How Ebsta Grew From $0 to $5 Million ARR in 3 Years: Guy Rubin's Data-Driven Pivot Playbook

This article was written and sourced from Guy Rubin’s keynote presentation at Founderpath’s last event. The images embedded below are from their slide deck. The full keynote recording is here.

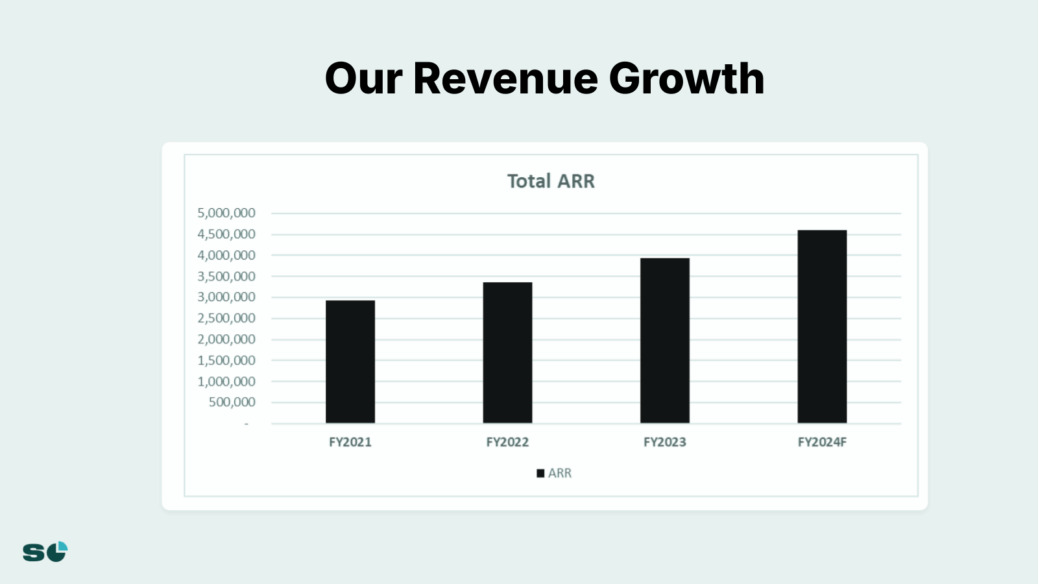

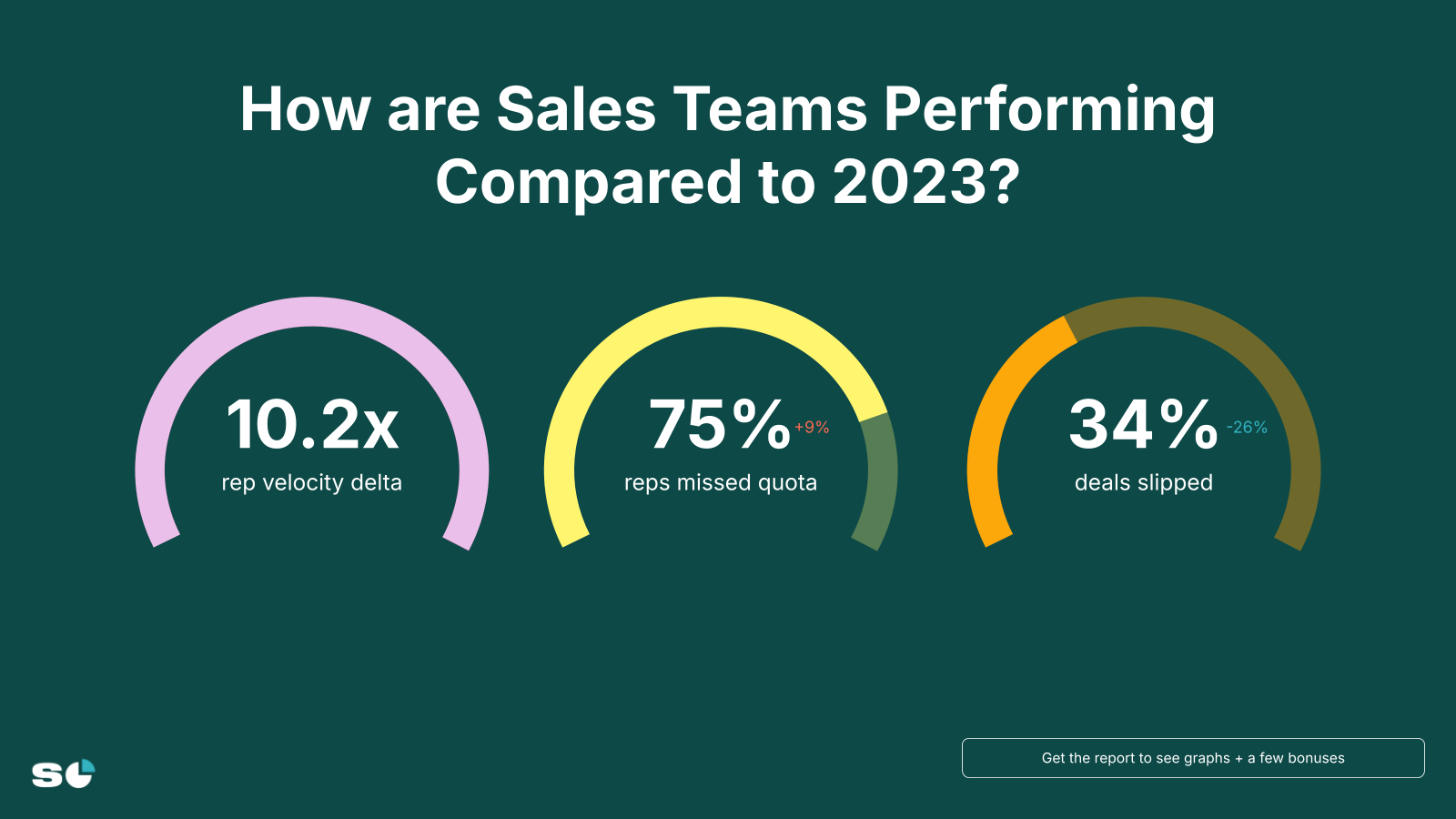

Guy Rubin transformed Ebsta from a 12-year-old sales enablement tool into a $5 million ARR revenue intelligence platform by analyzing $57 billion in pipeline data and identifying exactly what separates top-performing sales teams from everyone else. Speaking at SaaSOpen 2024, Rubin revealed how his company’s dramatic pivot in 2021 led to explosive growth by solving the critical problem that 75% of sales reps miss quota.

The Playbook: 5 Data-Driven Lessons from Ebsta’s $5M Journey

1. Pivot When the Data Demands It: After 12 years as a sales enablement tool, Rubin restructured the entire company in 2021 rather than starting fresh. The pivot to revenue intelligence unlocked immediate growth from near-zero to $5 million in three years.

2. Analyze Billions to Find Patterns: Ebsta processes $57 billion in pipeline data from 566 SaaS companies. This massive dataset revealed that only 16% of reps generate 80% of revenue – a problem they turned into their core solution.

3. Guarantee Results or Die: Rubin introduced three bold guarantees: improve rep quota attainment, achieve forecast accuracy within 10%, and go live within 30 days. If they fail, customers can terminate early.

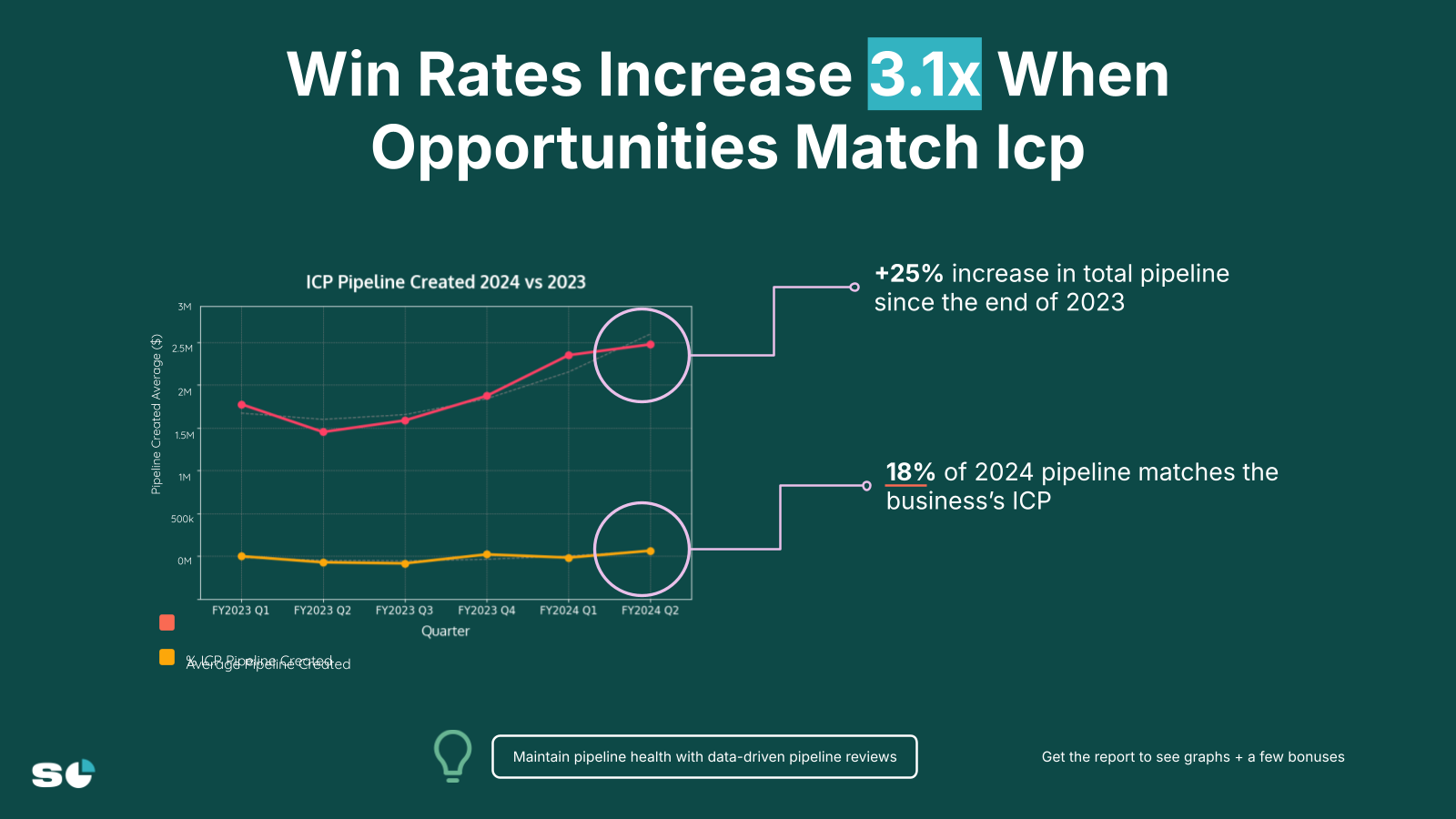

4. Focus on ICP Ruthlessly: Top performers achieve 3.1x higher win rates by qualifying out 30% of opportunities at discovery stage. Most teams are too scared to disqualify, keeping pipelines artificially high.

5. Score Relationships, Not Just Activities: Ebsta’s AI scores the strength of every prospect relationship. Top performers are 250% more likely to engage C-suite executives early in the sales process.

2021: The $57 Billion Data Discovery That Sparked Ebsta’s Pivot

Rubin’s journey to $5 million ARR started with a painful realization. After running Ebsta as a sales enablement tool for 12 years, he discovered they were solving the wrong problem. The company had been helping sales teams with basic productivity, but the real crisis was much deeper.

By analyzing massive volumes of sales data, Rubin identified a shocking pattern: the performance gap between top and bottom sales reps had grown to 10.2x by 2024. This wasn’t just a training problem – it was a systemic issue requiring AI-powered intelligence to solve.

The pivot decision came down to brutal honesty about market position. Rather than launch a new company, Rubin chose to completely restructure Ebsta into a revenue intelligence platform. This meant rebuilding the product, repositioning the brand, and essentially starting from scratch with existing infrastructure.

2022: Launch AI Forecasting Inside Salesforce and HubSpot – Hit $1M ARR

Ebsta’s new product launched in 2022 with a clear focus: become the AI layer inside CRMs that identifies pipeline risk before deals die. The complete keynote presentation reveals how they achieved product-market fit within months.

The platform introduced three core capabilities:

- AI Guided Selling: Prompts reps with best next actions based on what top performers do

- GTM Insights: Helps RevOps identify pipeline risks weeks before deals slip

- AI Forecasting: Predicts revenue within 10% accuracy using pattern recognition

First-year traction came from solving an urgent problem: 69% of reps were missing quota entering 2024, and companies desperately needed to understand why. Ebsta’s analysis of 4.7 million opportunities provided the answer – most teams weren’t qualifying deals properly.

2023: Process 1.2 Million Hours of Sales Calls – Reach $3M ARR

The breakthrough year came when Ebsta added conversation intelligence to their platform. By analyzing 1.2 million hours of sales calls, they discovered patterns invisible in CRM data alone.

Key findings that drove product adoption:

- Win rates drop 83% when deals slip past their close date

- Top performers close 30% of opportunities at discovery stage (vs 10% for average reps)

- Objections about ROI increased 127% year-over-year

- Sales cycles increased 20% while quotas grew 37%

Rubin’s team used this data to build their “momentum scoring” algorithm. The AI evaluates every email, call, and meeting to score relationship strength with prospects. This single feature became their primary differentiator – proving that relationships, not activities, drive revenue.

How Ebsta’s Three Guarantees Accelerated Growth to $5M ARR

The boldest growth move came when Rubin introduced unprecedented guarantees. While competitors offered vague promises, Ebsta put their revenue on the line with three specific commitments.

Guarantee #1: Improve Rep Quota Attainment

If Ebsta doesn’t improve quota attainment within 6 months, customers can terminate immediately. This forced the product team to focus exclusively on features that directly impact rep performance.

Guarantee #2: Forecast Accuracy Within 10%

The AI forecasting engine must predict quarterly revenue within 10% accuracy. This addressed CFO concerns about pipeline visibility during acquisitions and board reporting.

Guarantee #3: Live Within 30 Days

Unlike enterprise software requiring 6-month implementations, Ebsta guarantees customers see value within a month. This rapid deployment became crucial for closing deals in competitive situations.

The guarantees transformed sales conversations. Instead of debating features, prospects focused on ROI. Close rates improved dramatically when buyers knew they had an escape clause if results didn’t materialize.

2024: Bootstrap to $5M ARR While Competitors Burn VC Cash

By 2024, Ebsta reached just under $5 million ARR as a completely bootstrapped company. This achievement stands out in a market where competitors raised hundreds of millions in venture capital.

The bootstrap advantage showed in several ways:

- No pressure to grow at unrealistic rates

- Freedom to pivot without board approval

- Focus on profitability over vanity metrics

- Ability to offer guarantees without investor pushback

Rubin’s data revealed a crucial insight: only 18% of incoming leads match ideal customer profile (ICP), despite marketing spend increasing 25% year-over-year. This meant sales teams were busier than ever but closing fewer deals. Ebsta’s solution helps teams identify and prioritize ICP matches automatically.

The $57B Discovery: Why 75% of Sales Reps Are Failing

Ebsta’s analysis of $57 billion in pipeline data revealed systemic problems across B2B sales organizations. The data showed that three-quarters of account executives missed quota in H1 2024, up from 69% at the start of the year.

The root causes were clear in the data:

- Poor Qualification: 68% of deals progress past qualification without proper vetting

- Late C-Suite Engagement: Win rates drop 42% when executives engage late

- Momentum Loss: Most deals die from lack of momentum, not competitor losses

- ICP Mismatch: Only 18% of pipeline matches ideal customer profile

Top performers operate completely differently. They qualify ruthlessly, closing 30% of opportunities at discovery stage. They engage C-suite executives 250% more often in early stages. Most importantly, they maintain momentum through consistent, value-driven communication.

This performance gap created Ebsta’s market opportunity. By using AI to help average reps replicate top performer behaviors, they could guarantee quota attainment improvements.

How Ebsta Uses AI to Bridge the 10x Performance Gap

The platform’s AI engine works by pattern matching successful deal behaviors and prompting reps to replicate them. When analyzing cold outreach patterns, the system identifies exactly what messaging and timing combinations yield highest response rates.

Key AI capabilities driving results:

- Automatic Qualification Scoring: AI listens to discovery calls and scores MEDDICC criteria without rep input

- Relationship Mapping: Tracks engagement levels with every stakeholder in buying committee

- Risk Detection: Identifies deals likely to slip 3-4 weeks before close date

- Next Best Action: Prompts reps with specific actions based on deal stage and momentum

The AI processes every email, call transcript, and calendar event to build a complete picture of deal health. This eliminates the “happy ears” problem where reps overestimate their chances based on positive customer interactions.

One customer example: After implementing Ebsta’s AI qualification scoring, a SaaS company discovered their win rate was only 2% for deals over six weeks past close date, yet they had 120 opportunities in that category. They immediately closed those deals and refocused on higher-probability pipeline.

The Bootstrap Strategy: Hosting Poker Nights to Build Community

Rubin’s growth strategy extends beyond product features. At SaaSOpen 2024, Ebsta hosted an exclusive poker night for attendees, building relationships that translate into customer advocacy and referrals.

This community-building approach reflects their broader philosophy: relationships drive revenue. Just as their AI scores prospect relationships, Rubin invests heavily in building genuine connections with customers and prospects through strategic live events.

The poker night served multiple purposes:

- Created memorable brand experiences beyond product demos

- Facilitated peer networking among revenue leaders

- Generated organic conversations about sales challenges

- Built trust through informal, non-sales interactions

This high-touch approach works because Ebsta’s target customers – revenue leaders at fast-growing SaaS companies – value peer relationships and informal learning opportunities.

Ebsta’s 2025 Vision: Expand Beyond $10M ARR Through Partner Ecosystems

Looking ahead, Rubin plans to double revenue by expanding Ebsta’s presence within CRM ecosystems. The strategy focuses on becoming the default revenue intelligence layer for Salesforce and HubSpot customers.

Growth initiatives for 2025 include:

- Launching on Salesforce AppExchange with co-marketing support

- Building native HubSpot integration with revenue share model

- Creating industry-specific AI models for vertical SaaS

- Expanding conversation intelligence to analyze customer success calls

The company also plans to leverage their massive dataset for thought leadership. Their B2B Benchmarks Report, produced with Pavilion, has become an industry standard for understanding sales performance trends.

Key Takeaways: Building a Bootstrap SaaS to $5M ARR

Rubin’s journey from zero to $5 million ARR in three years offers several lessons for SaaS founders:

1. Don’t Be Afraid to Pivot After 12 Years: Ebsta completely restructured after over a decade in business. Sometimes radical change beats incremental improvement.

2. Use Data as Your Differentiator: By analyzing $57 billion in pipeline data, Ebsta gained insights competitors couldn’t match. Data moats are more defensible than feature advantages.

3. Guarantee Specific Outcomes: Vague promises don’t close deals. Ebsta’s three guarantees transformed sales conversations and accelerated deal velocity.

4. Focus on the Vital Few: With only 16% of reps generating 80% of revenue, Ebsta built their entire product around replicating top performer behaviors.

5. Bootstrap for Freedom: Without venture capital pressure, Rubin could make bold pivots and offer guarantees that VC-backed competitors couldn’t match.

The path to $5 million ARR wasn’t smooth – it required completely reimagining a 12-year-old business. But by focusing relentlessly on customer outcomes and using AI to democratize top performer behaviors, Ebsta built a sustainable, profitable growth engine.

For founders considering similar pivots, Rubin’s advice is clear: be ruthless about qualification, invest in understanding your true ICP, and don’t be afraid to guarantee results if you genuinely solve customer problems.

If you’re an ambitious founder looking for capital to grow, we’d love to consider funding you at Founderpath. Click here to request capital.

Recent Articles

Bootstrapping a Startup: The Complete Guide for SaaS Founders

Only about 0.05% of startups ever raise venture capital, according to Fundera. The other 99.95% either bootstrap, borrow, or shut…

SaaS Financial Model: How to Build One That Investors Want to See

A SaaS financial model is the single most important document in your company — and most founders get it wrong.…

SaaS Startups: How to Start and Fund a SaaS Company

Global SaaS spending is projected to approach $300 billion in 2025, according to Gartner, growing at nearly 20% per year.…