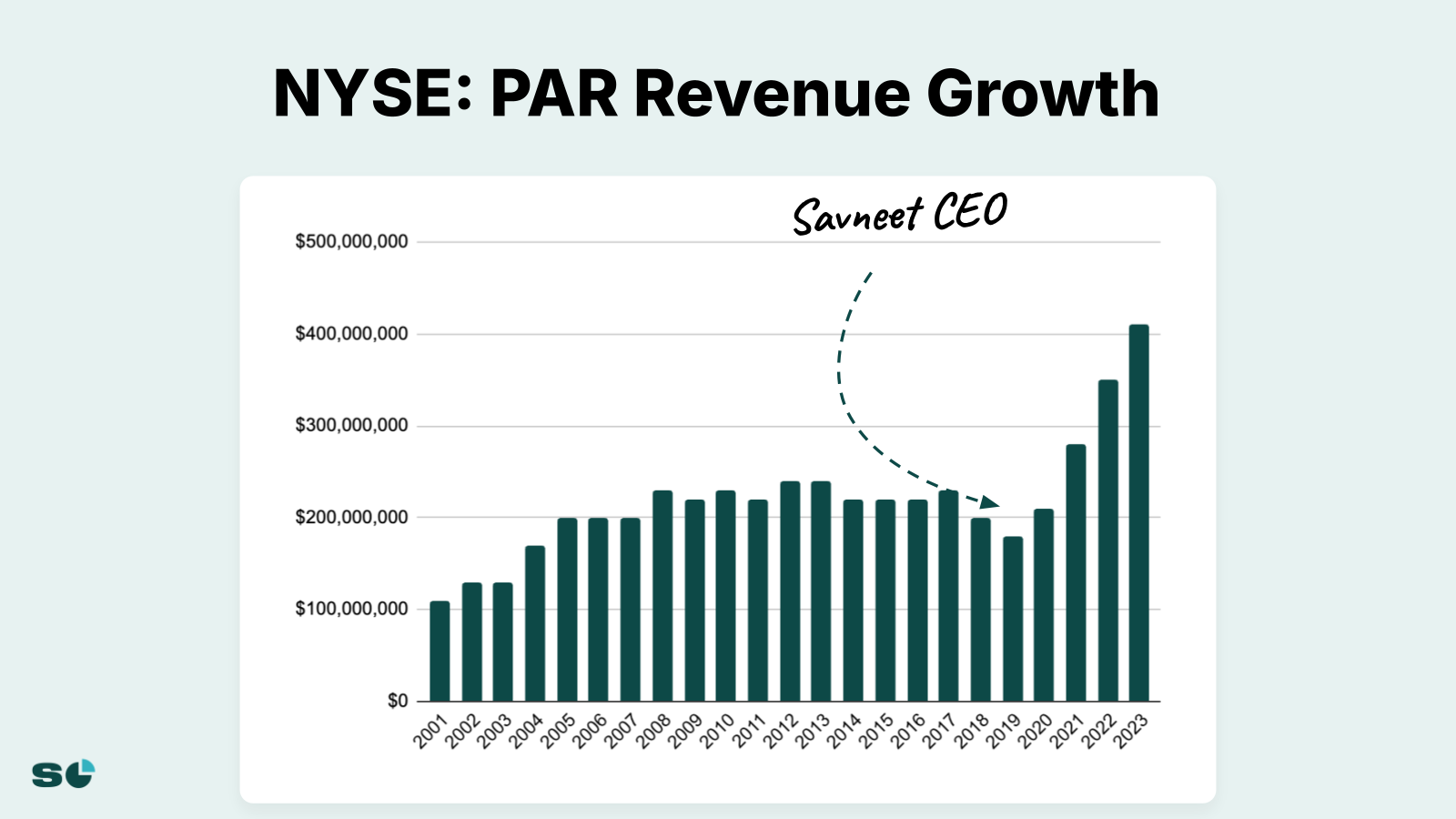

When Savneet Singh took over PAR Technology as CEO in 2018 at just 34 years old, the NYSE-listed company was worth less than when it went public in 1982 – a staggering 40 years of shareholder value destruction. Fast forward to 2024, and Singh has transformed PAR into a $2 billion market cap SaaS powerhouse generating $450 million in annual revenue, making it the third-fastest growing public software company in its category.

The Playbook: 5 Lessons from PAR’s $270M Revenue Growth Journey

1. Transform Hardware into SaaS While Public: Singh grew software revenue from $5 million to $250 million while maintaining hardware sales, proving you can pivot business models even under public market scrutiny.

2. Fix the Core Before Expanding: PAR spent tens of millions rebuilding their broken point-of-sale system that was crashing Dairy Queen stores before pursuing growth – stability beats speed when serving enterprises.

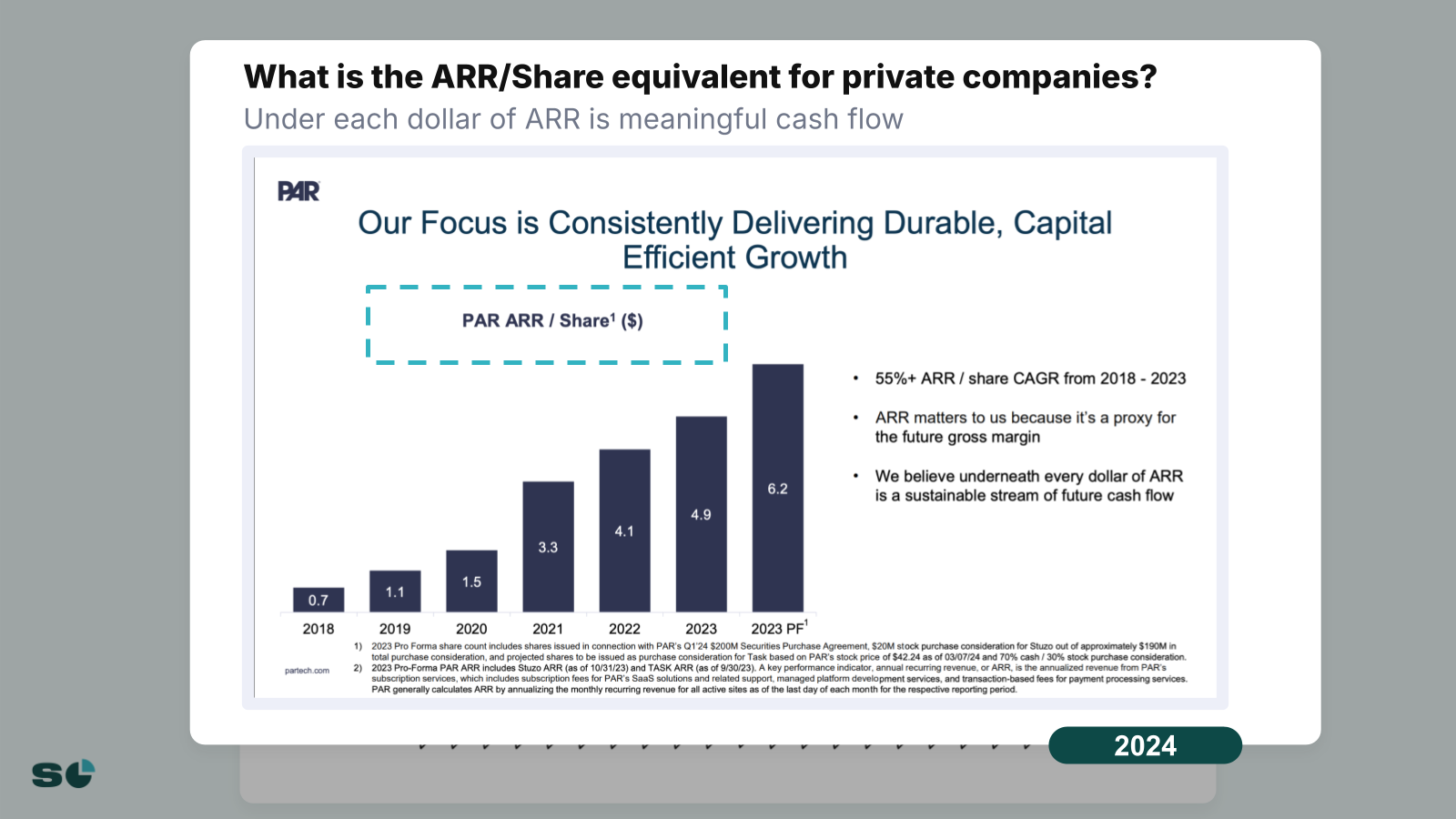

3. Master the ARR Per Share Metric: Focus on growing ARR per outstanding share rather than just top-line revenue – this metric reveals true value creation after dilution from fundraising or acquisitions.

4. Buy at Median Multiples, Not Peak: Singh acquired two companies for 4.5x ARR when others paid 10-20x, recognizing that the long-term median for software companies is 5.5-6x revenue.

5. Decentralize for Accountability: Give 30-year-old GMs full P&L ownership of $100 million business units – this Amazon-style structure creates more opportunities and drives performance.

2018: Inherited a 40-Year Failure Trading Below 1982 IPO Price

Singh’s journey began when PAR’s board recruited him to lead the CEO search process. Instead of finding someone else, they convinced him to take the role himself. What he inherited was shocking: a company that had destroyed shareholder value for four decades.

The numbers painted a grim picture. If investors had taken PAR’s IPO money in 1982 and simply invested in the S&P 500, they’d have $15 billion. Instead, PAR’s market cap in 2018 was lower than at IPO – an “incredible story of shareholder value destruction,” as Singh described it at a recent keynote. For more insights from Singh’s presentation, check out the full keynote recording and slides.

PAR’s revenue mix in 2018 revealed the core challenge:

- $170-180 million total revenue

- Only $5 million from software

- $165 million from hardware and services

- Customer NPS score: -60

- Customer health score: 99% red (not one green customer)

2019-2020: Rebuilt Core Product While Hemorrhaging Cash

Singh discovered PAR’s point-of-sale software was fundamentally broken despite being the first SaaS product in restaurants. The company was only shipping updates once per year, and their systems regularly crashed stores instead of processing transactions.

Rather than pursuing growth at all costs, Singh made the controversial decision to invest tens of millions rebuilding the core product. During this period, PAR strategically burned $2-4 million per quarter while maintaining revenue growth – a delicate balance that required exceptional operational discipline.

The turnaround strategy involved three critical decisions:

- Keep the profitable defense business temporarily: Generated $10 million EBITDA on $70 million revenue

- Use profits to fund software transformation: Avoided dilutive fundraising while rebuilding

- Hide software struggles from competitors: The defense unit masked the software division’s problems

2021: Divested $103M Defense Business to Fund Software Acquisitions

Once the core software platform stabilized, Singh executed a bold strategic pivot. PAR sold its government defense contracting business in two transactions for $102-103 million total, immediately redeploying that capital into strategic acquisitions that would accelerate their restaurant technology platform.

This move was particularly savvy because the defense business represented 40% of total revenue but was completely misaligned with PAR’s software future. Singh waited two years to sell it, using that time to rebuild the software products so the market wouldn’t discover how broken they were initially.

The divestiture freed PAR to focus entirely on their three streamlined revenue streams:

- Hardware: $80-100 million annually at 20-23% gross margins

- Subscription Services: The crown jewel growing to $250 million

- Professional Services: Installation, repair, and support services

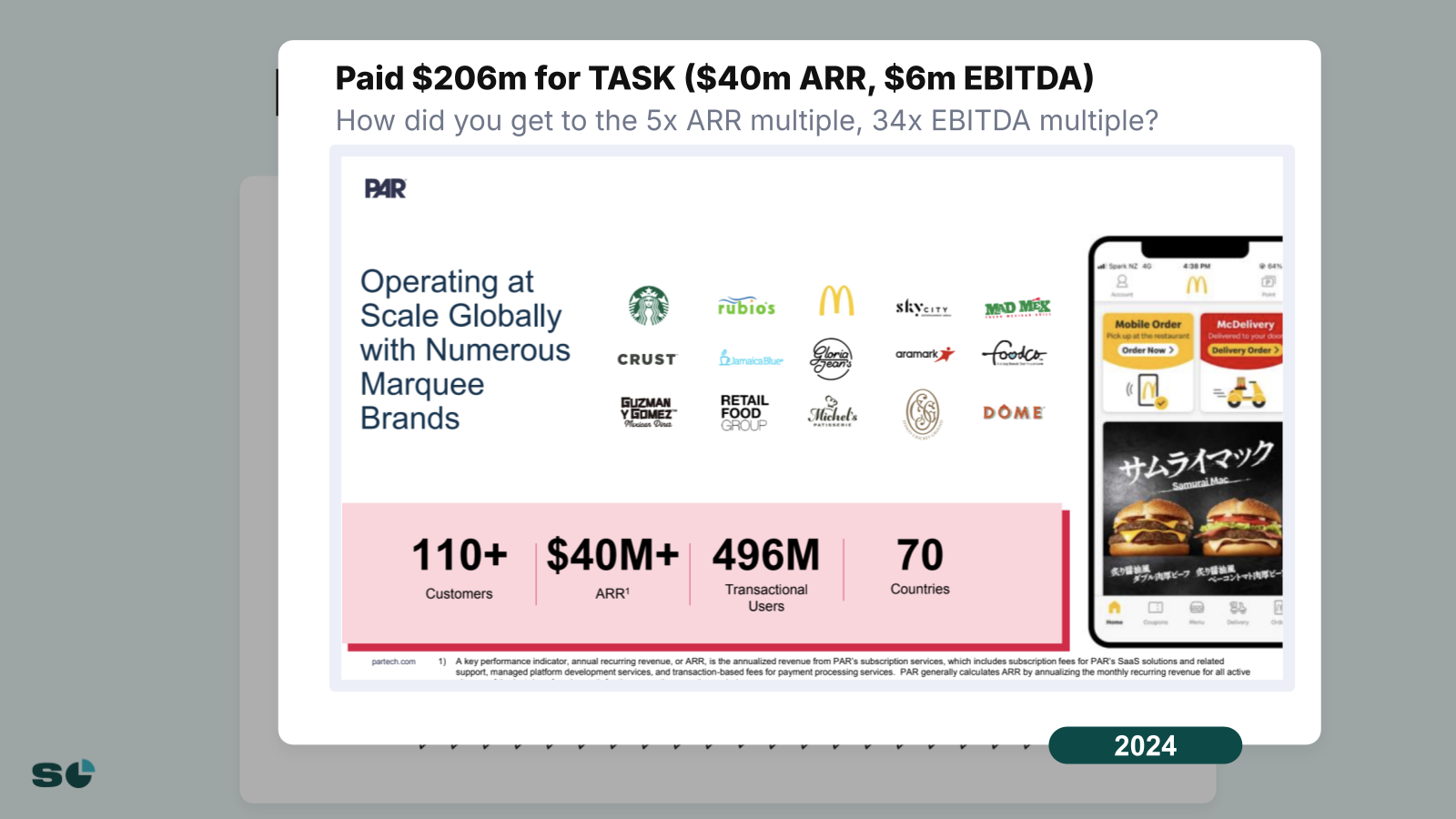

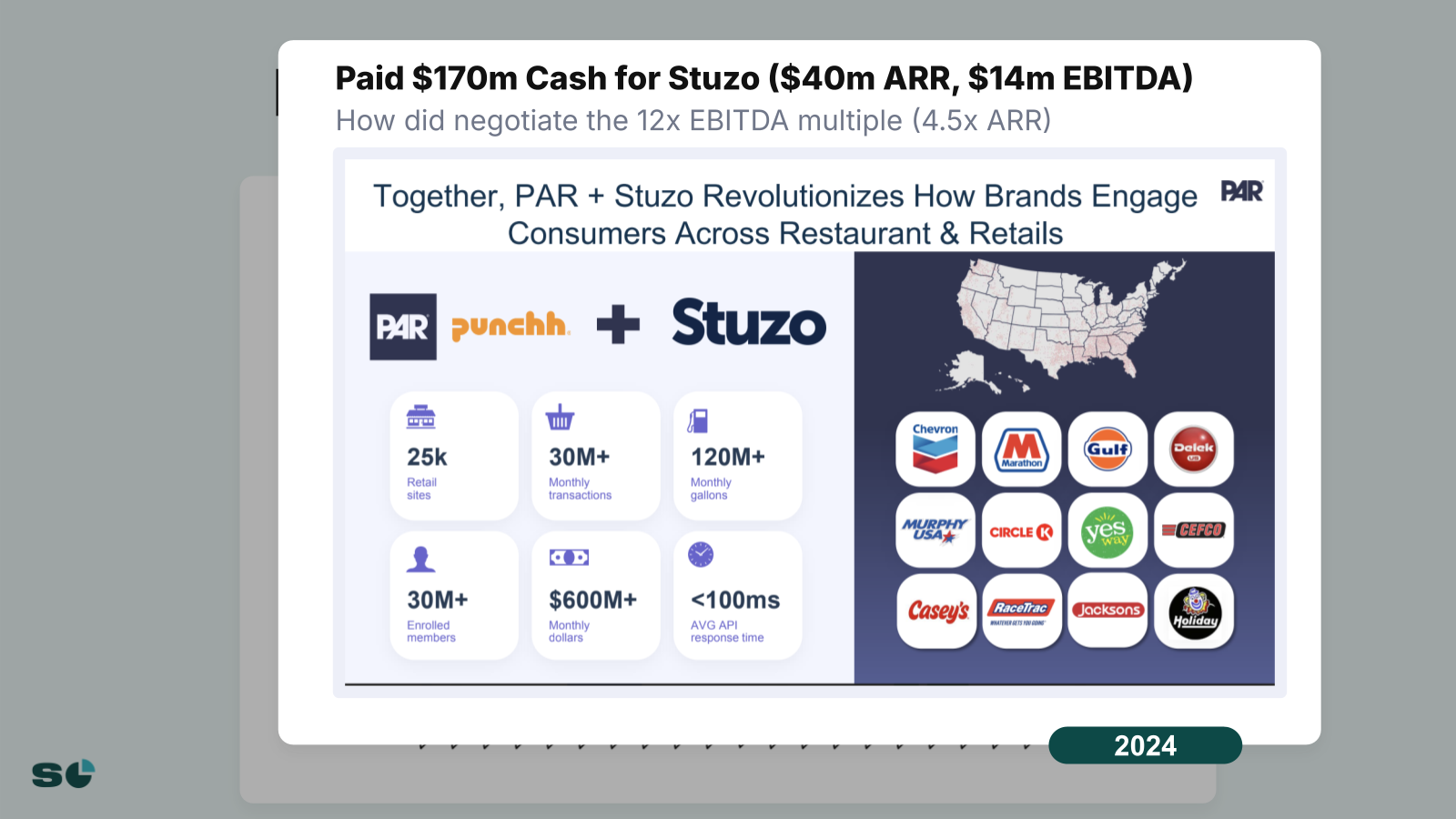

2024: Deployed $376M on Two Transformative Acquisitions at 4.5x ARR

Singh’s acquisition strategy in 2024 demonstrated world-class dealmaking. While the market was paying 10-20x ARR multiples, he secured two major deals at roughly 4.5x ARR by understanding fundamental valuation principles.

The TASK Acquisition: PAR paid $206 million for a company generating $40 million ARR with $6 million EBITDA. At 34x EBITDA, this seemed expensive until you considered the 5x ARR multiple – well below market rates. The founder was so upset with Singh’s negotiation that he didn’t speak to him for 30 days after closing.

The Stuzo Deal: An even better transaction at $170 million cash for $40 million ARR and $14 million EBITDA – just 12x EBITDA or 4.5x ARR. Singh’s negotiation philosophy was simple: assume median multiples (5.5-6x) are the norm, not the exception.

These acquisitions transformed PAR’s market position, adding critical capabilities in loyalty software and online ordering systems while maintaining disciplined capital allocation. Singh’s approach included pre-closing integration plans covering finances, organizational design, and cultural alignment.

How PAR Achieved 14% Sales & Marketing Spend vs 25% Industry Average

One of PAR’s most impressive operational achievements is spending just 14% of revenue on sales and marketing compared to the 25% industry average. This efficiency comes from selling enterprise deals where one salesperson can close multimillion-dollar contracts.

Singh shared stunning examples of sales efficiency:

- Burger King Deal: $230 million over 10 years ($23 million annually) – one salesperson

- Major Chain Contract: $5 million year one – one salesperson

- Enterprise Focus: Average customers spend hundreds of thousands to millions annually

The key to this efficiency is PAR’s multi-product strategy within the same buyer persona. Rather than having different sales teams for different departments, PAR penetrates the same restaurant customers repeatedly with additional products. This approach to expanding wallet share mirrors successful partner comarketing strategies where trusted relationships drive multiple product adoptions.

The Amazon-Style Org Structure: 30-Year-Olds Running $100M P&Ls

Singh implemented a radically decentralized organizational structure inspired by Amazon. Every product manager or GM owns their complete P&L with full accountability for results. This created an intense but rewarding environment where young leaders thrive.

The average age of GMs running $100 million P&Ls at PAR is just 30 years old, with some as young as 26-27. This structure provides multiple benefits:

- Clear ownership and accountability for results

- Rapid decision-making without bureaucracy

- More growth opportunities for ambitious talent

- Direct line of sight from actions to outcomes

For smaller SaaS companies, Singh’s advice is clear: quickly determine if you need one sales team or multiple for different personas. If you need multiple teams, rebuild your entire organizational design around that reality rather than forcing a single-team structure.

Why ARR Per Share Matters More Than Revenue Growth

Singh introduced a critical metric that most private companies ignore: ARR per share. This metric reveals whether you’re actually creating value or just raising dilutive capital to show growth.

The math is simple but powerful. If you’re growing 100% annually and raise a growth round selling 33% of your company, your share count increases by a third. Unless your growth rate accelerates significantly (from 100% to well over 133%), you’ve actually destroyed value per share despite the headline revenue growth.

Singh uses this metric to evaluate acquisitions and growth investments: “Did you actually need that money or was that money just a press release?” This discipline has helped PAR grow ARR per share consistently while many public software companies have seen negative returns.

The Current State: $450M Revenue Run Rate and Finally Profitable

Today’s PAR Technology looks nothing like the company Singh inherited:

- Revenue: $450 million run rate (up from $180 million)

- Software Revenue: $250-260 million (up from $5 million)

- Market Cap: $2 billion (up from sub-$500 million)

- Profitability: Now generating positive EBITDA after years of losses

- Stock Performance: Up 5x since 2018 while median software stocks down 21%

PAR hasn’t increased operating expenses in nearly two years while growing revenue 25% annually. This operational leverage finally delivered profitability after years of disciplined investment in product and strategic acquisitions.

The company now serves as the ERP platform for restaurants, offering everything from point-of-sale systems to loyalty programs and online ordering. Major enterprise clients can spend up to $23 million annually, validating Singh’s enterprise-first strategy.

The Future: AI and the Platform Play for Enterprise Restaurants

Singh’s vision for PAR is to reduce the number of vendors restaurants need from 20-40 down to five, with PAR representing 80% of that spend. This platform consolidation strategy positions PAR to capture more wallet share as restaurants seek operational efficiency.

The company is taking a breather from M&A to integrate recent acquisitions, having just announced updated company values incorporating the acquired teams. This integration discipline – including pre-deal financial, organizational, and cultural planning – has made PAR’s acquisitions notably successful.

Looking ahead, PAR is well-positioned to leverage emerging technologies and potentially explore programmatic SEO strategies to capture more of the massive restaurant technology market as establishments increasingly prioritize unified technology platforms.

Key Takeaways: From Value Destruction to $2 Billion Market Cap

Savneet Singh’s transformation of PAR Technology from a 40-year failure to a $2 billion SaaS leader offers crucial lessons for founders at any stage. His willingness to rebuild broken products before pursuing growth, acquire at disciplined multiples when others overpay, and maintain operational excellence while public demonstrates that turnarounds are possible even in the most challenging circumstances.

The most powerful insight may be Singh’s focus on ARR per share rather than vanity metrics. As he noted, the median public software company is down 21% over the past six years, while PAR is up 5x. This outperformance came from disciplined capital allocation, strategic focus on enterprise customers, and the patience to fix fundamental problems before scaling.

For founders evaluating their own growth strategies, Singh’s playbook proves that sustainable value creation requires choosing the right metrics, maintaining pricing discipline in acquisitions, and having the courage to rebuild your core product even when it means short-term pain. As Singh proved, sometimes the best path to explosive growth is fixing what’s broken first.

If you’re an ambitious founder looking for capital to grow, we’d love to consider funding you at Founderpath. Click here to request capital.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…